Cryptocurrency payments to suspected human trafficking groups increased by 85% in 2025, with hundreds of millions of transactions being tracked on public blockchains, according to a new Chainalysis report. This highlighted growth is a case of how digital assets provide avenues to international crime, especially within the scam ecosystem of southeast Asia.

Crime Hubs Explode

Chainalysis in its blockchain forensics analysis reveals that most illegal service providers are concentrated in Southeast Asia, which includes escort businesses, fake sites, and sellers of child sex abuse material (CSAM). These networks are border-less since the inflow of payments is obtained within the Americas, Europe, and Australia.

Chainalysis intelligence analyst Tom McLouth told CNBC.

There’s a broader migration from older darknet forums into messaging apps and semi‑open Telegram ecosystems, which, combined with crypto, let these networks scale faster, run ‘customer services,’ and move money globally with much less friction.

The most widely used currency is the stablecoins which redirect the income into Chinese-language laundering channels that moved $16.1 billion of illegal cryptocurrency last year.

CSAM’s Hidden Scale

CSAM networks are based on subscription plans of less than $100, and the money is deposited in privacy coins like Monero. Via one dark- web site that Chainalysis discovered in July 2025, $530,000 were raised on 5,800 addresses since 2022.

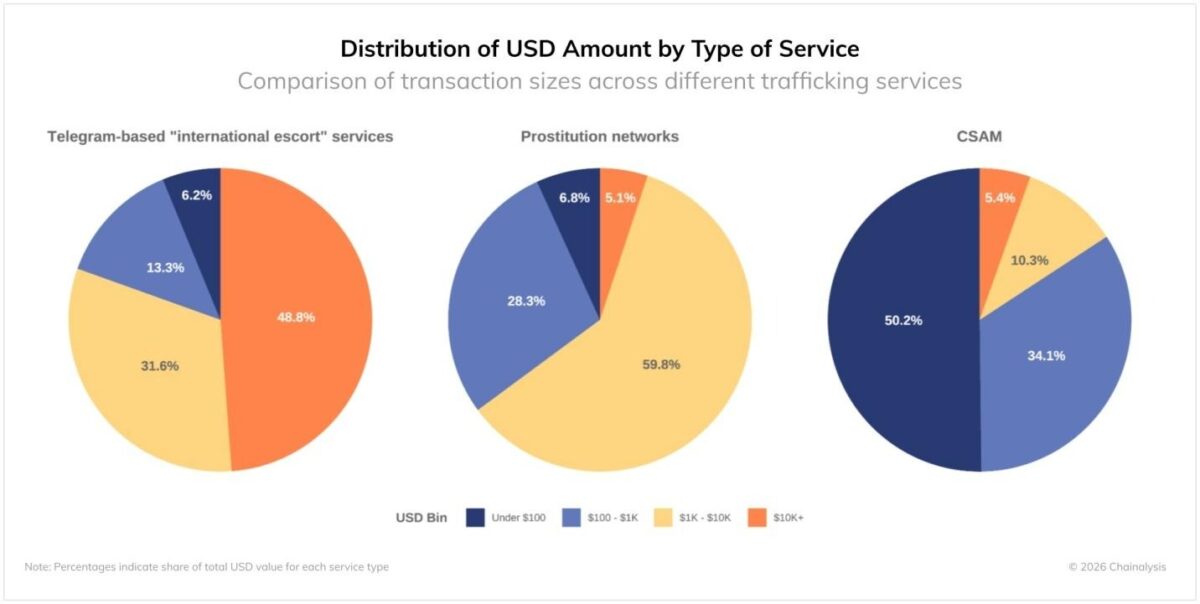

Different operational models for various suspected trafficking service types are revealed by the distribution of transaction sizes. With 48.8% of transfers exceeding $10,000, “international escort” services exhibit the highest concentration of large transactions, indicating large-scale organized crime operations.

Prostitution networks, on the other hand, tend to be mid-range, with roughly 62% of transactions falling between $1,000 and $10,000, suggesting possible agency-level activities.

Tax Edge and Outlook

The expansion of cryptocurrency is likely to increase the scale of trafficking flows, although the law-enforcement activities, such as the one that the DOJ used when targeting Cambodia ($15 billion) are still escalating. Regulatory stricterness of stablecoins and more advanced tools of artificial-intelligence tracing will possibly limit such activities but adoption will keep pushing enforcement capacities IN 2026.