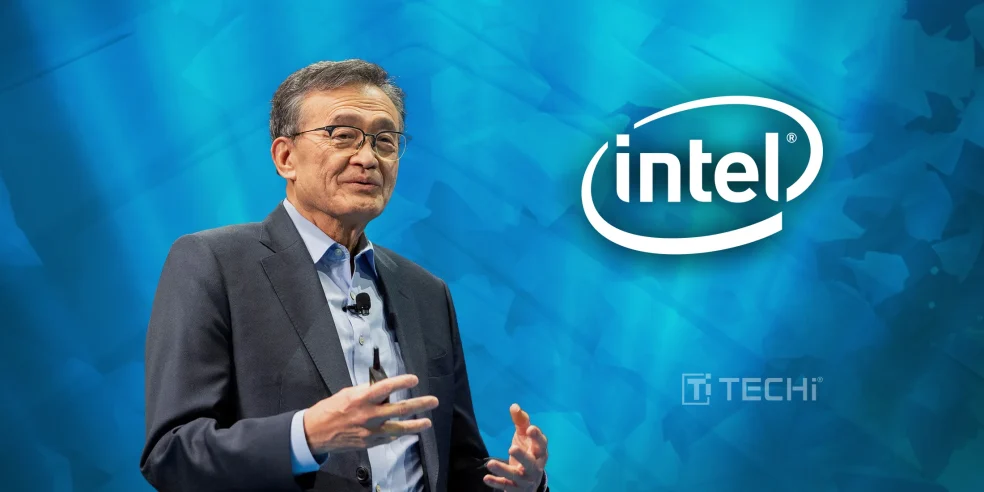

This marks a radical step towards changing the gears of Intel by its new CEO, Lip-Bu Tan, to abandon its 18A chip process in favour of 14A. Stock news on the site led to an increase in the stocks of the company by 2.79% or $22.49 dollars. It is possible that the decision to change its strategy is to win big businesses such as Apple and Nvidia which are already relying on TSMC to manufacture their chips. Intel is also hoping that with the 14A process. It will be more competitive in this area.

This strategy by Tan heralds a big change in the chipmaking strategies of Intel. Although the 18A process will continue to apply in the case of internal projects and the deals already in place. The company might cease to provide it to new customers. This may cause a financial write-down of up to $1 billion dollars. This reveals how seriously Intel is making this change. Panther Lake which is based on the 18A node is still scheduled to go into production by 2025 and will be fabricated within the U.S. As much as Intel has publicly rejected the reports and termed them as an act of speculation insiders indicate that the Intel board will make closure decisions in the fall. The company is trying to address the recent difficulties. It is also considering laying off its factory workers by up to 20% in a bid to cut down costs.

The impact of the move on Intel stock is part of the debate among analysts. Others believe that it might decrease by 7% pegging the target price at 21.20. Whereas others such as GuruFocus the main point. It has a 4.4% potential to go up and therefore the target price is 23.86. Such a mixed attitude indicates doubts about the long-term prospects of the new direction that Intel took.

Briefly, Intel has staked a lot. It may redefine its future by shifting to 14A and striving to secure the leading tech customers. However, there are huge risks associated with this new direction, such as the possible losses and layoffs, so a lot will also depend on the success of this direction. In the months ahead, in particular, the fall meeting of the board will prove critical in determining the way forward for Intel.