Intel has taken decades trying to make the transition in a more dynamic semiconductor world. The company that previously monopolised the industry lagged behind the key competitors owing to the tardy efforts, poor decision-making process, and wastage of opportunities.

However, this trend changed in March when Lip‑Bu Tan became the Chief Executive Officer, which was a turning point for the company and resulted in the introduction of a full-scale strategic reset.

One of the first steps which Tan took was the removal of unnecessary managerial hierarchy. He also reduced the organisational hierarchy to make the teams move faster and allow them to make decisions quicker. This cultural transformation will aim at strengthening the responsiveness of Intel to fast change in the artificial intelligence market, where speed and innovativeness are the order of the day.

A Powerful switch towards AI Inference

Tan has positioned Intel into its future of artificial intelligence. In October, he introduced a plan that focused on AI inference. This computational process occurs after training models and involves the deployment of trained models to make decisions and perform tasks. He reasons that this field will create a significantly bigger market than the sole AI training.

This shift is in line with industry trends. Large organisations like OpenAI are currently working towards more advanced and competent AI systems. The emergence of agentic AI and working towards long-term goals such as artificial general intelligence requires immense computational resources. Intel aims to provide the semiconductor bits that are required in this next stage.

When the chief technology officer at Intel left to join OpenAI, Tan took on a hands-on leadership role of the AI department, highlighting his desire to lead Intel through this important transition.

Funding, Partnerships and Early Results

To strengthen this change, Intel found a large financial source: an investment of $8.9 billion by the United States government, $2 billion by Softbank, and $5 billion by Nvidia, with the intention of creating custom data-centre and individual computer processors.

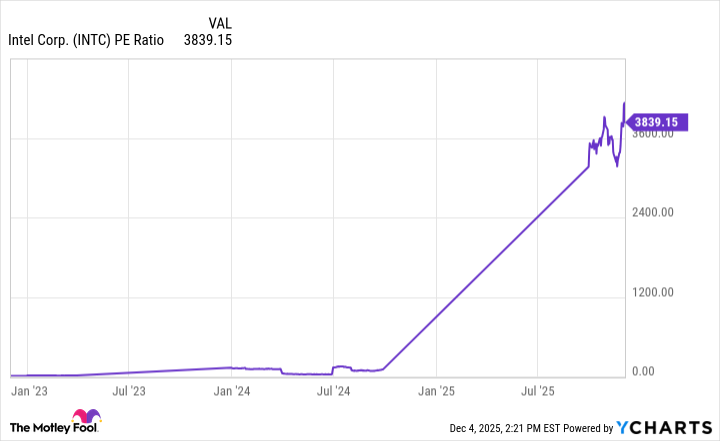

In the past, the financial performance of Intel was precarious. In 2025, however, the situation was significantly better, and third-quarter revenue grew by 3% compared to the same period the year before to $13.7 billion, and net income increased to $4.1 billion, thus indicating the company is no longer in the large loss the preceding year.

Is Intel Stock a Buy Right Now?

Investors are regaining confidence in Tan as its strategic efforts have seen the share price soaring up to more than 44 in December after a low of 17.67 in April. The announcement that Intel will also supply the processors to Apple also met a positive reaction from the market.

Final View

In the case of Intel, they seem to be moving towards a bright path under the leadership of Lip-Bu Tan. The company has developed new partnerships, attained high financial performance, and defined its priorities in artificial intelligence.

However, despite these advantages, the fast value addition of the stock in the recent past has made it relatively overvalued compared to its stock counterparts as Taiwan Semiconductor Manufacturing Company and therefore, investors may be well advised to wait for a pullback before joining the stock.