Pegatron, a Taiwanese electronic manufacturing company, is accelerating the process of constructing its first American factory in Texas, which is scheduled to be completed by the end of March 2026, and its trail production is expected to commence in the end of March or the first days of April according to President and CEO Kuang-Chih Cheng.

The plant is projected to focus on the production of hardware among key customers like Apple, Microsoft, Tesla and Dell, thus pegatron will have a closer involvement in manufacturing the high value in the North American market.

Global Supply Chain Re-alignment

The Taiwanese dominating technology companies are strategically moving its operation out of China to strategize moves with the happening trade and security pressure to accommodate the entry of Pegatron into the U.S. market.

The firm has already increased its capacity in Southeast Asia and Mexico, which augments an already existing maintenance center in Indiana and a California office. Texas’ location makes Pegatron close to other Taiwanese manufacturers, Foxconn, Inventec and Wistron, all of which have announced either a new or expanded presence in the state to better appeal to domestic demand.

Setting up of fresh U.S. Taiwan trade agreement

Its growth is linked to a newly signed U.S.-Taiwan trade agreement that came into effect in mid-January in the course of the year 2026, where Taiwanese are investing $250 billion in United States undertakings within the sectors of semiconductors, energy, and artificial intelligence.

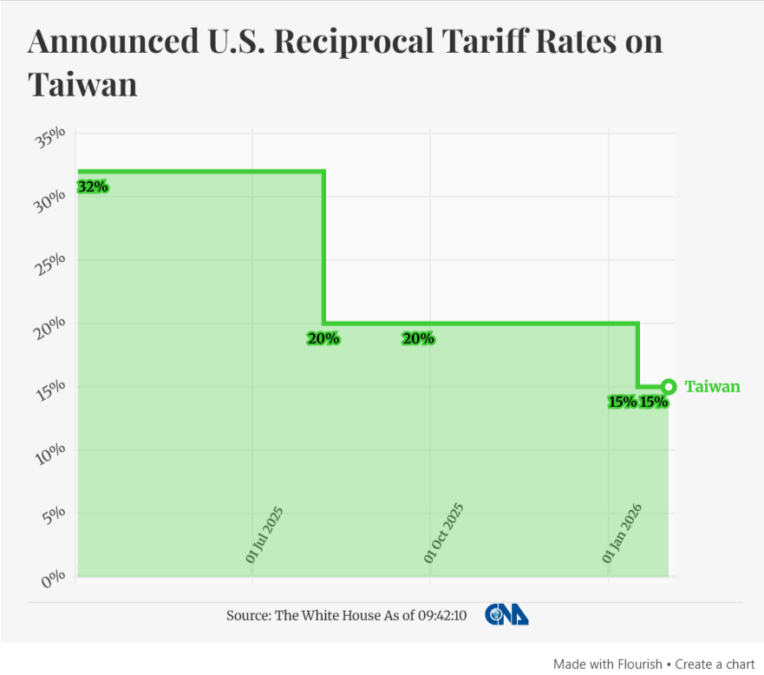

The agreement will cut tariffs on the U.S imports to Taiwan by half (15%-20%) and the increase in the economic feasibility of the technology supply chain across borders and provide the companies like Pegatron with a more credible reason to base production at the localized levels.

What experts say?

While every country pursues its own national security goals, Taiwan’s priority is to support the international expansion and extension of its high-tech industries.

The Company Statement.

This is not an industrial relocation but an extension and expansion of Taiwan’s technology sector,” she said, indicating that the sector’s output has grown at home while semiconductor companies have expanded their overseas investment footprint.

Outlook for 2026 and beyond

Assuming that the operations of the trials in Texas remain composed, the greater volume of production in the second 2026 would allow Pegatron to seize a larger portion of the U.S.-led development of AI and automotive electronics, but at the same time, reduce vulnerability to a Chinese-induced shock.

The operating performance of the plant will be put under substantial scrutiny so as to determine whether the promised $250 billion of Taiwan investment into the United States can become the robust profitable mass production.