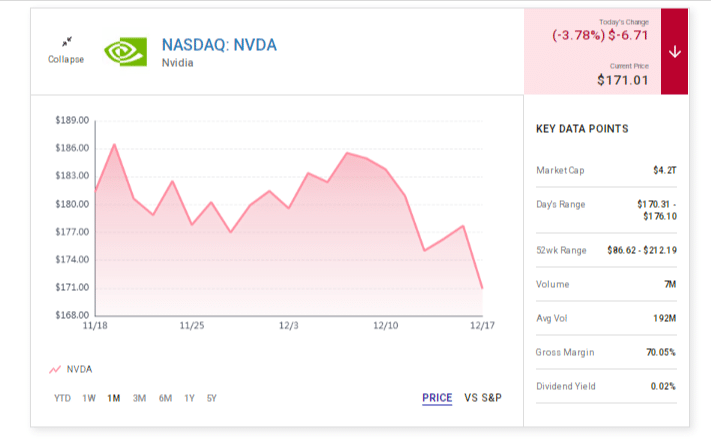

The artificial-intelligence (AI) industry has been catalyzed by the Nvidia platforms of GPUs that have led to a market capitalization growth of $364 billion in late 2022 and $4.2 trillion as of the latest records.

The increase in fiscal year 2025 sales was 114% with $130.5 billion and earnings per share (EPS) was 130% to $2.99.

Nvidia surpassed the expected revenue figures in the third quarter of the 2026 fiscal year, the company generated $57 billion, a 62% growth.

Nvidia has continually surpassed market expectations. Over the last three years, the stock has come out of nowhere to become the world’s largest company as measured by market cap.

Despite that retreat, Nvidia stock is likely on track to reach $15 trillion, and that may be a conservative estimate, predicted by The Motley Fool.

ASML’s Monopoly Muscle

ASML controls more than 90% of the lithography market with its extreme-ultraviolet (EUV) Lithography systems that its competitors are a decade behind.

ASML (ASML) closed at $1,080.85 in the latest trading session, marking a -3.74% move from the prior day. The stock fell short of the S&P 500, which registered a loss of 1.07% for the day.

Analysts and investors alike will be keeping a close eye on the performance of ASML in its upcoming earnings disclosure.

Analysts expect ASML to post earnings of $8.84 per share. This would mark year-over-year growth of 21.1%.

Meanwhile, the latest consensus estimate predicts the revenue to be $11.06 billion, indicating a 11.9% increase compared to the same quarter of the previous year.

Why does Nvidia Win Now?

The two companies are advantaged by the fact that AI infrastructure investment is projected to spend a range of $3-4 trillion in five years, but Nvidia is ahead of the pack.

According to Dell’Oro Group, global data center capex is estimated to reach $1.2 trillion by 2029. Hyperscalers are expected to account for nearly half of this spend.

Faced with escalating infrastructure and energy costs, cloud giants are exploring lower-cost accelerators to reduce the total cost of ownership while ensuring high performance.

In comparison, the dependence on foundry services offered by ASML (including those of TSMC) makes it susceptible to the geopolitical conflict between any of the two US and China.

Bold Future Outlook

Moving ahead, Nvidia is investing in robotics and autonomous systems, positioning it for long-term growth.

Even though ASML has a technological advantage, which is predicted to continue, Nvidia has a more favorable long-term outlook bearing in mind that its projected annual revenue increase is more than 50%.

As a result, Nvidia shares can be recommended to investors who would like to realize a considerable upside potential because the two companies together are beneficial in terms of diversified portfolios in the context of the further rise of AI.