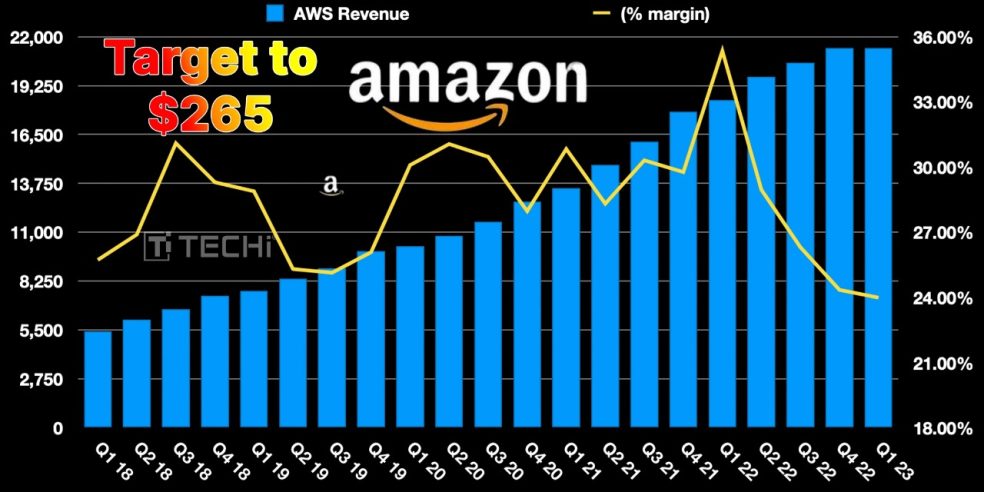

Amazon.com Inc. (NASDAQ: AMZN) is the most prominent stock in the field of AI under its belt. Jefferies raised its price target on the Amazon shares to 265 and retained an unchanged “Buy rating”.

The company meets a high revenue, and there is a possibility of the company having a higher-than-expected profit margin in its second quarter. It implies that much faith is put in the business power of Amazon and its capabilities of surviving in the market.

Jefferies points toward staunch growth as Amazon keeps growing its core business in e-commerce, cloud computing, and AI. AWS continues to be a powerful revenue stream, and its progress in AI solutions and infrastructure is blazing new business directions. The increasing interest in automation and AI projects can assist Amazon to remain in the game, rapidly developing technology industry.

It is necessary to mention that Amazon had retained its BofA rating as Buy. It indicates that although it might not be considered as one of the ultimate good ideas when it comes to finding a short-term investment option, Amazon is still considered to be a good and sound choice over the long term.

Amazon stands well in the market despite the conflicting information from the analysts. The firm enjoys an extensive base of customers, international presence, and strong technology solutions. Its flexibility and expansion in the fluctuating markets have continued to stay intact, maintaining investor confidence.

Nevertheless, other analysts suggest that other AI-focused companies could provide more upside potential in the short term. The smaller or more focused companies can bring faster returns as the interest in AI also increases. Amazon is an attractive tech stock as far as the fundamentals are concerned, and stability is on the side.

In a few words, the upgrade of Jefferies indicates that the company believes in the further expansion of Amazon, whereas the rating of Amazon made by BofA is an affirmation of its worth. The best AI stock is Amazon, as long as that is what you want to do with it: either invest to achieve stable growth, or to see the rise.