Advanced Micro Devices (AMD) is a company that has drawn a lot of investor interest stock, rising by 116% over the past nine months to the beginning of December 2025, mostly due to the growth in the demand of AI hardware.

The shares have, however, since the third-quarter earnings report on 4 November fallen about 15%, and the shares are now at a close of $215.80 on 4 December which is somewhere in the middle of its 52-week range of 76 to 267.

This recent taper-off dampens the current frenzy, with valuation multiples high, with a trailing price-to-earnings ratio of more than 100 and forward multiples of between 50 to 60×.

AI Boom Powers Surge

Exceptional demand of its AI GPUs, especially the Instinct MI300 and MI350 models, and the growing market share of a new family of its EPYC processor line in server deployments can both explain why AMD is performing so well.

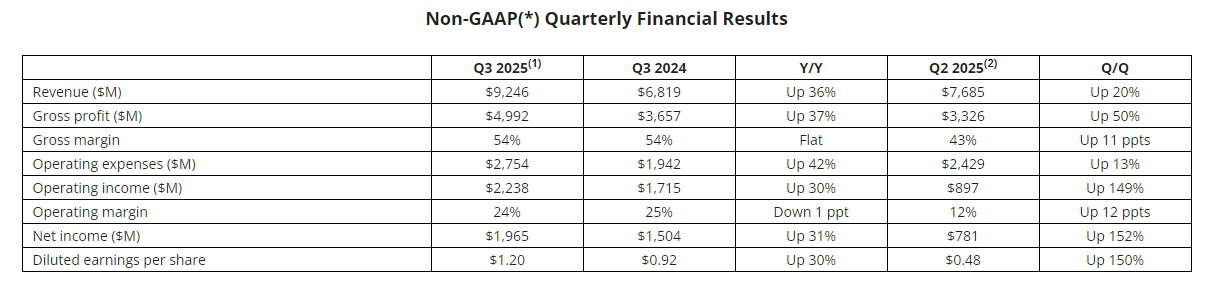

The company had revenue of $9.246 billion in the third quarter of 2025, which was an increase of 36 % year-on-year and 20 % sequentially. The data-center sales were $4.3 billion, which represented 47 % of the total revenues and 22 % annual increase.

The non-GAAP earnings per share increased 30% points to $1.20, which was higher than the consensus, and client and gaming segments showed growth of over 70 %.

AMD chair and CEO Dr. Lisa Su said

“We delivered an outstanding quarter, with record revenue and profitability reflecting broad based demand for our high-performance EPYC and Ryzen processors and Instinct AI accelerators,”

Risks in the Rearview

AMD has suffered the ills of historical price volatility, with a drop of 83% points during the dot-com bust, and a drop of 65% points in 2022, during the current inflationary pressures.

The current price growth with the year-to-date rise of 82 % that is above the 34 % growth by Nvidia highlights the possibility of revising the prices.

Bright Horizon Ahead

The strategic partnerships with OpenAI and Oracle that AMD has developed, combined with the upcoming 2026 launch of the MI450 GPUs and Helios server racks, could have large upside potential.

Cowen has placed its own intrinsic value of $290 per share, or an implied upside of about 35% based on its estimates of the earnings per share in the fourth quarter of 2026 to be more than 10.

Investors should keep an eye on the valuation measures, but the strong fundamentals of the company make it a worthy candidate of acquisition on a long-term basis, with the exception of having the caveat of macro-economic disruptions.