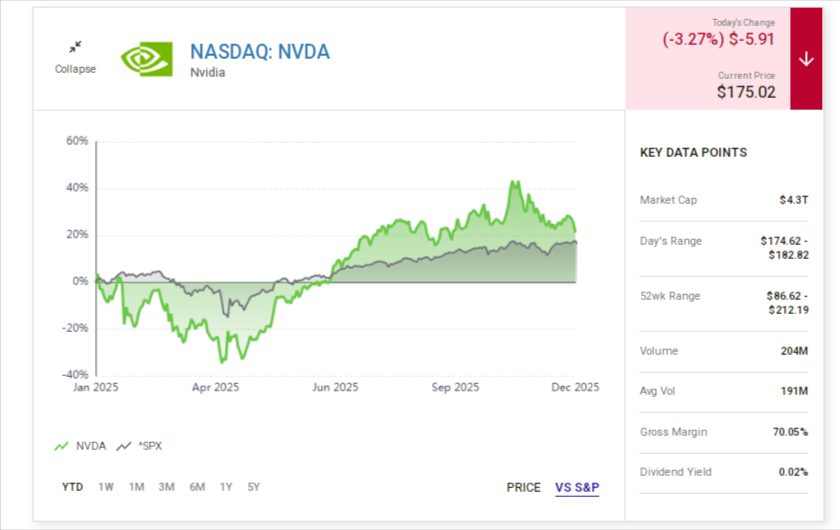

Share prices of Nvidia fell 17% since October, as the stock trades at $175.02 as of December 15, 2025, -5.91 in one day alone amid increased concerns about artificial intelligence.

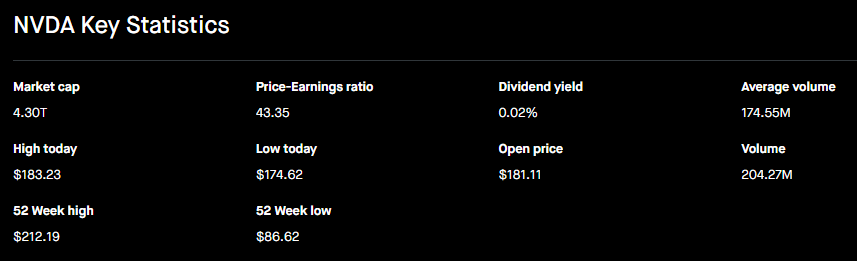

The GPU leader has a market capitalization of 4.5 trillion which can be speculated in looking at a possible AI bubble. Whether this pullback is a favorable place of entry to serious investors is also loosely to be examined.

Surging Demand Fuels Growth

Considering the widespread pessimism, the fiscal results of the third quarter of Nvidia superseded the expectation.

Nvidia’s sales grew 62% year-over-year to $57 billion in the October quarter, ahead of the $54.9 billion Wall Street had projected, signaling that demand for AI chips remains strong even as more questions emerge about whether returns from the technology will keep up with the pace of infrastructure investments.

It posted profits of $31.9 billion, up 65% from the year-ago quarter and also slightly above expectations. Jensen Huan, Chief Executive Officer said,

“Blackwell sales are off the charts, and cloud GPUs are sold out,”

The profitability was also boosted: the operating income increased by 65% to $36.0 billion, and the earnings per share was $1.30, an increase of 67%.

Valuation Risks Loom Large

Shares currently trade at about 43 times earnings. A valuation multiple like this makes sense if Nvidia can sustain its rapid growth and maintain its high gross margin in the 70s.

But if investors start to see signs that either of these important factors behind Nvidia’s valuation is at risk, the stock could take an even bigger hit. Semiconductor cycles however present more of a risk: they might hang after the existing build-out cycle.

Competitors like Alphabet and Amazon are also working on their own chips, which makes Nvidia less competitive.

The volume of shares increased to 204 million during the latest period as against a mere 191 million on average indicating more volatility.

On a year-to-year basis, Nvidia has a slight decline in performance compared to the S&P 500 in spite of the 52-week performance of between $86.62 and 212.19.

Prognosis: High Reward, More Risk

The role of dominance of Nvidia in artificial intelligence has not been waning as far as it can be predicted.

Some analysts such as Daniel Sparks have commented on a revival of accelerating growth,

“the stock’s pullback makes Nvidia shares more interesting than they were a few months ago. And it’s difficult to critique the business; not only did Nvidia’s sales accelerate in Q3, but management guided for a massive fourth quarter. Even so, the stock’s high valuation means investors likely won’t be very forgiving if the AI boom shows signs of slowing. To be clear, there’s no clear evidence it is fizzling out yet. But since the market is forward-looking, all it will take is one or two material signs of a cooling market for AI chips to send the stock sharply lower. While there’s no guarantee this happens, it is a risk that demands a margin of safety when buying the stock and I do not believe the stock’s margin of safety at the moment is sufficient.”

Similarly, the physical AI market is projected to grow at 38.5% CAGR through 2030, driven by NVIDIA’s Blackwell GPUs offering 30x faster inference and 25x better energy efficiency than prior generations.

More aggressive investors might buy as soon as possible; more cautious participants are to wait until the markets will reach lower points.