The AI boom that rippled through Wall Street last year projected two tech companies, Nvidia and Broadcom, into household status well beyond Silicon Valley. A year later, after all their much-hyped stock splits, the narrative around their unstoppable momentum and the figures behind it are even more exciting. Both companies are not only riding the wave of AI, they are piloting it today.

The AI Boom and a Stock Market lift

Within the last 12 months, Nvidia and Broadcom have seen their share prices soar out of order into the stratosphere with a value hitting well over an unrealistic $1,000-per-share benchmark.

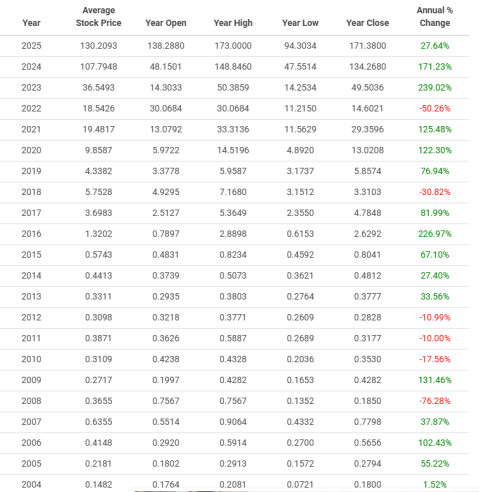

Such sticker-shock prices prompted bold actions by the two companies, Nvidia completed its 10-for-1 stock split on June 7 of last year, with shares trading at the split-adjusted price as of June 10. This brought the shares down from about $1,200 to $120. Since that time, Nvidia stock has experienced ups and downs, but it’s delivered a gain of more than 40%.. This was not a gimmick, but a keen tactical maneuver to democratize access and to stir up investor interest.

It is not that a stock split changes the core value of a business but redistributes the deck, providing additional stock at a reduced price.

This opens up the number of possible investors, such as employees, and firms new to the market, making the environment even more buoyant in the AI stock game.

Why AI Spotlight was taken over by Nvidia and Broadcom

Even before their splits, Nvidia and Broadcom were not strangers to dramatic gains. Indeed, Nvidia stock rocketed over 239% in 2023 and Broadcom soared in 2023 by a level twice as great as that, driven by a worldwide artificial intelligence turmoil.

However, the division achieved more than a headline, as it created a foundation of sustained growth into at least 2024 and this year.

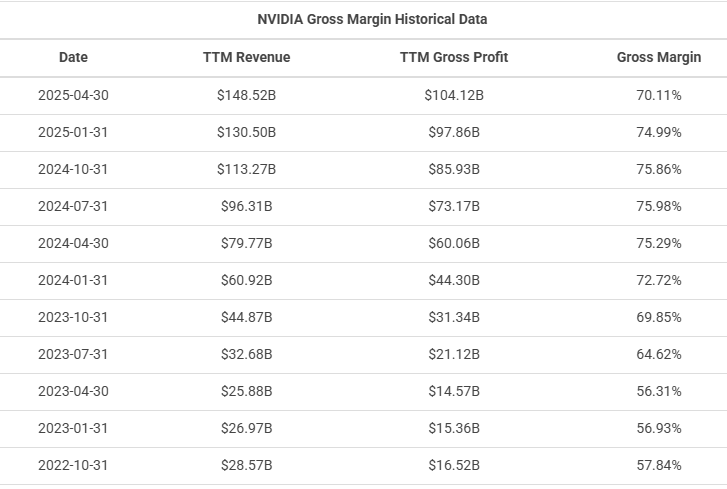

Their triumph can be reduced to the earthquake demand of their technologies. Nvidia, the undisputed ruler in the AI chip world, would find a new plane in its Blackwell architecture, unveiled last winter, which CEO Jensen Huang said, generating a mind-blowing $11 billion in revenue during its first quarter.

The gross margins remained above 70%, reinventing software engineer magic into cold, fiscal cash. Nvidia was not satisfied with simply having a large number: the company broke records and became the first company in history with a $4 trillion market capitalization.

Meanwhile, Broadcom was leading the race in networking. Cloud service providers raced to bulk up their AI muscle, and Broadcom provided the heart and power networking switches, routers, and specialty AI-purposed chips.

The latest quarter saw a 77% revenue growth in AI at Broadcom, to $4.1 billion, and their share skyrocketed by over 65% year-to-year.

Historic Highs

Wider market fears saw both stocks waver this year on the news of possible tariffs and broader worries. However, those dark clouds soon vanished. Robust corporate interest in AI continued to propel both firms to new heights.

Trade negotiations were renewed, prompting them both to climb to new all-time highs just days ago, with Broadcom hitting a record closing level. Their track record since the breakup is healthy enough to make any financial mind dizzy with delight beneath the headlines.

Despite factoring in daily market fluctuations, Nvidia stock has already gained more than 40% since its 2024 dividend declaration. Broadcom stock has increased by over 65% since its stock split due to the interest in its hardware and AI-enhanced services.

This is not about share prices; this is about fundamentals. The recent product releases and insatiable appetite of Nvidia to consume its GPUs are being paralleled by Broadcom as the critical supplier to datacenters and cloud giants all over the world.

The Cause of the Rally

One might be tempted to attribute all these returns to the obsession over stock splits. Most of the upside, in reality, was a result of competent execution and market leadership. Nvidia has chips to satisfy every data center on earth. The Blackwell chips were introduced with great hype, grossed $11 billion in upfront sales, and commanded excessive margins. Investors who wagered on the business at the heart of Nvidia were rewarded but in abundance.

“We delivered $11.0 billion of Blackwell architecture revenue in Q4 FY2025, marking the fastest product ramp in our company’s history,” said CFO Colette Kress in the company’s earnings report.

Instead, the growth of Broadcom is rooted in infrastructure. As cloud computing and storage swell to accommodate the mighty AI applications, Broadcom hardware is indispensable.

The best is yet to come?

Both stocks are also trading at reasonable valuation levels, considering their enormous earnings and future growth prospects. Indeed, the price Nvidia commands is modestly lower than its pre-split peak, whereas Broadcom has done the pack-on.

The forward PE ratios are still at a low enough level that experienced investors are expecting further growth, given the explosive path of the AI sector.

The markets have no crystal ball, but they are full of growth indicators. Trade concerns are narrowing, and the major technology consumers in the world are not slowing investments.

At the very least, the post-stock-split rally shows that investors are betting on the core AI thesis, the digital world is simply becoming larger, faster-moving, and brighter, and both Nvidia and Broadcom are at the center of that transformation.

The Future

The following 12 months after their stock divisions have taught Nvidia and Broadcom that they can flourish under the spotlight. They have authored the playbook on how AI leadership can work in the public markets-sheer operational excellence, product development, being able to harness hype and drive results that are unignorable.

The hallmark of true sustainable winners, though, is how they manage those highs and lows and both have proven their composure in bouncing back quickly when dips in the market take place and how they decline to allow passing concerns to throw off their overall plans.

The future is promising. The world is going all in on developing AI, and infrastructure investment is not slowing down. With potential to break out again in years to come, the stocks of Nvidia and Broadcom may again be ripe to make another spectacular surge upward, as investors are again reminded that the AI boom is no temporary trend.