IonQ, a quantum computing startup with the most strong investor following, has been pitting growth investors on it but its continued issuance of new equity raises concerns of distress.

The stock lost almost 60% of its 2025 highs, and is positioned at $35.19, equalizing a market capitalization of $12.65 billion.

Blistering Boost and Balloon

The road that IonQ has taken has attracted investors in this period of AI hype. The company had Q3 2025 sales of $39.9 million in the year 2020, a year on year increase of 222%, and was projecting end 2025 revenues of $106-$110 million based on modest revenues in the previous years.

This meticulous growth can be partially explained by organic quantum systems and large acquisition deals 5 deals in 2025 amounting to $2.4 billion and 2026 deals, including the $1.8 billion deal with SkyWater Technology and Seed Innovations.

One-Year Prognosis

IonQ is pursuing vertical integration, evidenced by its acquisitions, such as SkyWater, and can become quantum dominance in case it succeeds. Analysts expect its revenue to double to $75.4 billion, with adjusted earnings per share quadrupling to $33.38.

However, one should be careful; as far as dip-buying can be a tempting concept, the underlying indicators bear consideration.

Future Outlook

According to an analyst of Motley Fool, IonQ can fall to $10 in one year, as he believes that this risk is caused by the continued dilution of investor confidence. On the other hand, several firms, including Rosenblatt, reiterated “buy” ratings with $80-$100+ targets and a consensus ~ $75.91.

However, a Wolfpack Research short report and an Ademi LLP securities-fraud probe, offset by company rebuttals, create a significant legal and sentiment overhang.

IonQ is one of the classical high-risk, high-reward paths of a technology company: recent solid sales growth, strategic vertical integration in the form of acquisitions, and a passionate group of investors floating on quantum technology hype.

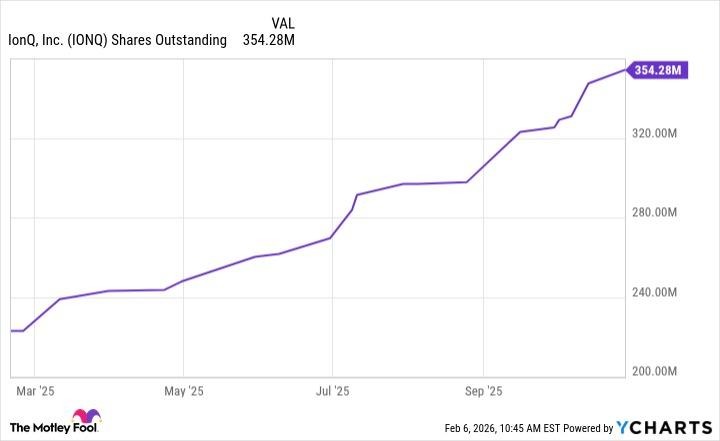

Nonetheless, extensive dilution of equity, risks of execution involved in the process of assimilating heterogeneous businesses, and continued speculative attention have placed a lot of volatility in valuations; some analysts forecast dramatic down-drifts whilst others forecast dramatic improvements.

The future investors of IonQ have to consider the possibility of becoming the industry leader and compare it with the actual financial and operational threats.