The Apple equity has been a generational compounder with returns of more than 900% over the last 10 years; however, in the present, the company is facing a turn-taking point where any development of artificial intelligence and the upcoming hardware features can shift its performance trend in the next 5-year period, 2026–27.

Where does Apple stand today?

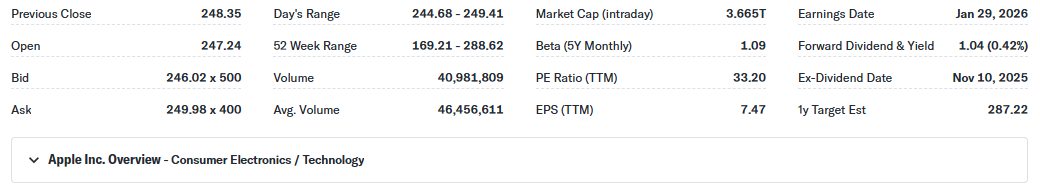

Apple Inc. has a market capitalization of $3.665 trillion.

In the previous year, it underperformed the S&P 500 indexer since capital shifted to specialized best AI stocks like Nvidia.

However, Apple led the global smartphone market with a 20% share and 10% year-over-year growth, the highest among the top five brands.

Samsung increased its market share by 19% year on year, thanks to consistent growth in the Galaxy A series and continued traction in the premium segment with the Galaxy S and Z series.

The second driver of growth at Apple has turned out to be the Services division, which is projected to make $28.8 billion in the fourth quarter of 2025 (15 % increase in growth annually) to be ranked as having over $100 billion revenue annualized at the end of the fiscal year 2025.

Looking ahead to its first quarter of fiscal 2026, Apple chief financial officer Kevan Parekh said in the company’s fiscal first-quarter earnings call,

“We expect services revenue to grow at a year-over-year rate similar to what we reported in the fiscal year 2025. And given Apple’s reputation for being conservative when it comes to guidance, I think this means that Apple could see an acceleration in its services revenue growth in fiscal 2026”.

Appraisal and company perspective

Apple now trades with an approximate forward price earnings ratio of about 30x, the premium which is indeed relatively high, though relatively congruent with the historical premium of the company, due to its size and profitability.

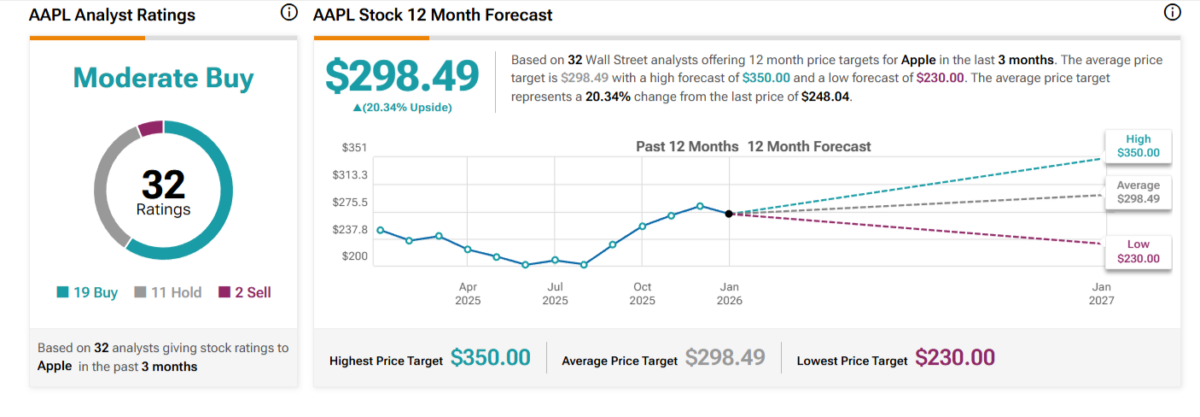

Based on 32 Wall Street analysts offering 12 month price targets for Apple in the last 3 months. The average price target is $298.49 with a high forecast of $350.00 and a low forecast of $230.00. The average price target represents a 20.53% change from the last price of $247.65.

A one year projection: A recovery play

In the next one year, the equity of Apple is expected to show a massive recovery, though it is unlikely to follow a straight line.

It is expected that the growth in earnings in 2026 will slightly increase, based upon the continuing strength of iPhone and Services streams, and supported by a small increment to the nascent hardware and AI monetization streams.

However, there is still a set of risks. The release of AI late, a downturn in the iPhone demand in the Chinese market, or macro-economic cyclones like a stronger U.S. dollar may limit the share price of Apple to a relatively small range, on either side of the proximate.

As a result, the stock trend in question will depend not so much on the state of affairs but rather on the capacity of Apple to prove to the world that it is a true AI and next-generation hardware leader in 2026.