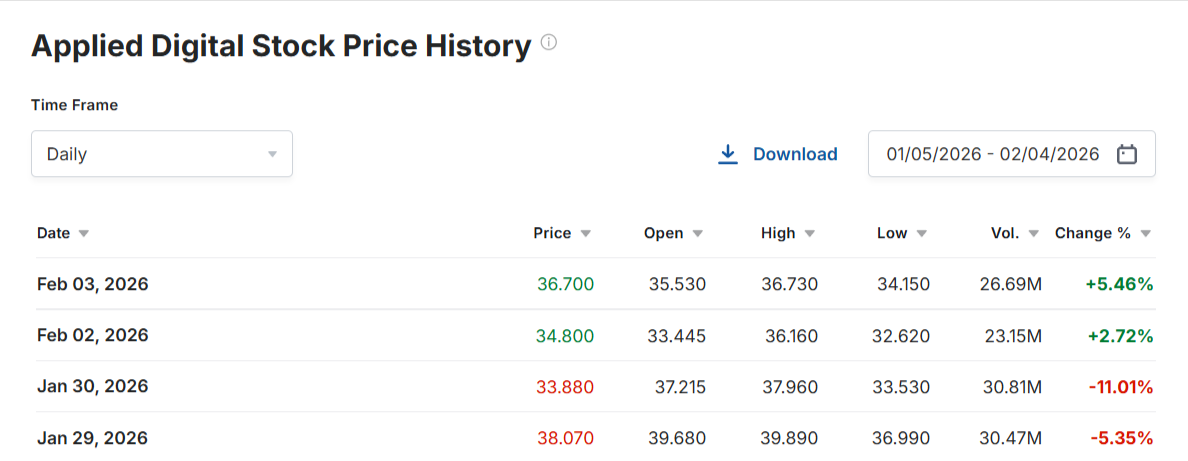

In the recent market practices, Applied Digital (APLD) equities have appreciated by 700% ever since the mid-2024 when the company experienced an interim high to a price of 36.7 on 3 February 2026 where the company has gained a market capitalization of about $10 billion.

Having built itself as a disruption in the data-center industry the company developed out of its roots with mining crypto currency and took advantage of the growing need in high-performance computing capabilities that occurred during the surge of artificial intelligence workloads.

Traditional data-centers architectures have failed to support these needs, but APLD has brought specifically-designed campuses that would fill the gap.

Artificial Intelligence Combo Drives Monumental Growth

The company is also hastening the completion of two massive plants Polaris Forge 1 (450 MW) and Polaris Forge 2 (300 MW) which will be ready in the year 2028 and another facility, Delta Forge 1 (430 MW) which will be ready in the middle of the year.

Delta Forge 1 represents the next stage of Applied Digital’s growth, as we continue to deliver AI infrastructure through disciplined execution,

Said Wes Cummins, Chairman and Chief Executive Officer of Applied Digital,

AI Factories succeed or fail based on how effectively power, cooling and operations are integrated. We believe this campus will be built to scale alongside hyperscale demand while delivering operational certainty for customers and lasting value for the communities where we operate.

As analysts noted the company’s apparent growth and strong customer interest, the stock of the business increased. Applied Digital’s reported order backlog of about $16 billion contributed to the positive mood.

This included a fifteen-year lease with CoreWeave and the $5 billion deal with an unnamed artificial-intelligence conglomerate.

Valuation Skyrockets Cause Concern

At the rates of 17-18 times the estimated revenue in 2027, APLD has a high valuation particularly against the backdrop of the high costs of developing infrastructure facilities and dependence on mega-contracts.

A gross margin of 16.4 % is shown in the company, and its adjusted EBITDA is positive at $20.2 million in the second fiscal quarter and which shows progress in its operations. However, net losses continue at $31.2 million.

Mirage or Millionaire Dreams?

Applied Digital is at the tipping point of its growth as a specialty provider of AI-concentrated data-center infrastructure. Its early migration to specialized places, the firm in a position to take advantage of the long term high performance computing demand.

However, its success will depend on how carefully it is carried out, how long will be its customer demand, and its efficiency in scaling in a more competitive environment.

To the investors who are open to volatility, Applied Digital will give them an exposure to the growing ecosystem of AI infrastructure, but a well-waited and diversified investment approach is highly essential.