Artificial intelligence-driven volatility has created unique inefficiencies in the market, presenting an attractive purchase opportunity for investors. At the beginning of February, the stock of major software companies fell sharply due to the increased worry of investors that artificial intelligence would undermine the traditional software company business models.

It impacted firms like ServiceNow and Salesforce disproportionately. The two equities dropped to their 52-week lows on 6 February despite the fact that their core business is still on a strong growth path.

Salesforce responds quickly to AI challenge

The identified market response can be viewed as part of a larger concern that AI devices may replace some aspects of enterprise software, performing customer service, data handling, and task automation tasks that do not require an elaborate platform.

‘However, recent financial reports of the above-mentioned companies show that these enterprises are in constant demand and that AI performs the role of triggering the growth instead of being a threat.

Reactive Strategic Measures by Salesforce to deal with the Artificial Intelligence Threat

Salesforce is still the leader in the sphere of customer relationship management software. Its services enable the sales teams and customer care individuals to handle the client interactions and daily operation processes efficiently.

In reaction to the rapid development of artificial intelligence, Salesforce launched a proprietary range of artificial intelligence agents, dubbed Agent force, in the year 2024. The business puts these tools into the existing platform ecosystem strategically, as opposed to it being a separate entity that can replace the existing platform.

In the third fiscal quarter, which ended on 31 October, Salesforce reported revenue of $10.3 bn, which is equivalent to a 9% year-on-year growth. The company increased its annual billion-dollar revenue expectations based on this performance to $41.5 billion as compared to the previous year’s $37.9 billion.

The growth rate of Agent Force has been high, and the annual recurring revenue has been increasing by $330% per annum. However, it is a small percentage of aggregate sales. During the third quarter, Agent force earned between %500 and $600 million in recurring revenues, which is a good sign of nascent demand but confirms that most of the Salesforce profitability still lies in its usual software offerings.

ServiceNow Folds Intense AI and Payments Development

ServiceNow is focused on online workflow development that allows companies to make the workflow process more efficient. The company achieved good financial performance in spite of a steep fall in its market perception.

During the fourth quarter, ServiceNow recorded revenue of $3.6 billion, representing a $21% increase compared to the year-end. The organization has already added AI functionalities to its platform and assumes that AI agents will widen the number of services to be offered to clients.

ServiceNow forecasts its subscription revenue to be no less than $15.5 billion dollars in 2026, which indicates a definite increase of that amount of $12.9 billion dollars in 2025. Subscriptions are the main source of income, which will comprise 97% of the total revenue of $13.3 billion dollars in the year 2025.

The company leadership argues that artificial intelligence and workflow software will not shoot one another; instead, they will be synergistic. The management is of the opinion that this integration will keep the firm relevant as more automation is embraced by the enterprises.

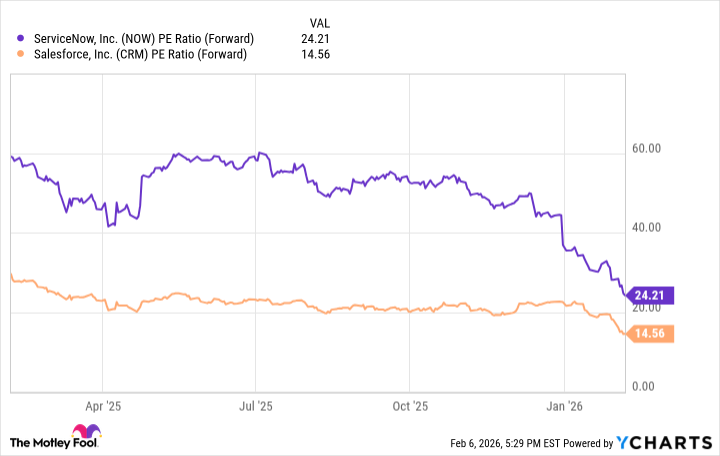

Assessments decrease and commercial presentation remains high

Despite the positive growth in both companies, the equity valuation of the two companies contracted owing to concerns about how fast AI would change the software industry. This market-backlash had a negative pressure on valuations in the industry.

Conclusion

Both companies show that artificial intelligence is the support of their work and not its destruction. The growth of revenues is stable, and the customers are gradually accepting the recently created AI services. However, Salesforce seems to have greater value at existing prices, besides having the advantage of its leading market share in customer relationship management. To the investor with a post-decline choice on the two software giants, Salesforce has a more favorable ratio of growth opportunities and valuation ratios.