For the cryptocurrency custodian BitGo, the U.S. initial public offering (IPO) has exceeded its hopes, and sold 11.8 million shares at a price of 18 each, 20% better than the expected $15-17 range, and a valuation of $2.08 billion, after the January 22, 2026.

The event marks the New York Stock Exchange (NYSE) listing of the inaugural digital-asset in 2026 under the abbreviation BTGO, and it will begin trading amidst increased institutional buying and selling pressure.

IPO Surge

The digital asset infrastructure company BitGo Holdings, Inc. (“BitGo”) announced today the pricing of its initial public offering of 11,821,595 shares of Class A common stock at a price of $18.00 per share. BitGo is offering 11,026,365 shares of Class A common stock, while some of its current stockholders are offering 795,230 shares.

The upgrading of the offering is an indicator of strong investor interests despite the consequences of the October cryptocurrency sell-off that impacted the markets with an increased volatility and aggravated the capital-raising environment.

Growth Stats

In the first quarter of 2025 revenue surged to $10 billion as compared to the $1.9 billion during the previous year and it is projected to go up to a full year mean of between $16.02 and $16.09 billion.

On September 30, 2025, assets under custody were valued at over $104 billion and supported over 1,550 digital assets on behalf of institutional clients.

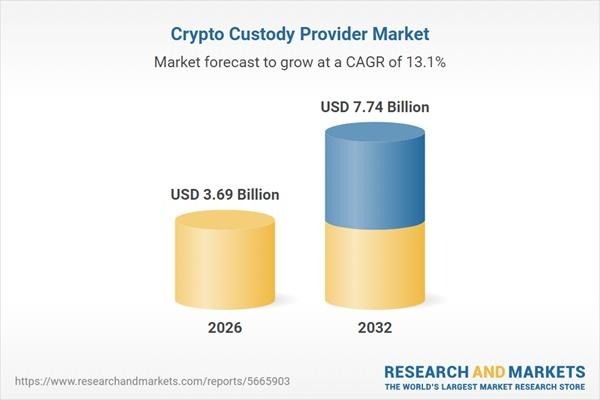

However, the Crypto Custody Provider Market increased from $3.28 billion in 2025 to $3.69 billion in 2026. It is expected to grow at a CAGR of 13.05%, reaching $7.74 billion in 2032. This steady growth is being driven by institutional capital flows, emerging regulatory frameworks, and rising enterprise demand for digital asset security and transparency.

Outlook

The successful flotation of BitGo might set a precedent to such offerings in the future, as Kraken is expected to hold its first-half 2026 IPO. Kraken doubled revenue to $1.5 billion by 2024 and received a $20 billion valuation in a late-stage round led by Citadel Securities.

Political efforts, such as the pro-cryptocurrency agenda of President Trump and proposed bills, including the General Endorsement of Innovation and National-Scale Unification of Secure Infrastructure (GENIUS) Act may streamline further listings, but the controversies about market structure remain.

Investors can subsequently follow the launching of BTGO as a source of information on the direction of the industry in 2026.