The gaming community niche company, Discord, has become a globally used communication platform and is being listed on Wall Street shortly.

The corporation has already secretly filed in the United States a first offering to the public, a move that is set to be among the most followed technology offerings of 2026.

Confidential Filing, Consequential Implications

On January 6, 2026, the San Francisco-based enterprise confidentially submitted its IPO filing to the U.S. regulators, which is confirmed by sources with knowledge of the situation.

The potential listing is receiving advisory services by the financial institutions Goldman Sachs and JPMorgan Chase.

Despite the preparations, official reports indicate that negotiations are still in the air and the company may delay or abandon the offering. One of the representatives of the company stressed that they preferred discipline to hype, CEO saying:

“the company’s focus remains on delivering the best possible experience for users and building a strong, sustainable business.”

From Gamer Tool to Digital Infrastructure

What started out as a niche tool for gamers has grown into one of the world’s most powerful communication platforms.

What began as a solution to clunky voice chat has evolved into something much bigger: a digital infrastructure on which millions now rely every day. It boasted of recording over 200 million monthly active users by 2025.

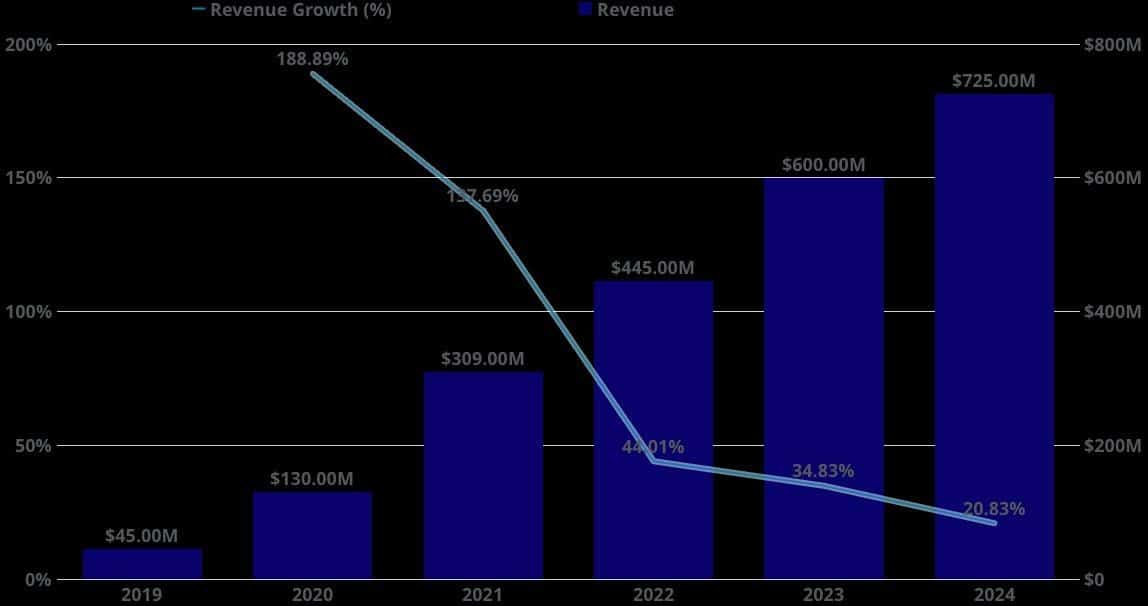

This rise in user base has paid off in strong financial velocity, and by end of 2024, the firm will realize an estimated annual recurring income of $725 million, which has been mostly attributed to its premium business and Nitro subscription services.

A Conducive Market Environment

After a few years of macroeconomic limitations and geopolitical uncertainties, 2025 marked a certain amount of stability and repositioning of the global IPO market.

Finally, the total initial public offering result was around 1,293 IPOs in the world which generated around $171.8 billion proceeds which was a significant 39% increase compared to the previous year, and the transaction volume was largely unchanged. This recovery is connotative of greater investor confidence and a noticeable move to better quality capital products.

Reduction of inflationary pressures and expectations of future rate cuts has recovered investor enthusiasm, even though there is still geopolitical and artificial-intelligence-sector volatility.

Prospective Developments and Risks

Following a 2021 private valuation of around $15.02 billion. However, some secondary market activity in 2025 indicates a reset closer to $10 billion.

Discord may surpass this amount when listed publicly assuming that the market conditions would be good. Analysts emphasize the expanding non-gaming use of the platform, GenZ adoption and the nascent advertisement and commerce as engineer growth drivers.

However, risks remain; including the problem of diversification of the platform and increasing volatility of the market. An effective listing, in its turn, would reinforce the shift of Discord out of a gaming utility and into a platform on which the modern internet economy relies.