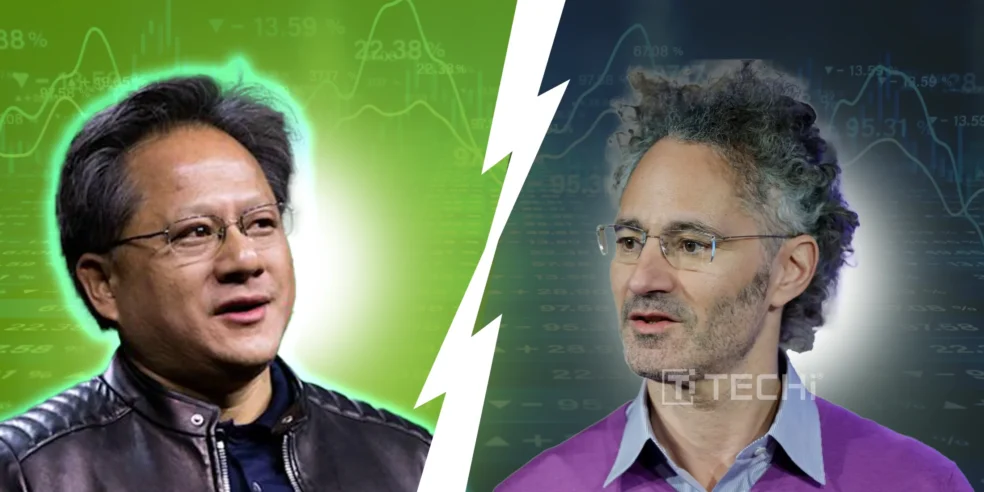

As artificial intelligence (AI) continues to reshape industries and disrupt markets, two companies, Nvidia and Palantir, have emerged as central players in this tech revolution. Nvidia, the dominant provider of AI infrastructure hardware, and Palantir, a leader in AI software solutions, have both experienced massive stock growth.

However, investors are now grappling with a critical question: which of these two tech titans offers the best investment opportunity for September 2025? In this article, we’ll compare Nvidia and Palantir across key metrics, growth potential, and market outlook to help you make an informed investment decision.

Nvidia: The Backbone of AI Infrastructure

Nvidia’s dominance in AI hardware has firmly cemented it as a cornerstone of the AI industry. As the provider of high-performance graphics processing units (GPUs), Nvidia powers everything from large language models to data centers and even autonomous vehicles.

Its GPUs are the foundation of most AI workloads, both for training models and for inference applications that run real-world applications.

Financial Performance and Market Outlook

Nvidia’s financial performance speaks volumes about its market leadership. In Q2 2025, Nvidia’s data center revenue reached $41.1 billion, reflecting a 56% increase from the previous year, contributing to 88% of its total revenue.

With projections forecasting global AI infrastructure spending to reach $3–$4 trillion by 2030, Nvidia stands to be one of the largest beneficiaries. Despite its high valuation, the company’s market position and profitability make it a solid choice for investors seeking long-term stability in AI.

Wall Street’s Optimism

Wall Street analysts continue to maintain a “buy” rating on Nvidia, citing its dominant role in AI infrastructure and the steady demand for GPUs. The company’s diversified business model, which includes hardware, software, and strategic partnerships, further strengthens its position.

Analysts forecast Nvidia’s revenue to continue growing as AI and data center demand remains strong. However, concerns over geopolitical risks and potential slowdown in growth still linger, especially with U.S. export restrictions on advanced chips to China.

Nevertheless, Nvidia’s scale, profitability, and dominant market position make it a preferred choice for AI-driven growth.

Palantir: AI Software with Government Ties and High-Risk Potential

While Nvidia dominates AI hardware, Palantir has carved out a significant niche in AI software. Known for its expertise in data analytics and AI-driven platforms, Palantir primarily caters to government clients, including the U.S. Army, the Department of Defense, and other intelligence agencies.

However, Palantir has also made significant strides in the commercial sector, positioning its AI platform as a key tool for businesses and government agencies alike.

Financial Growth and Risk Factors

Palantir has experienced phenomenal growth, with revenue jumping 93% year-over-year in Q2 2025 to $306 million. The company’s U.S. commercial business is now its fastest-growing segment, and it has established new contracts with the U.S. Army, the Department of Veterans Affairs, and the U.S. Space Force.

However, despite its impressive growth, Palantir’s valuation remains a significant concern. Trading at a price-to-sales multiple of 101.5, Palantir is among the most expensive stocks in the AI sector. The company’s high valuation leaves little room for error, as investors expect consistent revenue growth to justify the stock price.

Valuation Concerns

Palantir’s valuation is a key differentiator from Nvidia. While Nvidia’s high price-to-earnings ratio is considered justifiable due to its dominant market position and steady profitability, Palantir’s valuation is seen as a risky bet. With a forward price-to-sales multiple of around 101.5, the company’s stock price has outpaced its financial fundamentals.

Analysts are cautious, urging investors to tread carefully as Palantir’s stock price could be vulnerable if the company fails to meet expectations or if its reliance on government contracts exposes it to external risks, such as political changes or budget cycles.

The Wall Street Divide: Buy Nvidia, Sell Palantir?

While both Nvidia and Palantir are seen as winners in the AI space, Wall Street analysts have drawn distinct conclusions about their investment potential. Nvidia’s strong market position, profitability, and long-term growth prospects have earned it a “buy” recommendation from most analysts.

The company is viewed as the safer bet, offering steady returns and resilience against market volatility. In contrast, Palantir’s stock is seen as a high-risk, high-reward investment. Analysts acknowledge the company’s rapid growth, particularly in government contracts, but the steep valuation has raised concerns.

The stock’s high price-to-earnings ratio and reliance on government business make it more vulnerable to external factors, such as political changes or shifts in the defense budget. As a result, many analysts recommend caution when investing in Palantir.

Comparative Metrics

A closer look at both companies’ financials reveals stark differences in growth potential and valuation. Nvidia’s forecasted earnings growth, coupled with its robust market position, has analysts projecting an upside potential of more than 15% in the next year.

On the other hand, Palantir’s consensus price target suggests a possible decline of 10-15%, reflecting concerns over its high valuation. While Palantir has secured lucrative contracts, its stock price is now seen as highly speculative.

Which Stock is the Better Investment for September 2025?

The choice between Nvidia and Palantir ultimately comes down to the type of investor you are: are you looking for a safe, stable investment with solid growth prospects, or are you willing to take on more risk for the potential of massive gains?

Nvidia: The Safer Bet

Nvidia’s long-standing leadership in AI infrastructure, solid financials, and diverse revenue streams make it the more appealing choice for conservative investors. The company’s dominance in the GPU market, along with its expanding role in data centers and AI applications, positions it as a key player in the AI revolution. While the stock is not without its risks, Nvidia’s scale, profitability, and market leadership make it the safer investment for long-term growth.

Palantir: High-Risk, High-Reward

Palantir offers significant upside potential, especially if its growth in the commercial sector continues and its government contracts expand. However, its high valuation and reliance on government business make it a much riskier investment. For those willing to take on more risk in exchange for the possibility of higher returns, Palantir could be a worthwhile bet. However, the stock’s speculative nature and the challenges it faces in maintaining high growth make it less attractive for risk-averse investors.

Conclusion:

Both Nvidia and Palantir have carved out critical roles in the AI ecosystem, but their investment profiles are vastly different. Nvidia’s position as the backbone of AI infrastructure, its steady revenue growth, and its dominant market share make it the more reliable and stable investment. While Palantir’s rapid growth and innovative AI solutions are enticing, its high valuation and exposure to government contracts add a level of risk that could deter more cautious investors.

As we look ahead to September 2025, Nvidia stands out as the more compelling long-term investment. Its ability to provide steady growth, coupled with its leadership in AI infrastructure, positions it as the smarter choice for investors looking for sustainable returns in the AI space.