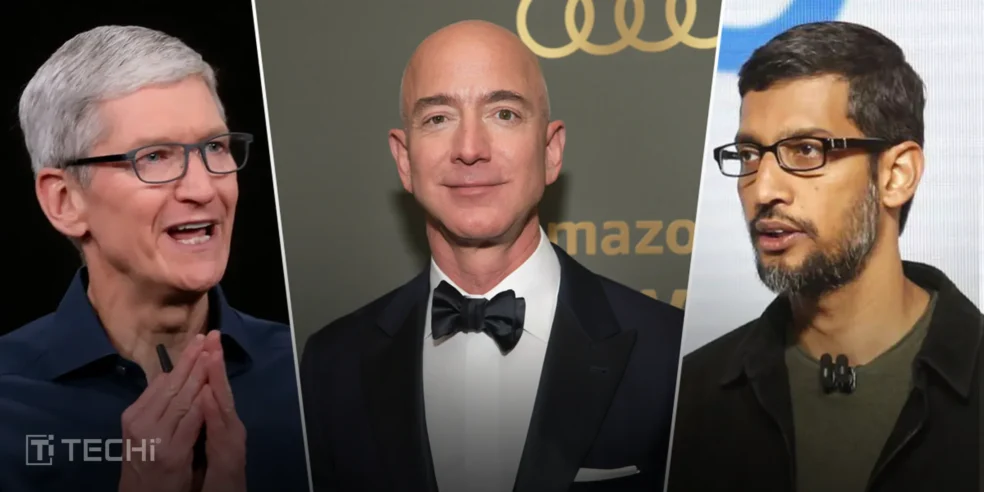

U.S. tech giants Apple, Amazon, and Alphabet saw mixed performance in premarket trading on Tuesday, reflecting investor caution ahead of upcoming economic data and earnings reports.

According to FXEmpire, Apple traded slightly lower, holding near a key resistance level of $260, while Amazon showed signs of consolidation following a strong September rally. Alphabet’s shares remained relatively stable as traders weighed its long-term artificial intelligence spending plans.

The broader U.S. market tone remained optimistic despite the uneven performance among these major stocks. The Nasdaq 100 futures edged higher in early trading, suggesting continued investor appetite for growth stocks, even as inflation concerns persist.

Analysts note that the premarket movement highlights a “buy-on-dip” sentiment, signaling that traders remain confident in the long-term strength of mega-cap tech leaders despite short-term fluctuations.

This cautious optimism comes as the tech-heavy Nasdaq recently regained momentum, supported by resilient labor market data and expectations that the Federal Reserve may hold rates steady through year-end.

Premarket Technicals & Price Action Snapshot

In early trading, Apple (AAPL) showed modest weakness, hovering around its premarket volume‐weighted average price of $254.17 after trading between roughly $251.63 and $255.72. The stock’s last trade was about 0.3 percent above that VWAP line, indicating mild upward bias but limited momentum. Its technical indicators remain mixed.

On the daily chart, Apple is in a “Strong Buy” position with 8 buy signals versus 0 sell signals. Its 50-day and 200-day moving averages lie below the current price, supporting a sustained uptrend. Its 14-day RSI sits near 53, which suggests it is neither overbought nor oversold. Meanwhile, on shorter time frames, Apple’s MACD reading is slightly positive.

Amazon (AMZN) also moved in a narrow range in premarket. It last traded near $217.12, slightly below its VWAP of $218.04. That suggests the stock is struggling to break decisively higher in early action.

In regular hours, AMZN currently stands near $219.51, down about 1.30 percent on broader market pressure. Its technicals show that analysts remain bullish overall, with consensus price targets averaging close to $263.78.

For Alphabet / GOOG, the premarket was relatively muted. GOOGL shares were quoted around $173.87 in early screens, up about 0.32%. That modest move suggests traders are holding position ahead of major catalysts. Its technical patterns seem less volatile in the near term, with limited breakout signals.

Taken together, the three names appear stuck in consolidation zones. None is showing a clear runaway move yet. The key support and resistance bands, along with volume confirmation, will likely determine which direction they follow after the market opens.

Fundamental & Analyst Views

Analyst expectations for Apple (AAPL) remain mixed, though the consensus leans slightly positive. According to TipRanks, Apple’s average price target is around $255.91, with a high forecast reaching $310.00 and a low estimate of $180.00. Some firms have become more cautious.

For instance, Jefferies recently downgraded Apple to “Underperform,” lowering its 12-month target to $205.16, citing concerns around product cycles and innovation. On the other hand, Seaport Research initiated coverage with a “Buy” rating and set a target of $310, suggesting there remains upside if Apple can deliver strong growth in services and hardware.

Apple’s recent quarterly results provide further context. The company reported $94.04 billion in revenue, a nearly 10 percent increase year over year, and earnings per share of $1.57,both beating expectations.

Apple also forecasts continued growth in the “mid to high single digits” despite tariff headwinds. Some analysts remain cautious about Apple’s AI strategy, noting that delays in new Siri features may weigh on growth.

Amazon (AMZN) continues to attract bullish sentiment across many analyst desks. The current average price target sits at $267.88, reflecting an expected upside of over 22 percent from recent levels. Analysts point to AWS recovering strength, although competition in the cloud and AI sectors remains fierce.

Notably, the firm’s advertising business, which often flies under the radar, has been highlighted by some analysts as a key near-term growth engine given its high margin profile.

For Alphabet (GOOG / GOOGL), analyst sentiment has been edging upward. MarketWatch reports an average price target of approximately $245.87, with a “Buy” recommendation from many of its 73 covering analysts.

Recent commentary suggests that fair value estimates have been raised in light of stronger ad revenue and AI momentum. Its cloud division is also under watch, though it is still a smaller contributor to valuation compared to its ad business.

Overall, the fundamentals point to an environment of cautious optimism. Apple must prove resilience amid product innovation challenges and tariff pressures. Amazon’s growth mix across cloud and ads positions it well, so long as execution holds.

Alphabet looks to benefit from strength in advertising and AI, though its cloud push remains a secondary narrative. Analysts appear to reward clarity of growth paths rather than hype, and the next earnings and guiding commentary will likely shape investor conviction.

Market & Macro Drivers to Watch

One of the most immediate influences on the tech sector is the Federal Reserve’s policy stance. Several Fed officials have recently expressed caution about aggressive easing. Kansas City Fed President Jeff Schmid described rates as “appropriately calibrated,” hinting that further cuts might be resisted. At the same time, markets still expect one to two additional 25-basis-point cuts by year end, which is helping to underpin valuations in growth names.

The U.S. labor market is under close scrutiny. Recent data showed weaker hiring and modest increases in job openings, signaling a possible softening in demand for workers. In that context, inflation trends are being watched for signs of stickiness. If inflation remains elevated, the Fed may hesitate to ease further, limiting upside for interest-rate sensitive stocks.

Another variable is the effect of the ongoing U.S. government shutdown. With the impasse delaying key economic releases, such as payrolls and trade figures, markets are “flying half blind,” using Fed remarks and anecdotal data to fill gaps. That heightens volatility risks for large tech names, which tend to move sharply on surprises.

Global factors also come into play. A relatively weak U.S. dollar supports multinationals more than those with primarily domestic exposure. Given that Apple, Amazon, and Alphabet generate much of their revenue overseas, a softer dollar could serve as a tailwind. Trade policy and tariff developments remain another source of uncertainty, especially for companies with complex global supply chains.

Finally, equity valuations are under close inspection. The tech sector continues to lead broad U.S. equity gains this year. But analysts warn that stretched multiples may leave the market vulnerable to disappointments. If macro surprises push sentiment negative, expensive stocks may be the first to give back gains.

Conclusion

Apple, Amazon, and Alphabet all display resilience despite mixed premarket movements. Apple’s steady technical support levels suggest potential for gradual recovery if upcoming product cycles deliver expected sales momentum.

Amazon continues to attract bullish forecasts, supported by its growing advertising and cloud segments, though near-term consolidation may persist. Alphabet remains positioned for moderate upside, as strong advertising demand and disciplined AI investment sustain investor confidence.

Broader market sentiment is cautiously constructive. Expectations of limited rate cuts and a softer dollar provide a supportive backdrop for large-cap technology stocks. However, investors should remain alert to potential volatility from economic data delays and any renewed inflation pressures.

In the short term, a “buy-on-dip” strategy remains consistent with prevailing analyst sentiment. Yet traders may prefer waiting for clear confirmation signals, particularly volume-backed breakouts, before initiating new positions in these mega-cap tech names.