Artificial intelligence once seen as an asset, but now emerging as a serious threat, causing tremendous distress to the European software conglomerates.

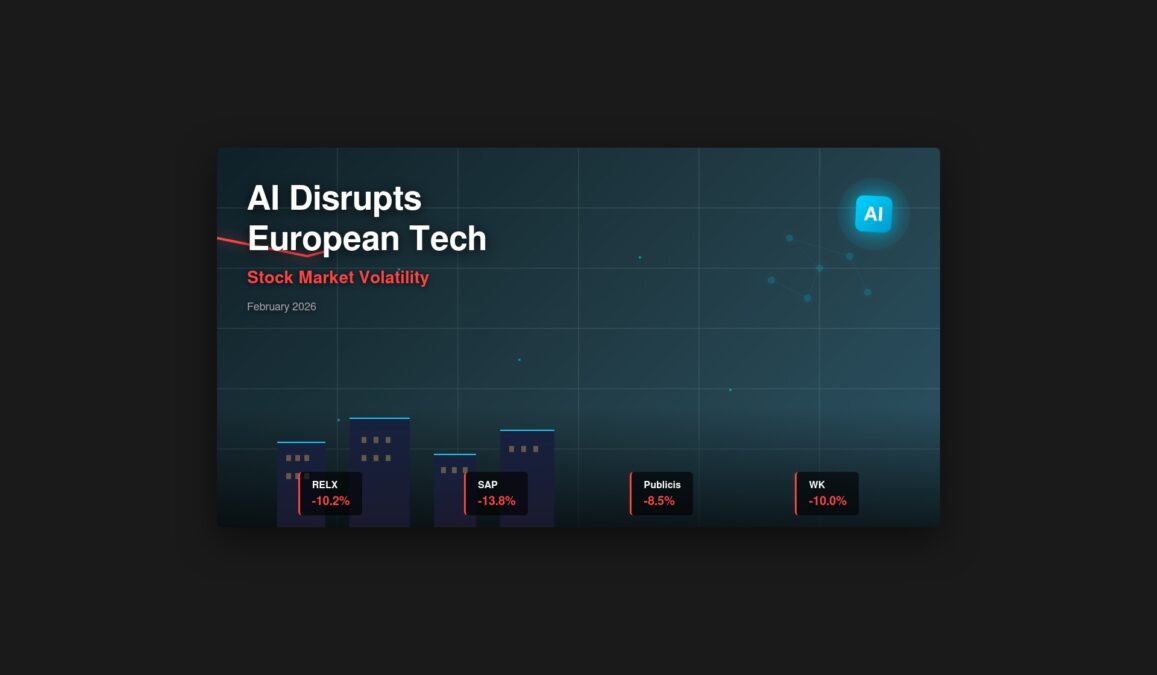

On 3 February 2026, both the shares of legal analytics market leaders RELX and Wolters Kluwers dropped by over 10% each respectively after the release of the Anthony Claude legal plug-in, triggering fears that AI based chatbots would undermine their (legal analytics) high-margin business.

The volatility seen is not confined to only a single company. The SAP of Germany, which was referred to as the most expensive company in Europe last year, saw its projected growth rate drop by 40% leading to a share price decline.

SAP shares closed at €170.56, down 13.8% over the week and 18.1% over the month. The year-to-date return is down 15.5%, and the one-year return is down 35.9%. This is despite three- and five-year returns of 57.9% and 70.7%, respectively

Similar companies in the professional services industry, namely Experian, Sage Group, the London Stock Exchange Group, and Pearson experienced a 4.2 to 8 % decline, as the investors express doubt about the ability of the said firms to recoup substantial capital used in AI-related models, due to the current model iterations.

Market Implication in advertisement Sector

The advertisement sector too has shown major backlash. Publicis shares rose 8.5% in the fourth quarter, but lost some of their gains in early 2026.

The stock has lost nearly a fifth of its value in the last year as investors worry about the risks posed by artificial intelligence.A recent survey by Barclays of buyside acquisitions found Publicis, WPP and Omnicom as the top losers of AI in European media, and agencies with the highest exposure to generative artificial intelligence software accelerating the automated process of creative operation.

Said Lars Skovgaard,

The software companies were assumed to be winners from AI.

senior investment strategist at Danske Bank.

But all of a sudden, you start to worry about whether you can earn the money back (from your AI investments), and/or will you be outsmarted by updates coming in

Future Outlook

It can be expected that the increase in merger and acquisition activity will be forthcoming but without unquestionable market gains, deflationary multiples are probable.

Those companies capable of speeding up the introduction of revenue-generating AI products are likely to survive, and slow movers will face even more severe losses in the face of this cutting edge technology repositioning.