The company has lately reached records in the market with Amazon shares trading at an all-time high of 254 and its present level standing at 232.16.

Whether or not the investment in this technology conglomerate is a good one in the existing market excitement, is the question.

Cloud Power Surge

The primary driver of Amazon growth is its Amazon Web Services (AWS). During the third quarter, AWS has updated the revenues by 20.2% to the point of $33 billion and a significant backlog of $200 billion of sources based on artificial-intelligence demand.

Gartner claims that custom silicon like Graviton and Trainium is better compared to other players based on price-performance.

Amazon has already allotted capital expenditure of $125 billion in 2025 which is set to experience growth in 2026, as Wall Street responded with an 11% stock surge to facilitate expansion of data-centers hence capacity in 2027.

TD Cowen noted that it sees three key drivers for Amazon shares in 2026.

These include accelerating AWS revenue growth, eCommerce and advertising momentum, and continued operating margin expansion.

AWS revenue growth is anticipated to accelerate in 4Q25 and accelerate further in both ’26 and ’27. This growth is being fueled by

“Core and AI workload demand and higher AI capacity amid the historic AI infrastructure build.”

Ads Steal the Show

It saw an increase of advertising revenue of 24% in the third quarter by $17.7 billion and it is estimated to grow more in 2026.

The main sources of conversion are Prime Video services and products that are advertised which can be improved by partnership with Netflix and Spotify.

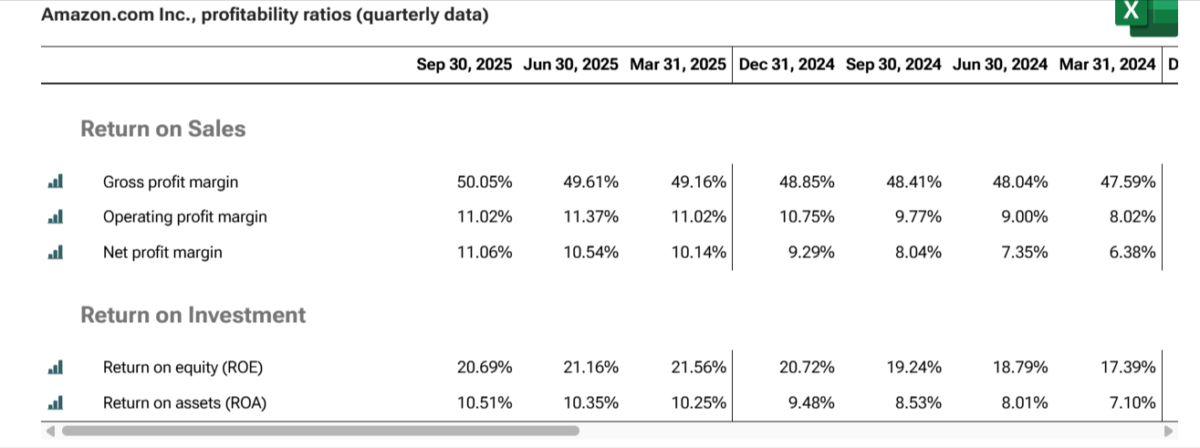

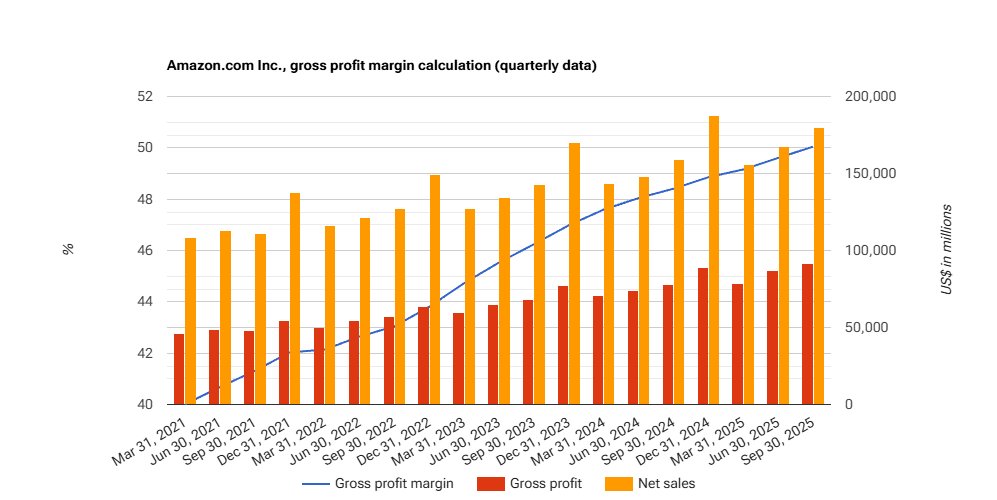

The gross profit margin of the retail segment has increased to 50.05% which is higher compared to that of the past fiscal year.

Valuation Check

Amazon has 2.48 trillion in market cap, and a forward-earnings multiple of 40x, which can be described as rather reasonable bearing in mind that NVIDIA has a 60x.

Although temporary retreats might be brought about by profit making activity, this market noise should have less weight rather than the long run growth projections of the company.

Most importantly, investments completed by Amazon in artificial-intelligence supporting infrastructure place the company ahead of other hyperscalers.

Future Outlook

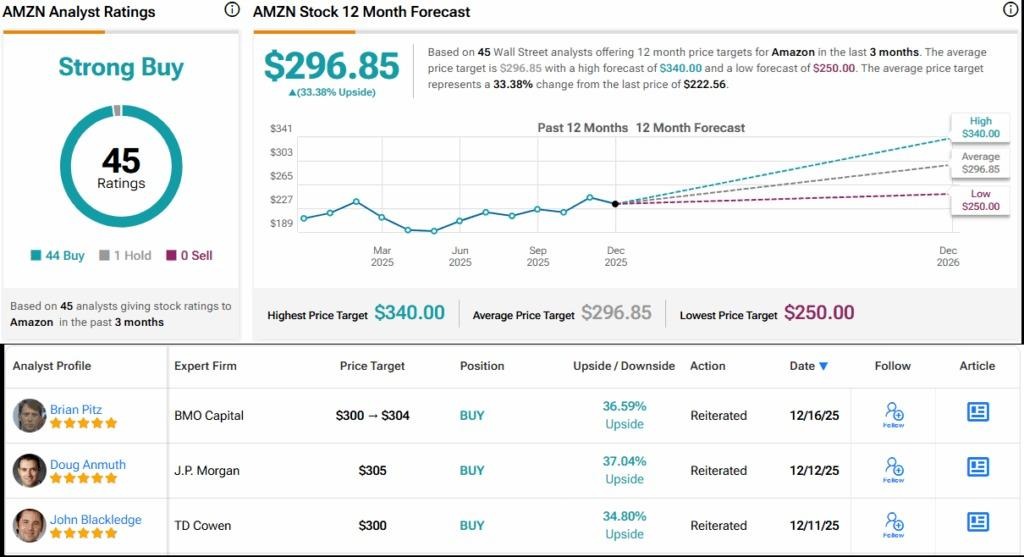

Looking forward from here, Blackledge rates Amazon’s stock as a Buy, with a $300 price target that indicates potential for a 35% upside in the coming year.

Similarly, Amazon’s Strong Buy consensus rating is based on 45 analyst reviews, with a highly lopsided split of 44 Buys to 1 Hold.

The shares are currently priced at $222.56 and the $296.85 average price target implies a one-year gain of 33%.

The future looks bright if the artificial-intelligence spending will speed up, thus compensating patient shareholders.