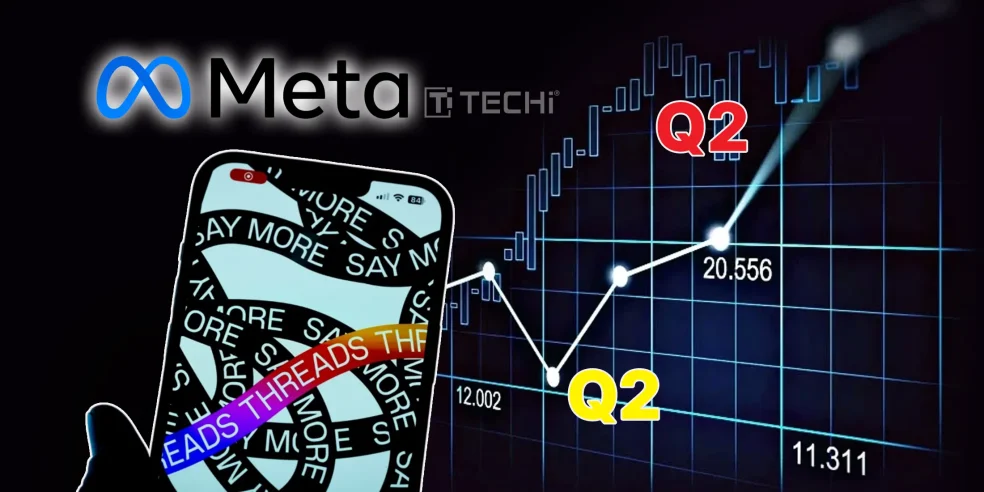

Seems like Meta is winning big, as the company just outraced every wall street prediction and recorded $47.5 billion, a commanding 22% year-over-year surge and earnings per share rocketing 38% to $7.14. The tech giant has proven that its AI transformation strategy is well crafted.

Twelve straight quarters of revenue beats and ten consecutive profit victories; such streak (Touchwood) is nothing but remarkable. A company that faced existential threats owing to the metaverse pivot chaos a couple of years ago has managed to maintain its superiority in this battle of AI.

The AI Revolution Fueling Growth

The growth is not a miracle or a fluke of luck; it’s a testament to Meta’s corresponding evolution with this Artificial Intelligence revolution. They’re going hard and they’re going fast in this transition towards AI. The promises of a “personal superintelligence” by the CEO Mark Zuckerberg himself are more than marketing rhetoric. It’s driving real revenue growth through enhanced ad targeting and user engagement across Facebook, Instagram, and WhatsApp.

Meta is determined to in-throw anything that it takes to stay ahead of the game. The numbers shocked in its revised 2025 capital expenditure forecast of $66-72 billion, with total expenses projected between $114-118 billion.

The Expensive Future

But not all is hunky Dory in Meta’s board room meetings. Reality Labs, the tech giant’s VR and AR division, hemorrhaged $4.53 billion in Q2 alone on just $370 million in revenue. While the losses are huge, yet they’re a signifier of Meta’s unshakeable bet on spatial computing and the metaverse.

In order to build tomorrow’s commuting platform, the said division is burning “Cash” at both ends. How long the investors stay faithful to Zuckerberg’s vision is yet to be seen.

Market Reaction: Confidence in the AI Play

Wall Street didn’t take a moment on responding to Meta’s stock surge over 9% in after-hours trading. It was immediate and emphatic. Despite ongoing antitrust litigation risks, investors are betting on Meta’s ability to monetize AI breakthroughs while maintaining its advertising dominance.

This spark and thrill is a statement; a statement that investors have faith in Meta and Mark Zuckerberg. It signals that they believe Meta’s substantial AI investments will generate returns that dwarf today’s Reality Labs losses. As digital advertising evolves and AI reshapes user experiences, Meta appears positioned to capture outsized value from these technological shifts.