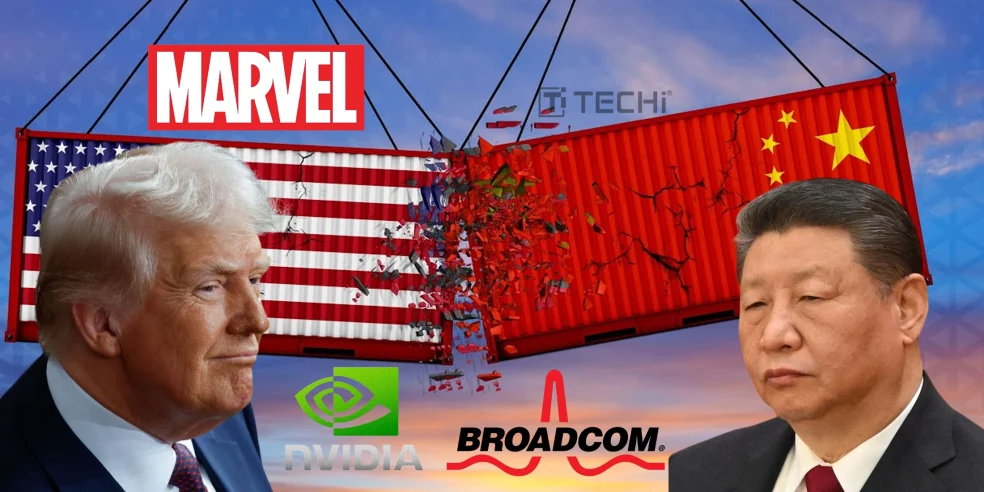

The recent tariffs imposed by the president of the US have shocked the semiconductor industry and specifically the major players such as Nvidia, Broadcom and Marvell. The firms experienced a loss in the value of their stocks following the decision of the United States to set higher trade barriers with key partners like China and Taiwan. This is important because this has coincided with a time when the artificial intelligence infrastructure is being invested heavily in.

The big tech companies like Meta, Microsoft and Alphabet are spending a combined total of $250 billion on the development of AI. They are also rapidly constructing data centres and the next generation computing capacity and power. Yet, such tariffs introduce a certain degree of uncertainty that may disrupt the country’s supply chains and the growth of chipmakers, who depend heavily on the international production process and global markets.

The increase in tariffs, as steep as 41%, and restrictions on trade are causing the industry to move into a troublesome situation. On the one hand, there is insatiable demand for AI chips driving a bullish sentiment and new records-breaking valuations, with Nvidia now coming into the realm of $4 trillion. Conversely, rising prices, supply chain disruptions, and even impeded policy reforms may place margins in jeopardy as well as curtail the delivery of essential semiconductor materials.

Even though this is faced with such headwinds, in the long run, the future looks bright. This stage is not so much the bull tech market ending, but more a transitional point, according to analysts. This sector will become incredibly volatile as it adapts to new geopolitical and regulatory conditions. Yet, the current digitalization, AI deployment, and technology investment at the national scales might ultimately lead to further development in the sector.

The US government’s “Winning the AI Race” plan and relaxed export restrictions to China are efforts to cushion the industry as it navigates these challenges. As the dust settles, well-positioned companies with strong innovation and diversified supply chains will emerge more resilient and possibly set the stage for the next rally in technology stocks.