The ASE Technology in Taiwan is expected to increase its sophisticated packaging income to approximately $3.2 billion in 2026 due to the unprecedented growth in the AI chip.

Strong Earnings Kickoff

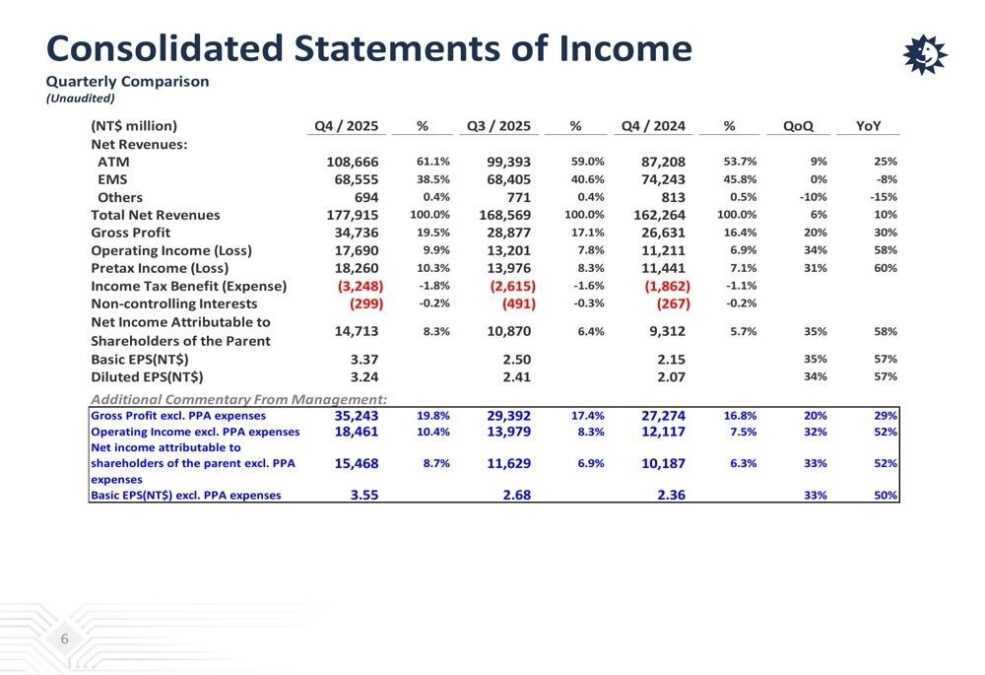

The ASE Technology Holding revenue was T$177.9 billion of which is a year-on-year growth of 9.6%. The revenue grew 58 % and this is an indication of the continued demand in the smartphones, AI servers and similar market with cutting edge technology. This shot is indicative of the dominant role of ASE in the semiconductor supply chain.

Historical Surge

A 2023 analysis of ASE retrospective shows that ASE advanced packaging has brought in an income of $250 million, this increased to $600M in 2024.

In 2025, the executives estimated its demand at $1.6 billion, of which 75 % will be through packaging and 25 % through testing caused by the AI demands of key customers like Nvidia. The doubling that the projection shows, up to $3.2 billion in 2026, is indicative of scale-up.

Dr. Tien Wu, COO, emphasized the company’s leadership in the fast-evolving technology landscape, stating,

In the fast evolution, amidst all uncertainty, customers tend to go for the leader to manufacture the first product.

Joseph Tung, CFO, highlighted ASE’s commitment to maintaining its competitive edge by stating,

We’re not shy on making the necessary investment to keep our lead.

What Fuels the Fire ?

High performance chips get high-density packaging technology with the use of 2.5D and 3D stacking. The high number of capacity expansions and collaborations with such leaders as Nvidia, whose AI servers rely on such innovations, is the source of the competitive advantage of ASE. Growth in Q4 revenues of 9.6% was higher than competitors and net profit grew over three times in comparison to the industry in a time when global chip crunches cooled.

Bold Outlook Ahead

The existence of the revenue of $3.2 billion in 2026 is predicted to stabilize the ASE portfolio as the AI move gains momentum, the industry will have more growth. However, some of the risks are disruption of supply chains due to U.S-China tension.

The uncertainties notwithstanding, the history of success of ASE indicates that doubling of its revenues will serve to strengthen Taiwan as a market leader in the semiconductor industry, therefore, progressing the next phase of technological development.