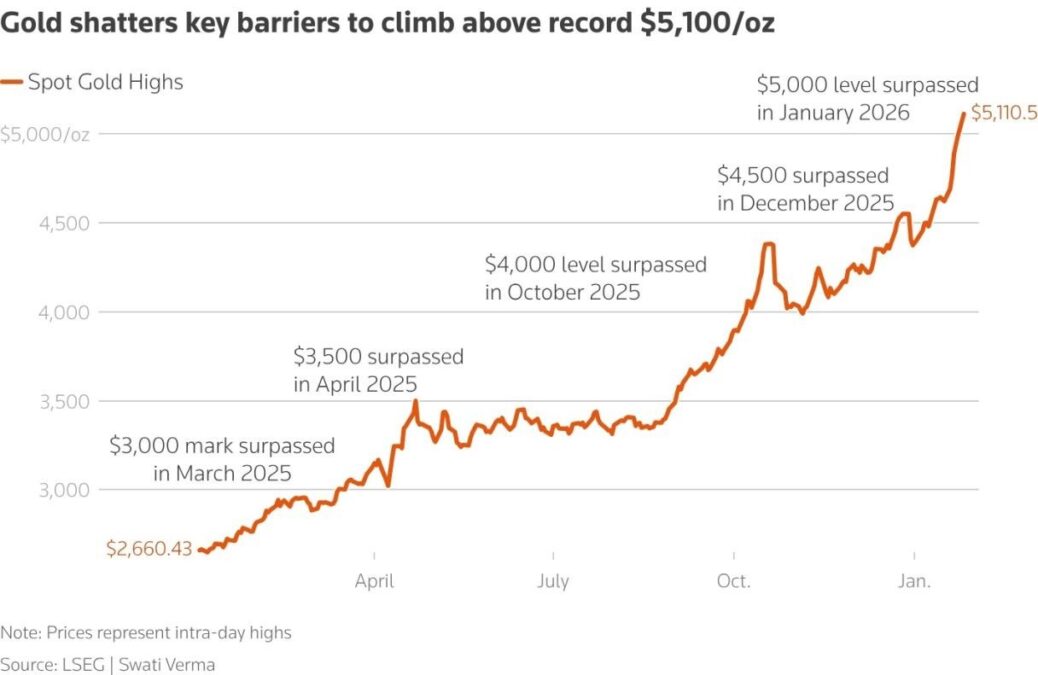

On Monday, 26 January 2026, the yellow metal was above $5,100 per ounce, records were broken and the history was made when investors all around the world saw the good old gold as a form of safe haven due to increasing geopolitical risk as well as a new threat of trade-war bursting at the White House.

Spot gold reached an intraday high of $5,110.50/oz and traded in the range of $5,098/oz in the early hours of Europe, gaining over 2.2% on the day which was driven by a convergence with safe-haven demand and a lack of confidence towards risk assets.

Market in panic mode

The above trend of Gold above $5100 is not just a technical speculation but rather a sign of a lack of trust in the status quo of financial markets and currency.

Hansen at the helm of commodity strategy at Saxo Bank argued that U.S. President Donald Trump along with the fear of missing out have been the main driver of soaring prices and investor demand propelled by the feeling of missing out.

An additional threat of a 100% tariff on Canada over a trade agreement with China has only made the situation worse, driving up gold and sovereign bond yields fell sharply.

Other metals jumping

Safe-haven demand is not only limited to gold. Silver shot to an all-time peak of 110/oz, This represents a significant 54% increase for the month, putting silver 280% above its value in January 2025.

The strong valuation of silver can be explained by not only its relative lack of liquidity but also a high degree of leverage in the derivative markets but due to its dual nature both as a shield asset and as an industrial commodity, thus making it highly vulnerable to changes in the risk sentiment.

Platinum was also very high to a record of close to $2,910.67/oz up by 3% and palladium recorded the highest record of three years of above 2,092.59/oz up by 2.5%.

Where next?

Spot gold is technically breaking through the resistance Analysts advise that if the faith in paper currencies diminishes further, then gold will tend to rise towards $6,000/oz but this action would probably be accompanied by short-term corrections that are abrupt.

In the near future, as the tensions in the world boil and the policy of the Fed still remains in a crucial position, the rise of gold has yet to stop.