Bitcoin still raises academic controversy as to whether it should be included in investment portfolios.

Despite falling short of the highs in October, Total debt has now surged past $38 trillion, the fiscal deficit is approaching $1.8 trillion, and the U.S. government’s interest payments on the debt now account for 13% of total U.S. government spending.

Investors are concerned that the dollar will lose significant value, which has made gold and perhaps Bitcoin a hedge against dollar debasement.

However, its ability to create millionaire wealth is the topic of intense investigation.

A Digital Gold Rush

Following the 2024 United States presidential election, the price of Bitcoin sped up, with crypto-receptive legislative frames becoming adopted.

The Trump administration, specifically, reduced regulatory barriers, and created the U.S. Strategic Bitcoin Reserve, thus supporting mainstream adoption.

It has also boosted investor confidence, and the major brokerages firms can now smoothly access the cryptocurrency markets.

This institutional and political support has fixed the image of Bitcoin being called digital gold. Compared to the limited physical gold in a limited amount, Bitcoin has a limit of 21 million tokens and only about 95% of these tokens have already been mined, an issue that makes the supply rarer.

The halving mechanisms in Bitcoin, which reduce the amount of new supply, increase its interest as a scarce resource even more.

Performance and Market Concerns of Bitcoin

The historical price trends of both Bitcoin and gold tend to be similar since each instrument is likely to gain benefits due to the pressure of inflation and the geopolitical risks.

The federal debt of the United States exceeded $38.40 trillion and the Net interest as a share of outlays is forecast by the Congressional Budget Office to be 13.85 % in FY2026, 14.11 % in FY2027, and 14.52% in FY2028.; a situation that adds concerns on the possibility of the dollar losing its value.

This kind of economic climate strengthens the use of Bitcoin as a hedge against the currency risk.

Nevertheless, the volatility of cryptocurrency continues to be high with Bitcoin.

Its flights, which resemble the technology stocks, often do not follow in the success of the relative stability in gold, and the issue is its sustainability.

Such newcomers to the market as Michael Saylor and Cathie Wood have imagined that the value of Bitcoin may increase multi-fold over the next decade, although there are considerable doubts.

What’s Ahead for Investors?

Experts recommend the integration of Bitcoin in portfolios.

Its stability in the times of earlier downturns in the market, as well as the increasing institutionalization, indicate that Bitcoin is not expected to disappear any time soon.

How the status of being a millionaire depends on a guest on time and a long time is a reflection of whether the early adopters become millionaires.

The “digital gold” story has potential but it requires caution in an environment that still presents itself as susceptible to shocks.

Future Outlook

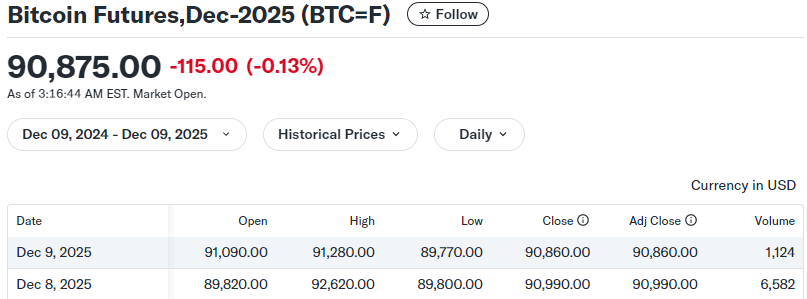

The future of Bitcoin seems positive among long-term investors due to the image of a digital gold standard and favourable regulatory relationships. Bitcoin is trading at around 90,875, with a market capitalization of $1.8 trillion, not too low compared to its highs recently but a big improvement compared to its lows per year.

The adoption on an institutional level is also on the positive line as demonstrated by the U.S. Strategic Bitcoin Reserve and cryptoplan-friendly legislative changes by President Trump that have lowered barriers to entry and made the industry more attractive to more capital inflows.