The price of Meta Platforms was below the highest on January 10, 2026, having fallen 16% after the completion of the third quarter of 2025 earnings announcement.

However, the advertisement engine behind it, which is enhanced with the help of artificial-intelligence capabilities, implies that the existing valuation can be a major investment opportunity.

Growth of the Advertising Dominance of Meta with the help of the AI

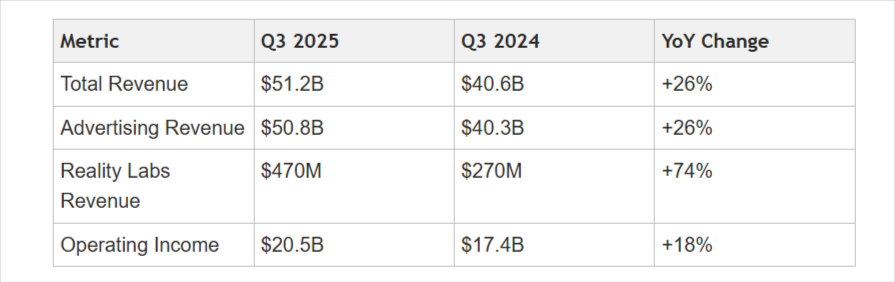

In the third quarter of 2025, Meta Platforms declared that it obtained advertising revenue on its core platforms of $50 billion, a 26% annual-over-annual growth which is largely due to the use of generative artificial platforms.

Measures of user engagement given that the user stay was extended on Facebook by approximately 5%, in Threads by approximately 10%, and video content was viewed on Instagram by 30%, hence user exposure was increased to premium and AI-focused advertising with high conversion rates.

Mark Zuckerberg, who is the Executive Chairman, highlighted the usefulness of these technologies when he said that artificial intelligence has scalable, measurable results to marketers.

The Advantage as well as the advertising platform alone had reached a run rate which in annualized terms is $60 billion, triple the amount since the start of the year, and makes Meta the second biggest AI driven ad monetizer after Nvidia according to analyst Beth Kindig.

Blasting Greater Capital spending and Shareholder doubtfulness

Shareholders are now worried about the increased capital spending of Meta Platforms. As of Q1 2025, these platforms served more than 3.98 billion monthly active users. Delivering targeted advertising to this enormous user base is the core of the business strategy.

About 99% of total revenue came from advertising, according to Meta’s Q3 2025 results. Hardware sales from Reality Labs account for the remaining 1%.

Reasons why the future of 2026 looks bright

One of the keys is the strong gross margin of 82% of the company in addition to a well-established user base of about 3.98 bn , which are the key competitive advantages.

According to most analysts, such as Cantor Fitzgerald, the revenue will grow by 20% in 2026 due to the synergistic impact of artificial-intelligence efforts, and have updated their equity-price targets accordingly to $920.

In case AI infrastructure investment is bound to produce the projected returns, it is assumed that Meta will grow by anywhere between 15% and 25%, on the other hand, like it might happen regardless of such investments, the cash flows of advertising will be expected to recover at a high rate.