Alphabet has changed the traditional story about the competition of artificial intelligence. Earlier described as underdeveloped compared to OpenAI, the company is now showing better performance, as evidenced by tremendous financial performances that can support its large strategic investments.

Earnings Surge

In the fourth quarter of Fiscal Year 2025, the company registered 18% growth in earnings, which rose to $113.8 billion and this is the first year the company has hit the $400 billion mark.

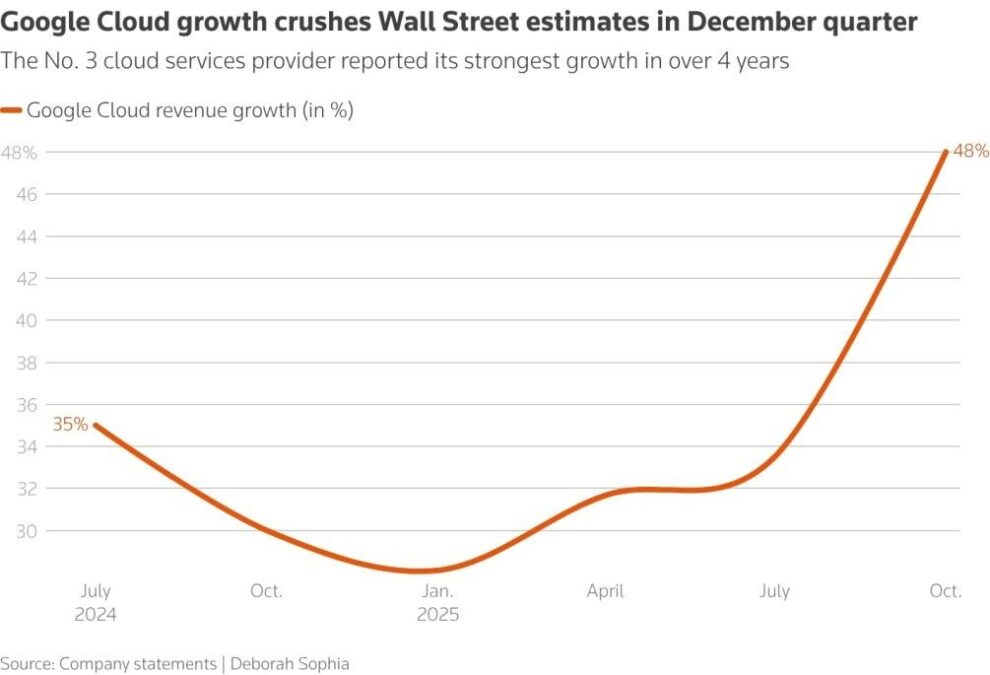

Google Cloud revenues performed better than anticipated, growing up by 48% to maintain an annual run rate of more than $70 billion.

CEO Sundar Pichai said.

Overall, we’re seeing our AI investments and infrastructure drive revenue and growth across the board

User Boom

Gemini application has 750 million monthly active users, the number of backlog increased by 55% to $240 billion owing to increased demand of AI services.

While interaction statistics increased after launching Gemini 3, the platform is now able to conduct more than 10 billion tokens every minute via its API.

Gemini enterprise products earned 8 million paid licenses. These are close to the 800 million weekly users that OpenAI had benchmarked in October, and adding Gemini to the AI Mode of Search and an increase in user retention rates is positive momentum.

Investor Shift

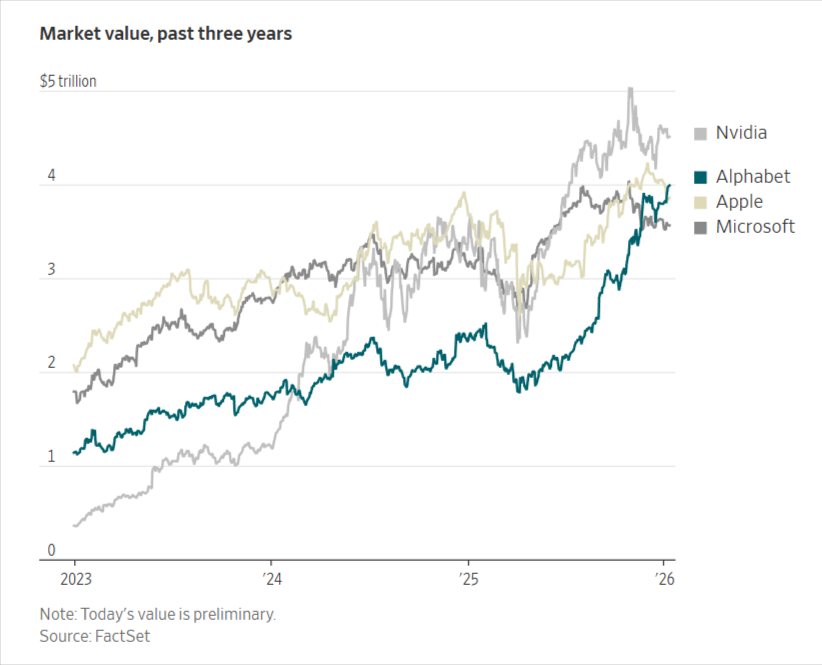

Alphabet, the parent company of Google, has surpassed $4 trillion in value, becoming the latest tech company to do so as investors reward the internet-search leader for its artificial-intelligence gains.

Alphabet shares rose 1% to a record $331.86 on Monday, bringing the company’s market capitalization just above $4 trillion.

Its stock rose 65% last year. Four technology companies have traded with market capitalizations of $4 trillion, with only Nvidia NVDA -0.50% down; the red down pointing triangle remains above that level.

Apple AAPL -1.48% drop; red down pointing triangle and Microsoft, which crossed the $4 trillion mark last year, now have market capitalizations of $3.8 trillion and $3.6 trillion, respectively.

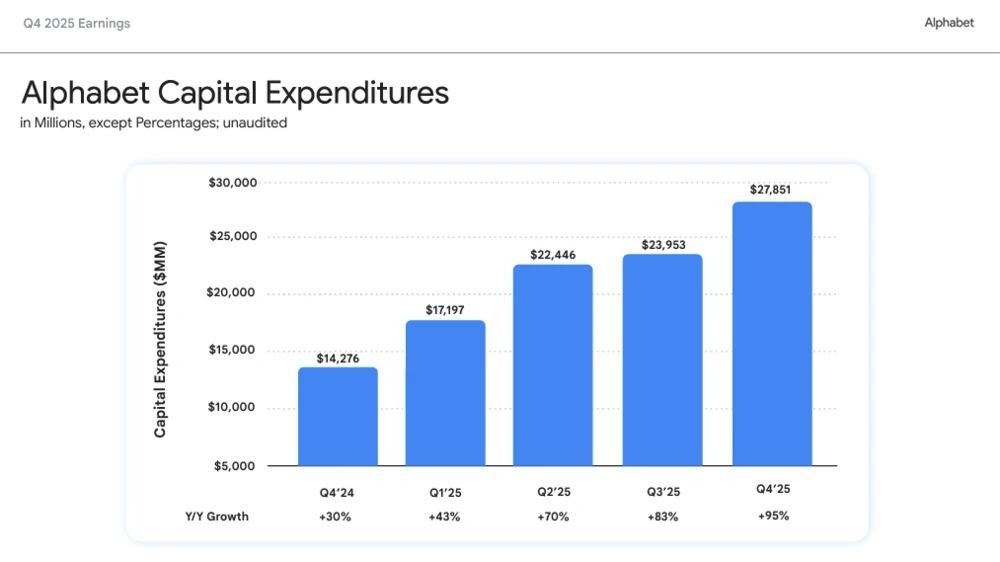

Boldest bets being paid

Reactions of stocks were damp and regained stability after strong Cloud performance. Contracts with Meta and Apple helped improve the financial partners, which is in comparison to the problems OpenAI faces in its attempts to fund the organization despite signing huge contracts.

The self-sufficient AI architecture Alphabet has, including Gemini models and TPUs, is better than other vendors that use external alliances, since it combines the consumer-oriented apps with enterprise functionalities.

With further investing capital spurring new growth, it is possible to envision that Alphabet will grow its dominance with its returns of the shareholders that will make the investments worthwhile and redefine the paradigm of large technological companies in 2026.