Micron Technology has managed to become one of the most recognizable equities in the artificial intelligence industry, and its share value has grown by about 300 % in the last twelve months and now is valued at around $372 a share, which means the company, is worth almost $420 billion in the stock market.

The boom may be deemed to be the expression of the generational lack of devices with a high bandwidth of memory because AI data centers, graphic processing units, and custom AI accelerators take up nearly all the accessible memory bandwidth.

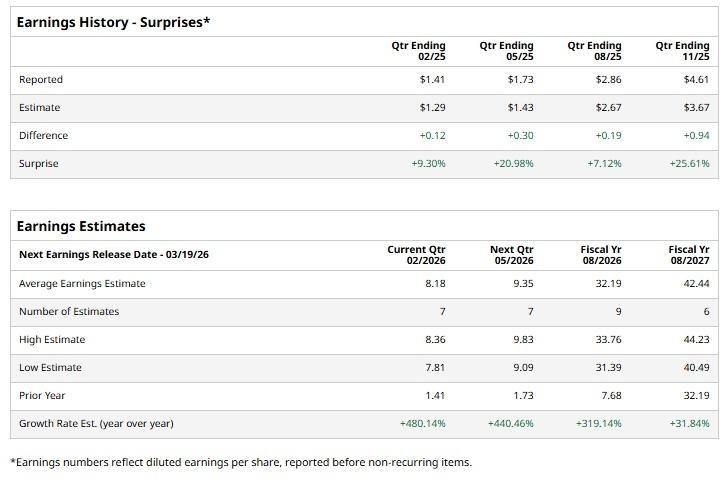

Analysts currently expect Micron to generate EPS of $32.19 in fiscal 2026, implying a year-over-year increase of more than 300% – 319% to be precise. Given the company’s strong start to the year and the favorable industry environment, earnings expectations could rise further if pricing and demand remain strong.

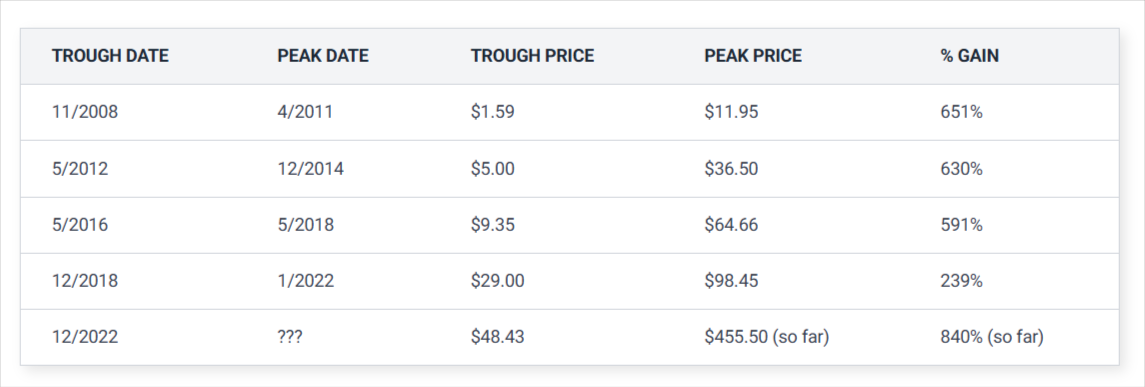

History of Booms and Busts

The historical path of Micron demonstrates the fluctuations of assets that are related to memory. In previous booms in the past 20 years, the company shares have experienced maximum returns of about 600% compared to the previous downturns, before experiencing sudden turns as it has been in 2012-2014 and 2016-2018.

At the latest profit peak, but based on the demand to use cloud-computing, the trailing net income of Micron reached over $16 billion but the trailing price-to-earning ratio fell to about 3 when share price rose after the announcement of earnings.

The reason why this cycle looks different

Micron Technology has had a strong start to 2026, with its stock price up 39% as of January 22. The growth is largely due to its excellent financial results, which included a record revenue of $13.6 billion, a 57% year-over-year increase, in the first quarter of its fiscal year 2026 (which ended November 27, 2025).

The major difference of naturalness lies in the magnitude and foreseeability of AIinfrastructure expenditure. The significant %age of capital spending that will be dedicated to AI-compute and memory demands is being projected to be allocated by the major hyperscalers: Amazon, Microsoft, Alphabet and Meta, who are collectively estimated to spend over $600 billion in 2026.

The market for high-bandwidth memory alone, according to projections made by Bank of America, might reach up to approximately $55-$58 billion in 2026. Micron has in turn increased its 2026 capital expenditure to around $20 billion but the same management is still expecting a seemingly unremitting supply constraint hence highlighting the chances of a long lasting pricing power.

This is, as a semiconductor strategist recently noted, the first memory up-cycle that the demand visibility is in years and not quarters, and its structural nature.

How High Could Micron Go Next ?

Micron’s fiscal 2027 earnings estimate is $39.39 per share. Assuming that is spread evenly over the four quarters of the next fiscal year, it could earn $9.85 per share in the first quarter of fiscal 2027 (which ends in November 2026).

Adding that figure to the potential earnings it is expected to record in the remaining three quarters of the current fiscal year suggests that its bottom line could reach $37.29 per share over the next four quarters (which roughly correspond to calendar 2026).

Similarly, the historical record shows that the stock prices usually become highest before the earnings announcements, and the present price-to-earnings ratio of Micron being located in the mid-teens on trailing data, already reflects excessive optimism.

Currently, limited supply of HBM, AI capital spending increasing at a faster rate, and a more than triple earnings growth make Micron a high-betting stock to leverage the AI memory super-cycle, but investors should expect that once this cycle ultimately shifts, the corrective phase thereafter would be just as harsh as the boom has been bountiful.