In the world market, the car shipments of Porsche decreased by 10% in 2025 reaching 279,449 vehicles compared to 310,718 last year. Weakened demand in China and effecting European Union policies helped in the shrinkage as it is reflected in Audi and Mercedes which performed themselves with fading woes.

China Slump Hits Hard

In China, the sales had been reduced, weakened by the high rivalry among luxury car makers and price rivalry in the electric vehicles market.

In the electric vehicles market competitors within the domestic market like BYD took their share leaving Porsche with no option but to find other alternatives.

In 2025, 34.4% of Porsche vehicles delivered worldwide were electrified (+7.4% points), with 22.2% fully electric and 12.1% plug-in hybrids.

This puts the global share of fully electric vehicles at the upper end of the stated target range of 20% to 22% for 2025.

Sales in Germany dropped by 16% and in the wider European market by 13% that can be attributed to the European Union cyber security laws that stalled the supply of internal combustion models of the Macan and 718 models. Company Statement

We have a clear focus for 2026.

Sales and Marketing Chief Matthias Becker said.

We want to manage supply and demand in accordance with our ‘value over volume’ strategy. At the same time, we are realistically planning our volume for 2026 following the end of production of the 718 and Macan with combustion engines.

US Holds Steady

In North America, Porsche defied the trend with flat sales, outperforming Mercedes and Audi, both of which experienced 12% drops. Analysts believe that US inventory pull-forwards to avoid tariffs may have helped Porsche’s results.

Nonetheless, without a manufacturing base in the United States, Porsche expects tariff costs of around €700 million in 2025.

Road Ahead Tough

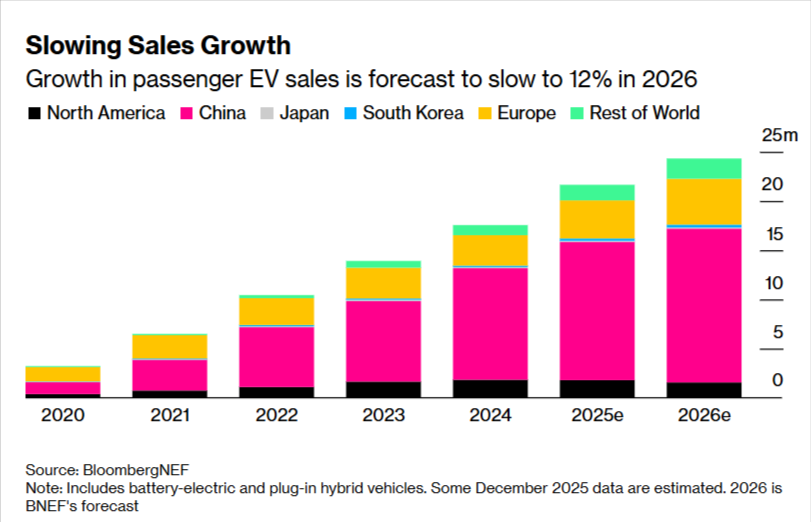

Porsche has to overcome many challenges until 2026, such as the continued weakness of the luxury market in China, the increasing tariff regimes, and the slowing pace of EV launch.

According to a Bloomberg Intelligence forecast, China’s passenger EV sales, including plug-in hybrids and extended-range hybrids, will reach 15.6 million in 2025, up 27% from the previous year. Sales for 2026 are expected to rise only 13%.

Such strategic readjustment is needed, as well as the improvements of exclusivity, cost cuts, and decisive transitions of powertrain that will be presented during the next Capital Markets Day.