Nvidia has switched to being a capitalist on AI trends to playing an active role in influencing the wider infrastructure market.

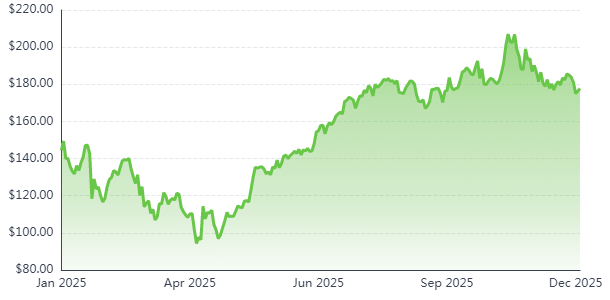

On 17 December 2025, it had a valuation of about $4.3 trillion, and the stock prices are at $178.03 at the Nasdaq.

Analysts believe the share will be at a new high of more than 45% even though this valuation has given a base of $256.95 as their consensus price.

The gamechanger is the main story of Nvidia and its unique visibility of the order and speedy product development.

According to the study of Bank of America reported by The Motley Fool, between the beginning of 2025 and the end of 2026 Nvidia is expected to sell between $500 billion and $600 billion of its Blackwell and Rubin GPU systems with approximately $150 billion being shipped.

This amount of forward demand is practically unprecedented in the semiconductor sector.

Background and new drivers of growth

In the past, data-center revenues of Nvidia were largely dependent on U.S. hyperscalers and the decrease in sales to the Chinese market by the U.S. export controls of 20-25% of its data-center revenues.

Similarly, the United States will allow Nvidia’s (NVDA.O), opens new tab H200 processors, its second-best artificial intelligence chips, to be exported to China and collect a 25% fee on such sales, U.S. President Donald Trump said.

Wells Fargo analyst Aaron Rakers projects that this change in policy has the potential to bring in an extra $25-$30 billion per year.

The Financial Times reported via Reuters on the same day, citing two individuals familiar with the situation, that Beijing regulators are expected to restrict access to NVIDIA Corporation (NASDAQ: NVDA)’s H200 processors despite Trump’s export license.

At the same time, Nvidia has unprecedented order visibility through 2026, backed by $500 billion worth of orders for Blackwell and Rubin systems.

Nvidia has also entered into a few deals, which can expand its demand visibility beyond $500 billion.

These include an expanded partnership with the Saudi Public Investment Fund’s AI company, HUMAIN, to deploy 400,000 to 600,000 GPUs over the next three years.

Nvidia has also collaborated with Anthropic to provide underlying GPU infrastructure for training its next-generation frontier models, with up to one gigawatt of compute capacity.

Analysts interpret this as a signal of higher-than-expected 2026 revenue, particularly in the data center segment, potentially $60 billion above prior estimates.

The issue of valuation and the reasons analysts might be behind

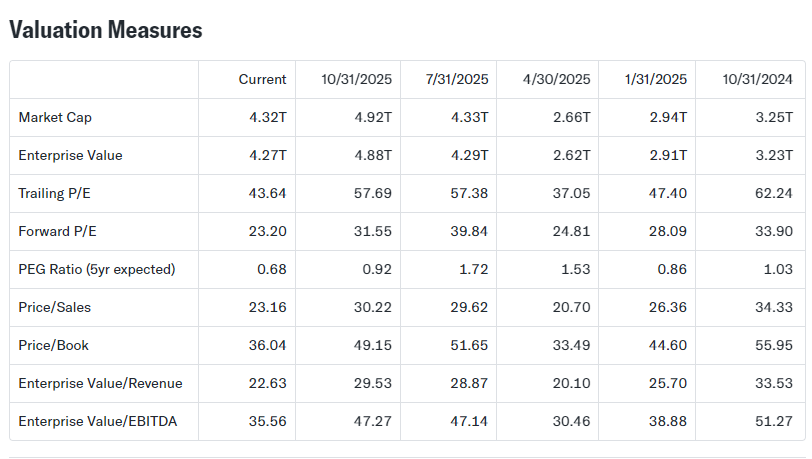

With such a position, Nvidia is traded at estimated 23.1 times forward earnings with PEG of the company being close to 0.68 as per the FactSet records posted by Yahoo Finance.

The market implicitly supposes a sharp slow growth beyond 2026 in the case of a company with projected fiscal 2026 revenue of $213 billion and consensus models of a $555.5 billion result in 2031.

This supposition contradicts the scale of the opportunity that Nvidia is pursuing because the management estimates annual spending on AI infrastructure to be $3-4 trillion by 2030.

Even with a 20-25% share in the market reduction at best as the competitive pressures intensify, Nvidia would still make up to $600 billion to $1 trillion in annual revenue in the late-decade; all of which is larger than current Street estimates.

There is still an intellectual drift, between the optimistic peak of an AI-ecosystem business ideal and the perceived reality of Nvidia as bar-coded chip stocks, creating a fundamental misperception that prevents seeing the long-term upside.

What comes next?

In the future, the important question is not whether the demand is there but whether Nvidia will be able to maintain the lead as the AI workloads become diversified, and governments impose more restrictions on the data and computing.

Having a large share of the target market with the dominant use of its graphics, a developer group of five million CUDA developers, and the strong control over the development of advanced packaging and HBM, Nvidia now takes place in the center of AI infrastructure.

Assuming AI investments grow to the multitrillion scale by 2030, the how these investments and growth will be valued at could be viewed as conservative in current revenue models.

But any effect on supply chains, their export or introduction of an accelerator ecosystem with a sensible competitive offer would squash both margins and market.

As of today, the evidence indicates that the long-term growth story at Nvidia is being predicted to run on a discount that might not be supported by the facts on the ground.