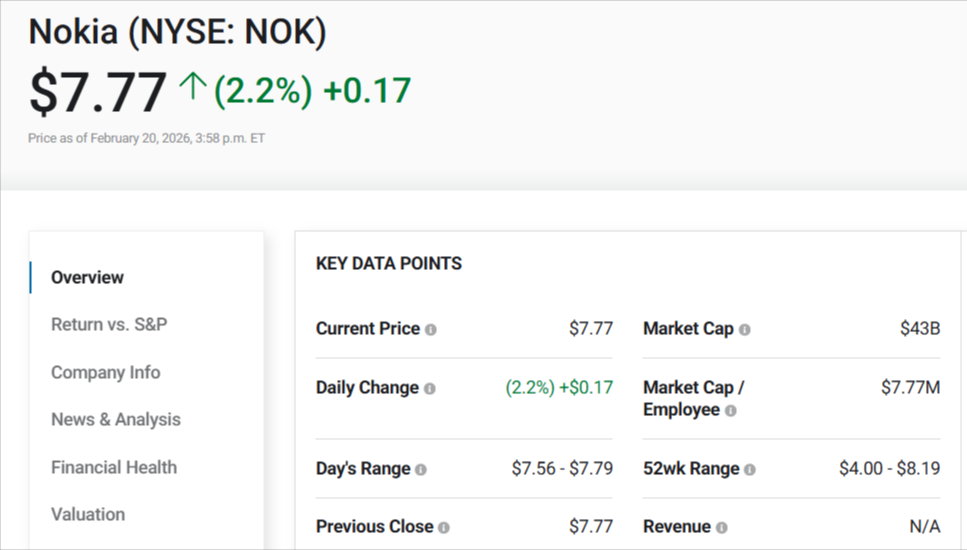

The Nokia stock has had an incredible growth, and it has risen by almost 98% since July 2024, thus topping the 24.7 % growth of the S & P 500. The equity has been trading at its highest close since 2015 at a valuation of $7.77 on 20 February 2026.

Stock Surge Unpacked

The rally began in the fall of 2025, which was initiated by strong order pipelines that marked good revenue outlooks in 2026. Net sales of four quarters 2025 in a constant currency went up by 3 % year on year to €6.1 billion against a full year net sales that went up by 4 % to €19.9 billion.

Gross margin recorded 48.1% in Q4 which however saw the operating profit decline due to continuing exploration of artificial intelligence and a merger with Infinera. Nokia has a net cash reserve of EUR 3.4 billion, a dividend yield of 2.01% and a short-interest ratio of just 1 % which is in line with traditional value traits.

Analyst Split

There is a sign of uncertainty in Wall Street as the average price target was of $6.87 which can be seen to be around 10% less than the current market value and there were equally as many buy and sell suggestions.

However, according to JPMorgan’s analysis, earnings before interest and taxes (EBIT) for the first quarter, fiscal year 25 and fiscal year 26 will be 14.3%, 10.9%, and 3.9% lower than previously estimated.

Outlook

Nokia predicts operating profit to be of EURO 2.0-2.5 billion in 2026 and Network Infrastructure growth of 6-8 %. The operating margin for network infrastructure is predicted to increase from 9.5% in 2025 to 13% to 17% by 2028, with a measured increase in 2026.

In line with 2025, Mobile Infrastructure aims for an operating profit of at least EUR 1.5 billion. Compared to 2025, when the segment produced net sales of EUR 850 million and an operating loss of EUR 97 million, Portfolio Businesses’ 2026 target is a lower operating loss.

The trend can appeal to the value investor, but could be chosen by growth chasers to avoid; hence, in the face of high risk levels of 5G maturity, it would be reasonable to adopt a hold policy.