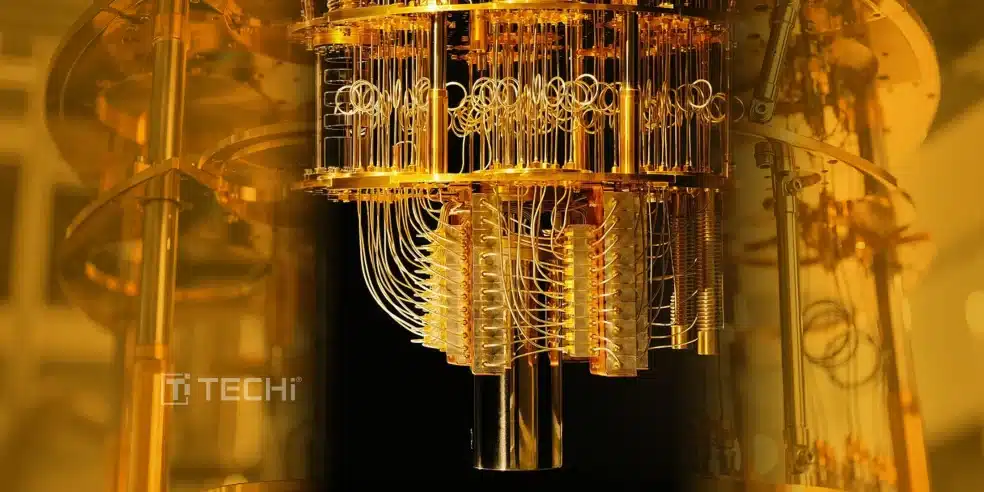

Quantum computing is taking a step out of the lab and onto the stage, emerging as one of the exciting investment opportunities in technology. Such as IonQ uses trapped ion technology, which can be cost effective and very precise. D-Wave Quantum uses a different process called quantum annealing. Neither company uses superconducting, which involves cooling a particle to near absolute zero. This is an expensive process, but it’s also the one that most companies are taking.

By taking their own approaches, IonQ and D-Wave Quantum give themselves better chances at success, as they’re not directly competing against the big quantum computing companies with nearly unlimited resources.

Both companies have sidestepped expensive superconducting methods and instead charted their own paths to ensure that they never have to compete against tech giants with seemingly unlimited resources.

The picture changes when you look at Alphabet and Microsoft. These legacy companies not only have a strong track record in quantum computing research, but are building their own quantum hardware instead of outsourcing to other vendors.

For Alphabet and Microsoft, quantum computing is more about enhancing cloud services and less reliant on pricey suppliers such as Nvidia. This double-barreled value means that their stocks have a steady growth component from core cloud businesses, as well as a likely tailwind component from quantum advancements farther down the timeline.

Nvidia produces top-tier traditional computing hardware but has not been heavily involved in the quantum computing arms race. Instead, it focuses on what it does best and provides a hybrid solution for quantum computing.

By developing the equipment needed to connect existing traditional computing infrastructure with upcoming quantum computers, Nvidia appears once again to be positioning itself nicely to take advantage of a massive computing spending spree.

The tech sector as well as the stock market in general are already starting to feel the effects of “quantum dollars.” As we see further advances in quantum research and as companies experiment with applications, we can anticipate increasing demand for supporting hardware and cloud infrastructure. For investors, this is an important time to identify those companies that are spearheading the transition away from the old paradigm.

In the future, the advancement of science, the strength of strategic alliances and partnerships across the technology landscape will define the success of quantum stocks. Those investors that make smart decisions early on now could potentially be well ahead of the game, as quantum technology comes to maturity and commercial adoption increases in the years ahead.