With everyone being on the go these days, it’s only natural that the smart small business or entrepreneur would take advantage of the technology that is now available. If you’re in the know, you’ll be able to utilize your mobile phone’s technology to collect payments for services rendered while you are at an event, away from your business’ central location, or just out and about.

Apps such as GoPayment, Square, Pay Anywhere, Sailpay, and Sage are prime for growing your business while on the go.

Apps such as GoPayment, Square, Pay Anywhere, Sailpay, and Sage are prime for growing your business while on the go.

- GoPayment offers users a free card swipe dongle that attaches to your mobile phone. With no annual fee and a small charge of as low as 2.7% per swipe, users can be operational in a matter of minutes for minimum cost. Each GoPayment account can have up to 50 users on it, meaning you can expand your mobile business up to 50 fold and have all the funds collected deposited in your account within 2 – 3 business days. GoPayment also has an option to work with QuickBooks to make accounting easy for the business owner. Receipts can be sent via text or email and the system is secure and encrypted for the protection of both you and your customers.

- Square works similarly to GoPayment; however, Square also offers a register option, where one can turn an iPad into a cash register with their proprietary card reader dongle. The register program also allows users to take inventory of their product and save customers as favorites for quick and easy checkout. It will even calculate tips – when needed – to make things easier on the clientele.

- Pay Anywhere also uses a proprietary dongle and has a register option, pairing wirelessly with an AirPrint enabled printer to create a POS-lite system that’s easy to use and quick to setup and break down at events.

- SailPay operates similarly to the aforementioned programs – free card reader, register option, 2.70% swipe charge (or 1.95% swipe charge plus a $9.95 monthly fee, if you prefer) – but also allows barcode scanning and syncs with an online dashboard for quick reference and for keying transactions in case you forgot your credit card reader at home.

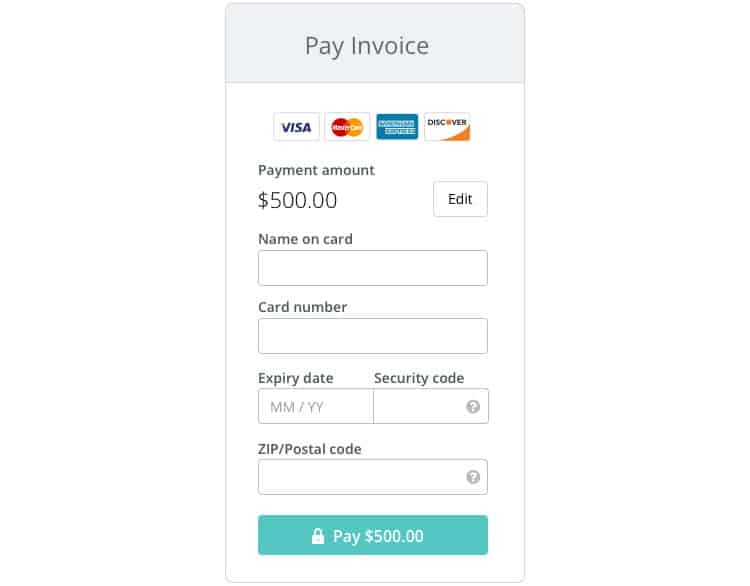

- Sage offers the card reader, competitive rates, and boasts operation on over 400 different mobile devices. Additionally, Sage offers an invoicing option that will retrieve an invoice from the database and allow a user to pay against that invoice in real time.

All of these apps exist to further your small business’ success…why aren’t you using them?

GIPHY App Key not set. Please check settings