In a transaction that is all too common but one monitored closely, Alphabet CEO Sundar Pichai sold over $10.4 million of his company shares this week, a check cashing transaction in which the shares were trading at all-time highs as a result of strong momentum due to artificial intelligence breakthroughs.

Sale Details

This corresponds to an amount of 22,411 shares of Alphabet Class C stock that Pichai sold on January 7, 2026, at a range of between $315.39 and $326.05 apiece, as per a Form 4 filing with the U.S. Securities and Exchange Commission.

The amount of the transactions was $10.44 million dollars. After the sale, Pichai has a significant ownership position in the company, which constitutes 2,244,372 Class C and 227, 560 Class A stock, and thus his long-term affiliation with Alphabet shareholders.

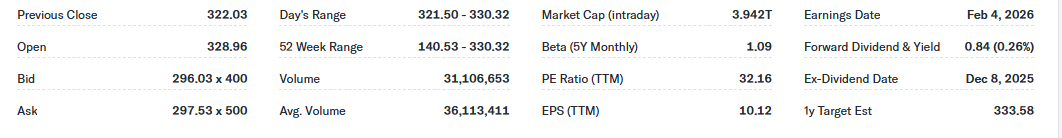

On January 9, 2026, shares of Class C of Alphabet (GOOG) were trading at 325.44 the only one below their 52-week high of 330.32, which gave the technology conglomerate a valuation of around 3.9 trillion.

An Analyst Sentiment and Stock Performance

The stock of Alphabet has been giving disproportionate returns, capitalizing on investor excitement over AI-based expansion. The PE ratio for Alphabet stock is 31.81 as of January 8, 2026.

This accounts for the stock price of $325.44 and the most recent EPS of $10.23. The PE ratio has increased by 54% from its average of 20.7 over the previous four quarters. The current price-to-earnings ratio of 31.81 is 15% more than the historical average. The Wall Street mood is still generally upbeat.

Cantor Fitzgerald this week elevated Alphabet to the Overweight category because of the competitiveness of its Gemini AI platform, and Jefferies increased its price target to $365 on account of increasing user engagement and monetization opportunities.

Strategic Context

The deal coincides with the increased integration of Gemini system-wide at Alphabet. New Gmail features now support natural-language search and AI-driven email summaries which further supports the competitiveness of Alphabet compared to competitors like OpenAI and Microsoft. These capabilities of the company in terms of scale, data advantage, and distribution strengths, can be observed.

Looking Ahead

The volatility in share values may continue to rise in the coming months as U.S. legislators deliberate on new policies regarding self-driving technologies since the progress in this area could eventually be favorable to Waymo, an autonomous vehicle, which is a part of Alphabet.

As industry competitors predict millions of dollars of autonomous vehicles revenue, the AI leadership status booster of Alphabet places it in a good position to grow further.

Attention to investors is currently centred on the forthcoming Q1 earnings report to get a better indication of the Gemini acceptance and margin sustainability. In case execution is good, a path to $400 per share is the dream of some bulls.