The comparison between IonQ and Rigetti highlights two very different strategies for achieving leadership in quantum computing. Both companies are pursuing distinct hardware approaches, financial models, and partnership paths, and the better investment depends on how the industry evolves over the next several years.

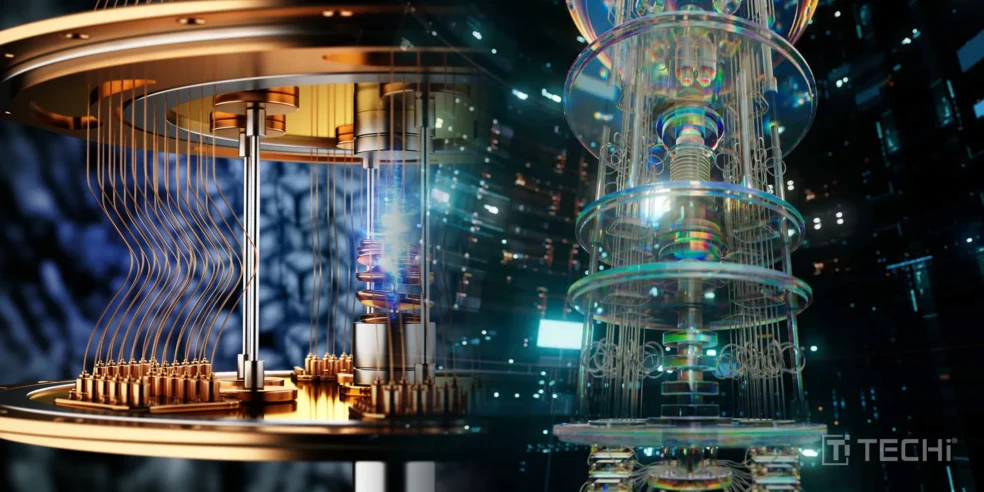

IonQ uses trapped-ion qubits, which currently offer stronger coherence times and higher gate fidelity, reaching up to 99.9 percent according to company benchmarks. This architecture allows for precise qubit control using electromagnetic fields without requiring extreme cryogenic systems.

Rigetti, on the other hand, builds on superconducting qubits, a more traditional method that leverages semiconductor manufacturing processes. Its in-house foundry, Fab-1, gives it tight control over chip fabrication, which could enable faster iteration cycles and integration with classical electronics.

However, this approach faces ongoing challenges in coherence and scalability. At present, IonQ appears to have an edge in fidelity and stability, while Rigetti’s model emphasizes scalability and long-term manufacturability.

Financially, both companies remain unprofitable and are heavily reliant on external funding. IonQ currently has a slightly longer cash runway, estimated at around 16 quarters, while Rigetti’s sits closer to 13 quarters even after factoring in a potential capital raise of about 350 million dollars. Such funding efforts could extend Rigetti’s survival but may also dilute existing shareholders.

IonQ has been more active in acquisitions, such as its purchase of Oxford Ionics, signaling an effort to consolidate technical expertise and protect its position. Rigetti’s government and academic contracts provide a steadier but narrower revenue stream, which may not scale quickly enough to offset its high costs.

Commercial traction remains limited for both players, as the quantum computing market is still in its early stages. IonQ’s partnerships with major cloud providers and its effort to integrate quantum systems into existing enterprise workflows suggest a broader go-to-market strategy.

Rigetti’s deals remain concentrated in research and public-sector projects, which are valuable but less likely to drive significant near-term revenue. Given this, IonQ’s broader ecosystem engagement and product visibility give it a modest lead in commercial positioning.

Valuation risk remains high for both. Each trades at lofty multiples relative to sales, reflecting heavy speculation about future breakthroughs rather than current fundamentals.

Both also face competition from major technology companies like Google, IBM, and Microsoft, whose resources and research capabilities could easily overshadow smaller firms.

Furthermore, customer concentration is a vulnerability for both: IonQ depends on a few strategic partnerships, while Rigetti relies on institutional clients and government contracts.

Overall, IonQ currently presents the stronger investment case. Its technical lead in qubit fidelity, longer funding runway, and deeper partnerships give it a more defensible position in a still-speculative industry.

Rigetti’s integrated manufacturing model is promising but its slower growth and tighter finances make it a higher-risk choice. For investors who believe in the long-term viability of trapped-ion technology and the gradual commercialization of quantum computing, IonQ seems the better bet for now.