Meta Platforms stands out as the bargain hunter’s dream in the Magnificent Seven lineup.

The Magnificent Seven Nvidia, Apple, Alphabet, Microsoft, Amazon, Meta, and Tesla dominate global markets with trillion-dollar valuations. Yet Meta shines cheapest on forward P/E metrics.

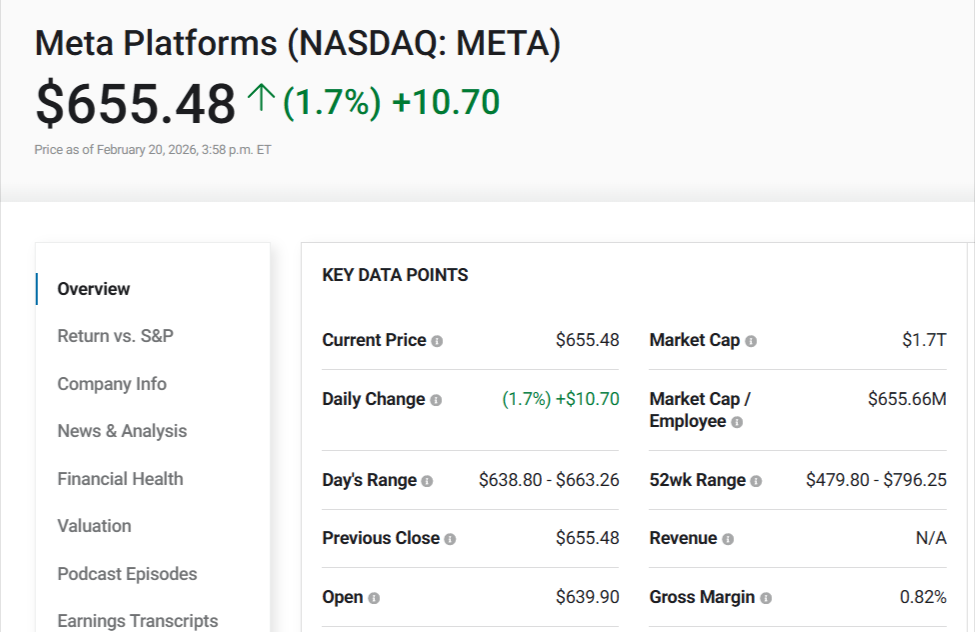

Recent data pegs peers higher: Nvidia at 40x, Apple at 33x, Microsoft and Alphabet around 29-30x, Amazon at 32x, and Tesla over 200x. Meta’s $1.66 trillion market cap pairs with shares at $655.48, up 1.7% on February 20 amid a 52-week range of $479-$796.

This valuation edge stems from market jitters over AI bets, despite robust ad revenue.

AI Spend Fuels Growth Debate

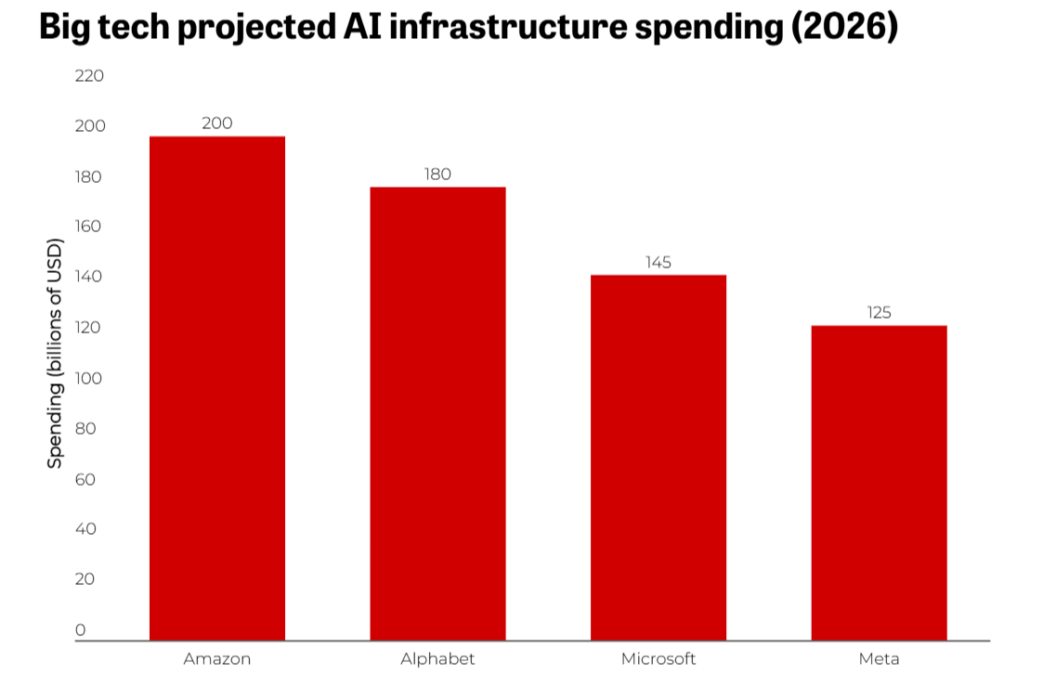

Meta crushed Q4 2025 with $59.9 billion revenue, up 24% year-over-year, 97% from ads yielding $30.8 billion operating income though Reality Labs bled $6 billion. For 2026, capex surges to $115-135 billion, laser-focused on AI infrastructure.

The statement;

The spend looks enormous, but it’s less speculative than it appears. For context, $650 billion represents roughly 15-20% of the combined annual revenue of Microsoft, Alphabet, Amazon and Meta, and a far smaller proportion of their combined market capitalisation

Says Shai Luft, co-founder and COO of Bench Media.

Together, these companies generate more than $1.5 trillion in revenue each year. The bigger risk isn’t overconfidence, it’s under-investing and leaving core products like search, cloud and advertising exposed to disruption

Analysts cheer; RBC’s Brad Erickson rates it Outperform at $810, citing Strong Buy consensus with 28% upside.

Smart Buy with Patience

Meta’s combination of discounted valuation, dominant ad profitability, and aggressive AI investment positions it uniquely among mega cap peers. For those willing to tolerate short-term uncertainty, Meta may represent one of the most compelling risk-reward setups within the Magnificent Seven today.