The share of Microsoft has suffered a sharp fall of 28% since the 52 week high amid a broad technology sell-off that has raised questions about sustainability of AI driven valuations.

The company is at year-to-year-fall of 18% and has lost another 5% with capital-expenditure anxieties that have created significant investor trepidation notwithstanding the very strong company business momentum.

Strong Earnings Momentum

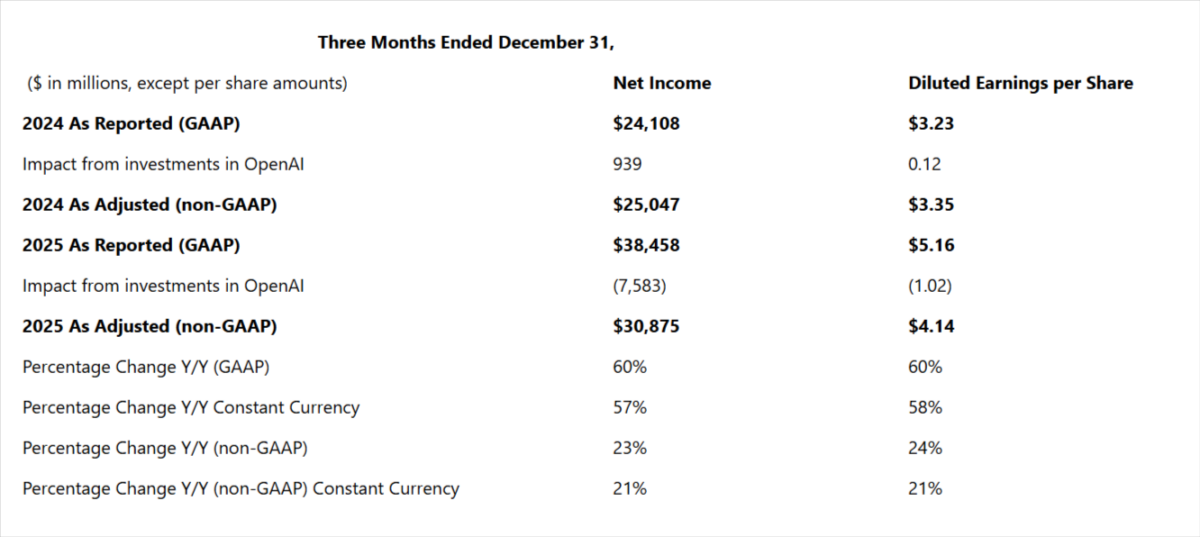

The fiscal second-quarter performance, which ended on December 31, 2025, Microsoft reported a revenue of $81.3 billion which is 17% higher than the previous year, and 15% in constant currency values which is higher than the estimates of $80.23 billion.

Said Satya Nadella, chairman and chief executive officer of Microsoft.

We are only at the beginning phases of AI diffusion and already Microsoft has built an AI business that is larger than some of our biggest franchises.

The operating income increased by 21 % to $38.3 billion and the earnings per share of $4.14 was above the estimates by 5.34 %.

The group of cloud revenues hit the milestone of over $50 billion and reflected the increased interest in the demand of AI-enabled services.

Backlog Boom, OpenAi Boost

The commercial remaining performance obligations (RPO) of the firm increased 110% to $625 billion of which 45 % belonged to OpenAI’s $250 billion Azure obligation and the rest 28%.

Capex Crunch Hits Margins

Capital expenditures were quite large and they grew by 66 % to $37.5 billion with specialization on the areas of GPUs, CPUs and data-center infrastructure with half of that being short lived equipment used to boost AI capacity. As a result, Gross margins declined to 68.59% noting that it may worsen profitability in the future as Microsoft seeks to expand its AI capacity by around 80%.

Buy, Hold or Sell?

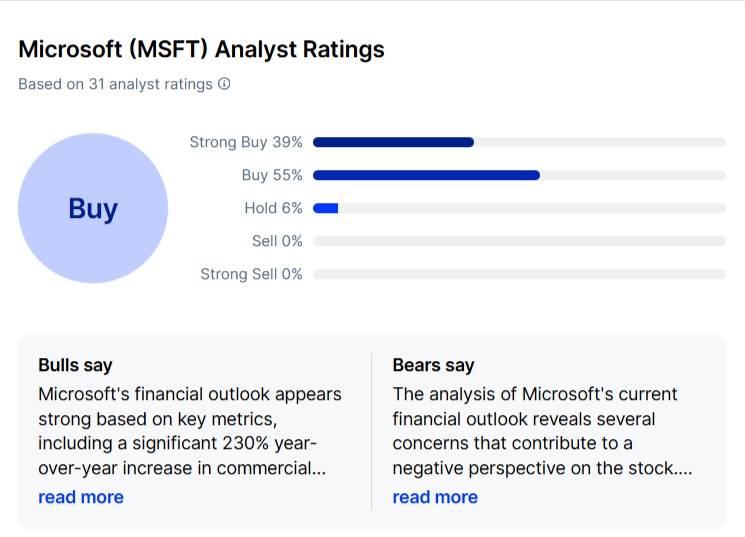

The price to earnings is 25 forward which is reasonable when compared to peers though aggressive use of capital discourages the excitement. Microsoft (MSFT) has been analyzed by 31 analysts, and the consensus rating is Buy. 39% of analysts recommend a Strong Buy, 55% buy, 6% hold, 0% sell, and 0% predict a Strong Sell.

The long-term viability of the Microsoft AI moat anchored by Azure and OpenAI puts it in a better position to dominate the market in case its investments are effective.

It would appear reasonable to place a hold recommendation in the near term since bullish patient investors can slowly but surely help in share appreciation as soon as the AI capacity matches market demand at the end of 2026.