The recent decline in Amazon stocks by 10% is an indication of suspicion over its slowed expansion in the field of artificial intelligence and cloud computing, which has been a growth propellant in most technological firms. It has given investors more reason to shift their money toward rivals such as Nvidia and Microsoft which have twice its market value. Nonetheless, Amazon has a further potential to gain profit in its major e-commerce and retail charge, which is highly effective.

In the last couple of years, Amazon has been able to dramatically increase its profit margin in North America, with the help of its increased high profit margin advertising revenue and third parties seller service. It is expected that the growth will not only be at the domestic market, but also at the international levels where the company takes advantages offered by the larger markets and continued enhancement of efficiency.

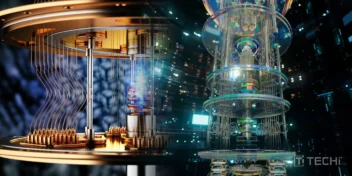

There is also Amazon Web Services (AWS) that has been expanding at a slower pace than its competitors but plays a very important role in the future of Amazon. The collaboration between AWS and AI startup Anthropic is likely to drive its revenue and technological cloud service expansion until the year 2025. Since AWS has a huge revenue base and its profit margin is high, it would continue to act as a critical profit engine to Amazon.

In 2026, Amazon is projected to have incomes of close to $100 billion dollars. Having a forward price-earnings ratio roughly equal to that of the wider market could price Amazon at about three trillion. Such potential growth can be attributed to both the increase in retail margins, as well as continued innovation and investment in cloud and AI. Although the short-term performance of the stock has been poor, the long run position is a positive sign that indicates good growth in terms of profit and market capitalization. Therefore, the stock is a stock worth looking at in terms of investment by long run investors keeping in mind the future gains.