Nvidia is managing to hold the spotlight even in the sea of tech tantrums and economic eye roll, as Nvidia receives an uplift in confidence from Phillips Financial. Phillips Financial Management LLC has increased its stake in Nvidia by an additional 14.6% during the fourth quarter of the fiscal year. The firm has disclosed in its latest Form 13F filing with the Securities and Exchange Commission (SEC) that it now holds 16,971 shares of the company, with an increase of 2,161 shares from the previous quarter. The current valuation of this stake amounts to about $2.279 million. The Phillips Financial move comes as part of a wider institutional support that developed for Nvidia, which is now at the epicenter of artificial intelligence and semiconductor growth.

Increasing Interest in Nvidia

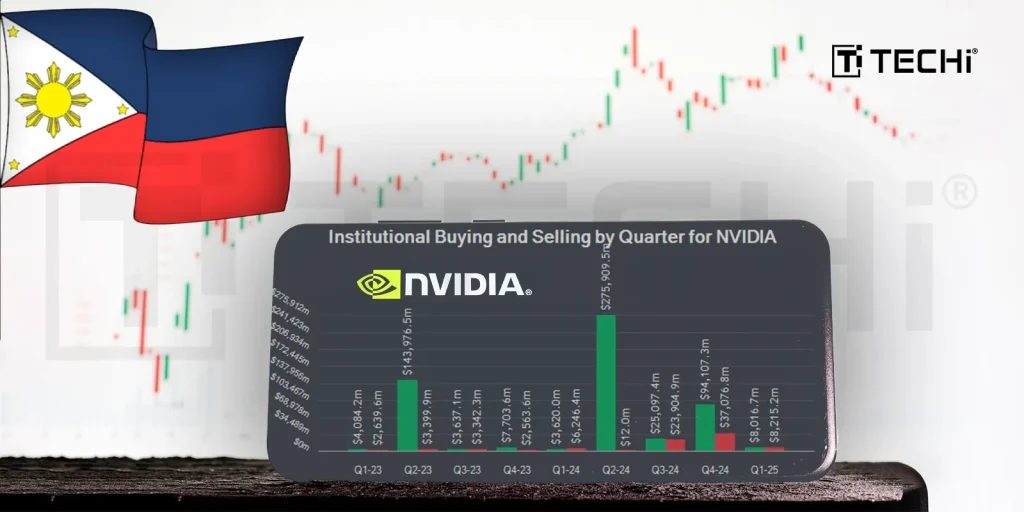

Phillips isn’t the only one with a great deal of faith in Nvidia. A number of other institutional investors made similar moves in the previous quarter. Wealth Group Ltd. raised its position by 5%, now owning 5,602 shares, valued at $680,000. SOA Wealth Advisors LLC had a small increase of 0.3%, owning 120,634 shares, worth $14,650,000 million. The holdings in Nvidia owned by Swedbank AB increased by 4.8% in the third quarter. After buying an additional 1,868,358 shares last quarter, Swedbank AB now owns 40,888,722 shares, valued at $4,965,526,000.

Quintet Private Bank Europe S.A increased its stake by 6.5% in Nvidia and now owns 1,675,393 shares, worth $203,460,000 after buying another 102,869 shares in the last quarter. Last but not the least, Arlington Capital Management raised holdings in Nvidia by 2.5% and as a result, it now owns a new record of 62,318 shares, valued at $7,568,000 following an additional purchase of 1,512 shares in the previous quarter. Currently, these institutional investors now own up to 65.27% of Nvidia’s total stock, this suggests an exceedingly high confidence in the market regarding the potential for continued dominance by the chipmaker.

Insider Selling

Not all signals are optimistic, indeed very recent insider transactions reflect a more cautious internal stance. Director John Dabiri sold 2,663 shares early in March at a price of $110.00 with a total value of $292,930. Robert K. Burgess sold 53,324 shares at a price of $115.49, amounting to more than $6.15 million. With almost double-digit reductions over their respective holdings, 13.35% for Dabiri, 17.52% for Burgess, were made by both. Altogether, insiders sold over 147,147 shares worth more than $17.1 million in the past three months. Insiders still own 4.23% of the company’s stock after all these sales.

Stock Performance

Nvidia’s shares recently closed at $101.33, and the stock traded between $75.61 and $195.95 over the past 12 months. Nvidia remains one of the most valuable tech firms globally with a market capitalization of $2.47 trillion and a price-to-earnings ratio of near 40. This is further supported by its quick ratio of 3.64 and 0.13 debt to equity ratio. Most recent quarterly results have outperformed analyst forecasts, with EPS at $0.89 with a revenue of $39.33 billion during the quarter. Analysts expect the annual EPS to hit 2.77 for the current year.

Dividends and Analyst Forecast

Nvidia has been rewarding long-term investors with a modest dividend, which now stands at $0.01 per share. On April 2, dividends were paid to shareholders on record, as of March 12. The annualized yield is now at 0.04%, which shows that the company is following a growth-first capital strategy. Sentiment among analysts remains very positive, with Cantor Fitzgerald maintaining its “overweight” rating, this time with a target price of $200. Benchmark and Truist Financial were also supportive in their “buy” recommendations, while Mizuho lowered its target marginally downward from $175 to $168. In a contrary move, HSBC Global downgraded the stock from a “strong-buy” rating to a “hold” rating.

The stock has been rated as a “hold” by 6 investment analysts, while 36 analysts have rated it a “buy”, and two have rated it a “strong-buy”. Overall, MarketBeat report shows Nvidia stock has an overall consensus rating of “Moderate Buy” with an average target price of $165.51. The company has stock in bold characters today, it continues to hypnotize the imagination of investors and cash through its strength in the booming AI market, being the crucial semiconductor making industry. Although insider selling is an indicator of caution at least in the short-term, institutional players like Phillips Financial are backing it up with a double wager on long-term growth. With strong fundamentals and an optimistic analyst outlook, Nvidia remains a stock to be watched, as the tech sector gears up for its next wave of innovation.