Microsoft and Oracle continue their struggle to dominate in artificial intelligence and cloud computing, though the direction towards the prolonged wealth creation is quite different in the case of two companies.

On 7 January 2026, the equity price of Microsoft was around $478.63, which is relatively up compared to the previous day, but Oracle shares were around the price of $193.75 after experiencing excessive changes in late 2025 and early 2026.

It is based on this that institutional investors will assess the business that is in the right place to provide improved returns in the face of growing demand for cloud-based services.

Oracle’s High‑Stakes Gamble

Oracle stock had gone up by over 17% year-on-year, despite the company missing a number of fiscal objectives, and it has been facing execution risks.

The fact that its backlog is large i.e., $523.3 billion with the majority of it being AI-focused cloud deals suggests that it can have a significant revenue stream in the future; however, the downside is that a slow turnover rate and a limited number of customers are the limiting factors to growth.

The concerns identified by analysts include high levels of debt and huge spending on AI infrastructure as the key factors that can limit upside.

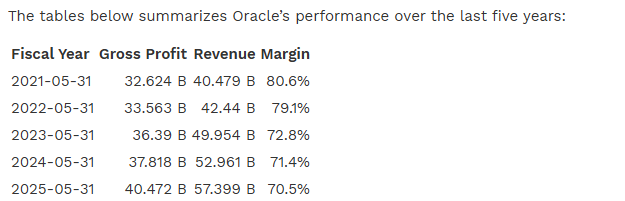

The forward price to earnings ratio of Oracle stands at about 28.41 and gross margins are some 70.5% and yielding profits of about 0.98% per annum, but there is one factor that holds a critical place in profitability and this is the conversion of pipeline to real earnings.

Though Oracle cloud revenues have been growing strongly and long-term outlook is still optimistic, some estimates suggesting the radical growth of OCI revenues in the next ten years, short-term profitability concerns and implementation risk have had a negative influence on performance and shareholder trust.

Microsoft’s Steady Powerhouse

The scale and diversification of Microsoft remain on par with expectations. The company has a market capitalization in the trillions, even after having slightly declined on its all-time highs due to a broad service of cloud implementation, plus integrated AI services operating across the Azure infrastructure up through productivity aids like Copilot within Microsoft 365.

There has been strong growth in terms of Azure and cloud services, and Azure subscription revenues have been growing on average 40% year-over-year, which contributes to overall growth that compares favorably with most competitors.

The forward price to earnings ratio of Microsoft is slightly elevated compared to that of Oracle of about 28.8x which depicts high growth expectations.

The large ecosystem of the business through gaming, productivity applications, and enterprise software provides diversified marketable assets and reduces the risk of not being dependent on any one business area.

Key Metrics Face-Off

| Metric | Microsoft (MSFT) | Oracle (ORCL) |

| Market Cap | $3.6T | $557B |

| Share Price | $478.63 (up vs prior day) | $193.75 (volatile) |

| Forward P/E | 28.8x | 28.41x |

| Gross Margin | 68.76% | 70.5% |

| Dividend Yield | 0.71% | 0.98% |

| Recent Cloud Growth | 40% YoY (Azure) | 14% overall (OCI strong) |

| Backlog/Pipeline | Strong long-term contracts | $523.3B (AI-focused) |

| Execution Risk | Low | High (debt, conversion) |

Brighter Road Ahead?

With a prevailing market commentary as of 7 January 2026, Microsoft is still a core winner in the AI and cloud space, with bullish price targets and strong earnings performance that remains in the form of sequential double-digit growth in revenue and earnings-per-share that runs above expectations in the recent periods.

A number of analysts carry positive proactive expectations of Microsoft cloud and AI subsectors, thus improving its prospect when compared to competitors.

Conversely, Oracle has enjoyed varied investor feelings; whereas some analysts emphasize its strategic strength in the long-run, others lay stress on its profitability in the short-run and borrowing strains.