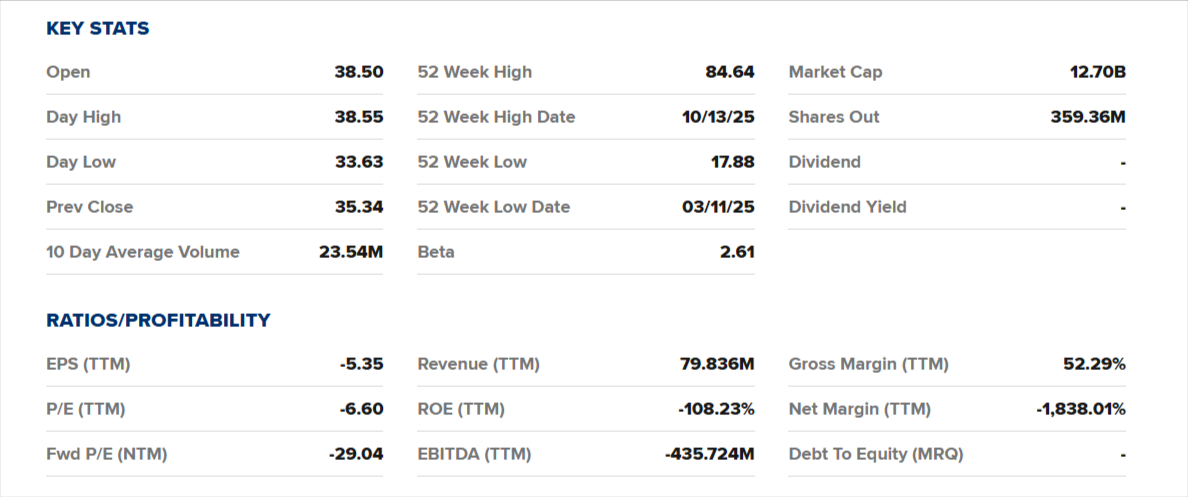

IonQ is the quantum computing genius with investors talking, and the company shares are trading at $35.34, or 8.4% down on February 5, 2026, following a 52-week high of 84.64, in the fall of 2021.

Tech Edge Sharpens

IonQ has pioneered trapped-ion qubits that avoid the error traps of competitors with stable atoms replacing synthetic ones. Oxford Ionics buyout It beats records at 99.99% two-qubit gate fidelity rate replacing large lasers with small microwave controls.

This reduces the size of machines and increases their stability even in presence of heat or vibration. Operating losses topped $160 million in Q2 2025 alone, as revenue is still not enough to pay for significant R&D expenses. Analysts predict that as the business moves closer to its 2030 targets, these losses will increase.

Bold Moves Build Ditches

The IonQ playbook is characterized by smart acquisitions. The flesh of rounding off SkyWater Technology deal is a $1.8 billion deal, signed January 26, which gives priority access to quantum chip fab, a la Nvidia-TSMC synergy full control of the supply chain.

IonQ is an initiative with a high level of risk and corresponding returns. It has undergone a sharp upward tick and at the same time has had a high volatility in its valuation.

Major depressions are an indispensable part of its historical account. Improvement in the development of the system and exploding revenue flows means that the enterprise can soon reach a crucial inflection point.

Moreover, in the event that quantum computing becomes a commercially viable practice in the coming years, the early investors will reap significant benefits. On the other hand, the amount of losses, in case of such commercialization not being realized, may turn out to be significant.