Nvidia gains market capitalization of $4.5 trillion, which is far beyond its rivals in the ultimate market capitalization battle. 8 out of 10 top spots belong to major technology companies that seem to have been driven by the unstoppable force of artificial intelligence.

By 24 December 2025, these corporate giants have fundamentally changed the worldview of accumulation of wealth fundamentally.

Top Five Surges

Nvidia’s Unmatched Power

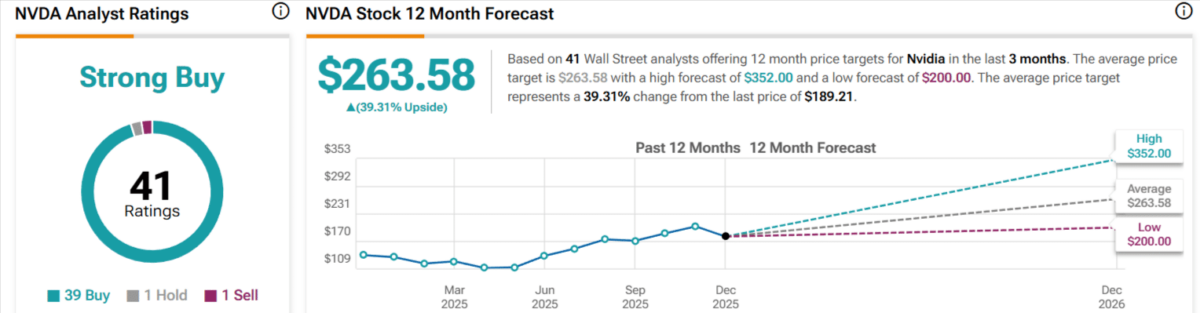

Nvidia (NVDA) has a share price of $189.21 and a market value of $4.5 trillion, and it is at the top of information technology. In the third quarter of 2025, the recorded revenue was of $57.0 billion, up 22% from Q2 and up 62% from a year ago

Record Data Center revenue of $51.2 billion, up 25% from Q2 and up 66% from a year ago. In comparison, last year the company earned revenue of $35.08 billion and had a net profit of $19.31 billion.

Established free cash flow of 13.47billion and gross margins of 72.42. A five-year cumulative performance of 72.97% is better than 15.79 her yearly performance of S and P 500.

Analysts are highly recommending a Strong Buy rating, the Street in general, suggests a Strong Buy analyst consensus rating for Nvidia with a $263.58 average price target.

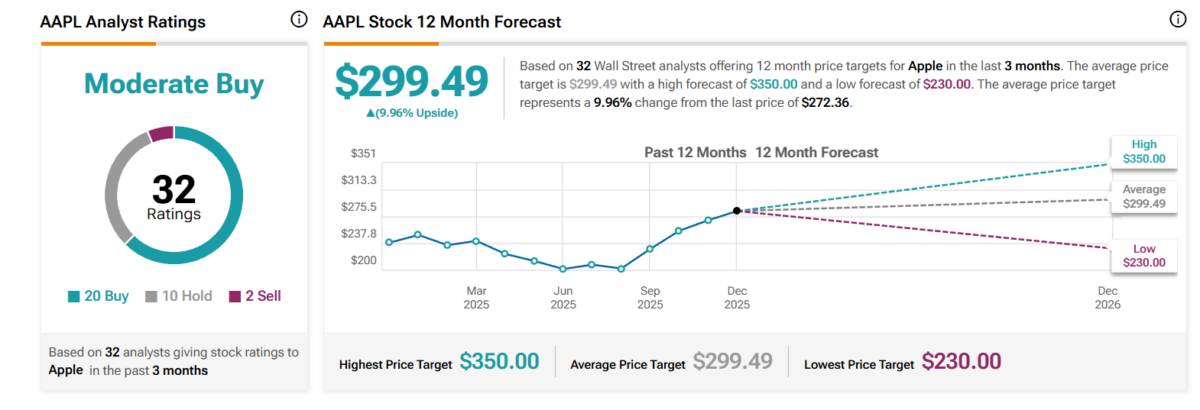

Apple

At position two, Apple (AAPL) has a market capitalization of $4.0 trillion and a share price of $272.36. The company, hailed as one of the symbols of information technology, enjoys a Buy consensus that has been drafted by Based on 32 Wall Street analysts offering 12 month price targets for Apple in the last 3 months.

The average price target is $299.49 with a high forecast of $350.00 and a low forecast of $230.00. The average price target represents a 9.96% change from the last price of $272.36; a force that is supported by the cognitive-technology efforts of the firm amidst the prevailing antitrust investigations.

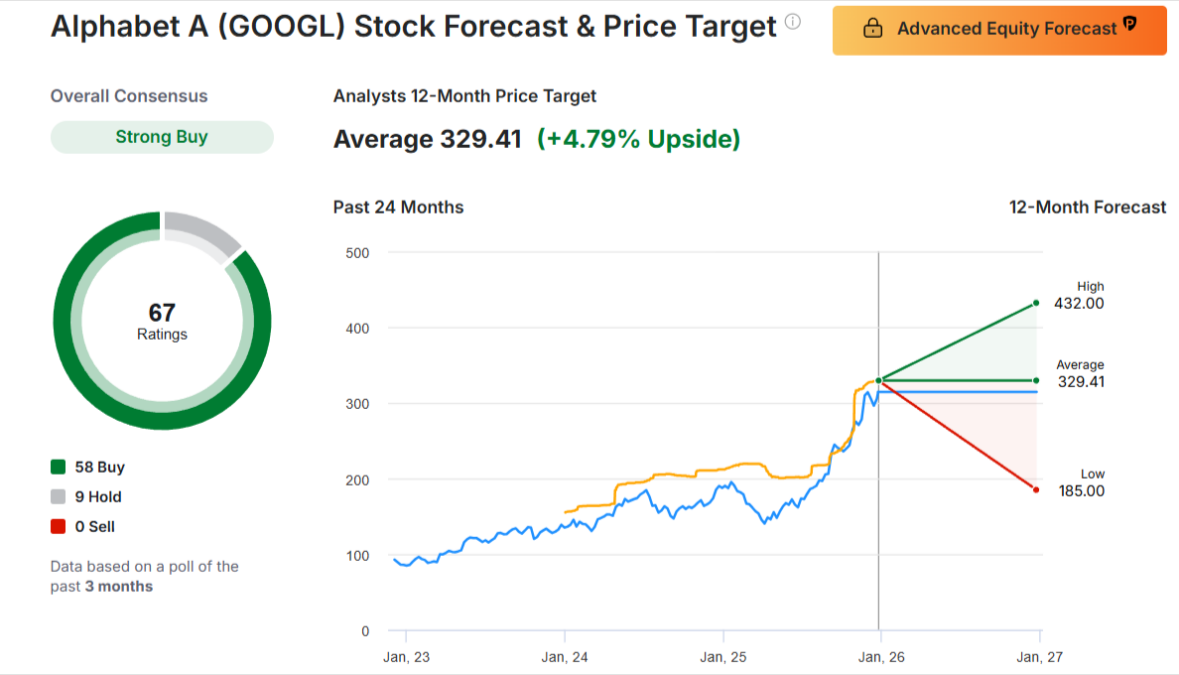

Alphabet

In the third position, Alphabet (GOOG) enjoys a market capitalization of $3.8 trillion and a share price of $315.68, mainly by the communication services.

The company has a strong buy motivated by competitive dynamics of the search engine.

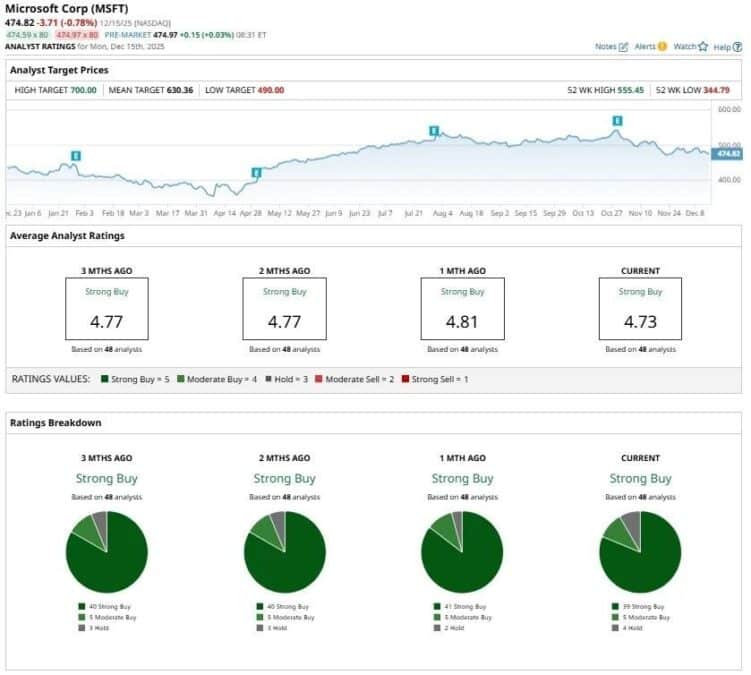

Microsoft

Fourth, with a market cap of about $3.6 trillion and a share price of $486.85. Analysts are upbeat and maintain a “Strong Buy” consensus rating on Microsoft stock. Owing to the expansion of AI where Azure will fit in.

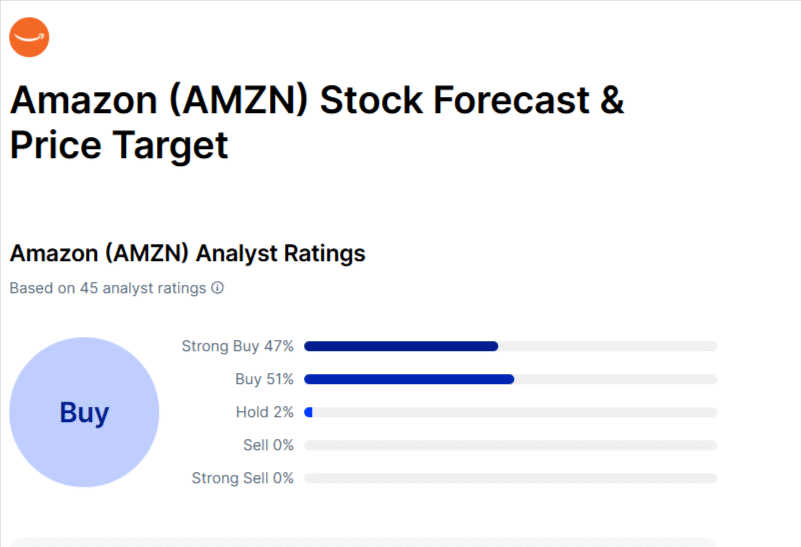

Amazon

Amazon (AMZN) competes in the fifth place with a market capitalization of $2.5 trillion and stock price of $232.14. Amazon (AMZN) has been analyzed by 45 analysts, with a consensus rating of Buy. 47% of analysts recommend a Strong Buy, 51% recommend Buy, 2% suggest Holding, 0% advise Selling, and 0% predict a Strong Sell.

| Rank | Company (Ticker) | Market Cap | Price | Sector | Analyst Consensus |

|---|---|---|---|---|---|

| 1 | Nvidia (NVDA) | $4.6T | $189.21 | Info Tech | Strong Buy |

| 2 | Apple (AAPL) | $4.0T | $272.36 | Info Tech | Buy |

| 3 | Alphabet (GOOG) | $3.8T | $315.68 | Comm Services | Strong Buy |

| 4 | Microsoft (MSFT) | $3.6T | $486.85 | Info Tech | Strong Buy |

| 5 | Amazon (AMZN) | $2.5T | $232.14 | Consumer Disc. | Buy |

Mid‑Tier Titans

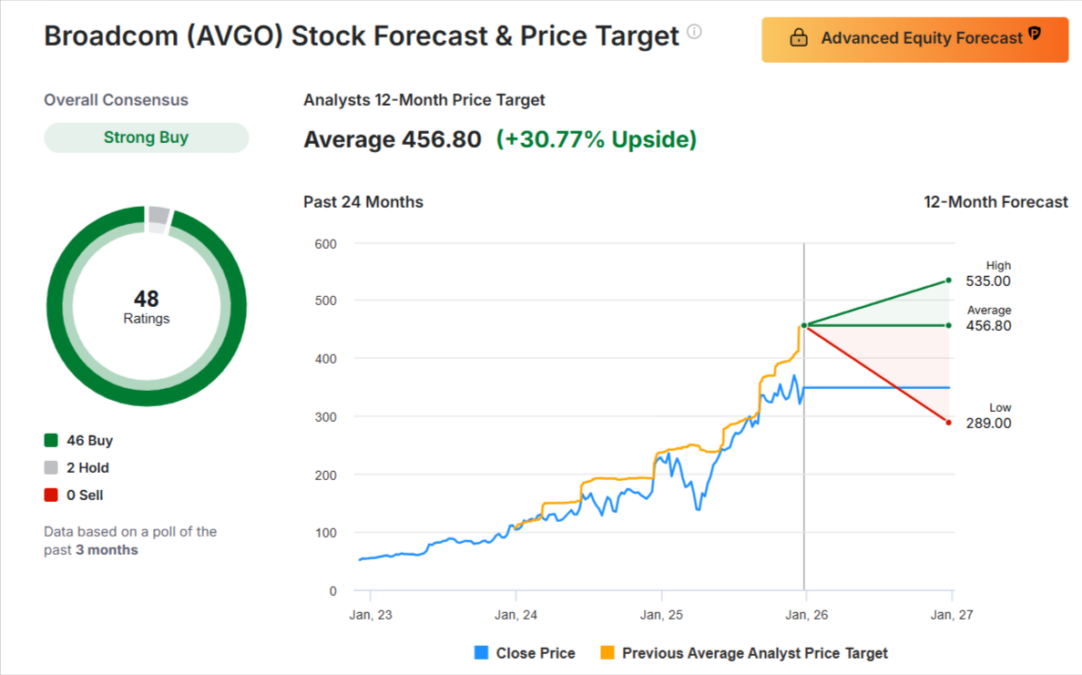

Broadcom

Broadcom (AVGO) holds the sixth place in the market-capitalization ranking that is valued at $1.7 trillion. It enjoys a consensus rating of Strong Buy and a target price of $456.80 following the acquisition of VMware.

It is a company that is a leader in advanced semiconductor technology and experienced a Strong Buy consensus rating.

Meta

Meta (META) is at place number 7 with a market capitalization of $1.7 trillion. Based on 44 Wall Street analysts offering 12 month price targets for Meta Platforms in the last 3 months.

The average price target is $828.71 with a high forecast of $1,117.00 and a low forecast of $655.15. The average price target represents a 24.63% change from the last price of $664.94.

Taiwan Semiconductor Manufacturing Company (TSMC)

In the 8th position is Taiwan Semiconductor Manufacturing Company (TSMC) (TSM) with a market value of $1.5 trillion. Tariff pressures have not deterred a target rating of $320 that has been given to the technology foundry a Strong Buy rating.

Tesla

Tesla Inc. (TSLA) is ranked the 9th, having a market capitalization of $1.56 trillion, or $485.86, a leader in the consumer-discretionary industry. Overall, there are more than a dozen price targets at $500 or greater for Tesla stock, according to FactSet. The average analyst price target is about $420 a share.

JPMorgan

JPMorgan, at the 10th place with market capitalization amounting to $849.45 billion (as of Dec. 1) was given the Buy recommendation when it attempted cryptocurrency endeavors.

| Rank | Company (Ticker) | Market Cap | Key Stats | Sector | Analyst Consensus |

|---|---|---|---|---|---|

| 6 | Broadcom (AVGO) | $1.7T | $59.9B TTM | Info Tech | Strong Buy |

| 7 | Meta (META) | $1.7T | AI push | Comm Services | Buy |

| 8 | TSMC (TSM) | $1.5T | $165B U.S. | Info Tech | Strong Buy |

| 9 | Tesla (TSLA) | $1.56T | EV king | Consumer Disc. | Hold/Buy |

| 10 | JPMorgan (JPM) | $49.45B | $4T assets | Financials | Buy |

AI Revolution Ahead

It is estimated that in 2026, it will have become even more colorful. Major technology companies like Apple and Microsoft are introducing AI products to consumers, TSMC is increasing its manufacturing base in the U.S., and Tesla is introducing autonomous vehicle technology.

Broadcom is already in a position to enjoy the advantages of AI of the enterprise grade and diversified conglomerates such as JPMorgan Chase act as stabilizing forces in unstable markets.

Portfolios which focus on their views of consensus Strong Buy recommendations will achieve significant returns throughout the technology-driven economic growth.