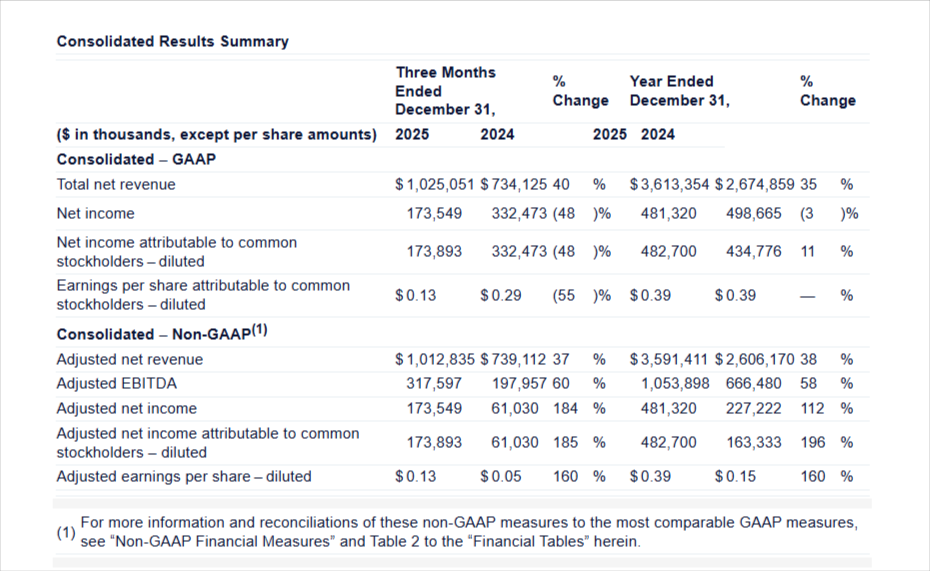

On January 30, 2026, SoFi Technologies announced that its net profit increased by a significant margin in the fourth quarter due to both record loan demand and a sharp rise in activities based on fees, bringing its adjusted revenue to about $1.0 billion, 37% higher than in the previous year.

Said Anthony Noto, CEO of SoFi.

2025 was a tremendous year and the fourth quarter was nothing short of exceptional, delivering more than $1billion in quarterly revenue for the first time in our history.

Lending of records and altering consumer trends

Throughout the quarter ending December 31, 2025, all loan originations amounted to record highs of $10.5 billion that added to the overall increase of 46% over the previous year, largely due to the high level of personal loan, student loan and mortgage demand.

The recent cuts in the interest rate have provided consumers with incentive to both refinance and roll high-cost credit-card debt into lower-rate personal loans supported by mobile-first fintech services, which are gaining growing popularity with younger, tech-based borrowers compared to traditional and branch-driven banks.

Fee based engine gains momentum

The revenues of the financial-services division of SoFi, which includes credit-card and investment products, increased 78% to an aggregate of $456.7 million in the quarter, whereas the revenues based on fees as a whole grew 53 % to about $443 million dollars, which makes up about 44 % of the adjusted net revenue.

This revenue mix is even less likely to expose the enterprise to interest-rate uncertainty, since the volume of fees tied to memberships, trading, and other various services continues to grow at a rate that is faster than the net interest income which is tied to lending business operations.

Risk of credit cards and policies context

Earlier this month, U.S. President Donald Trump proposed a 10% cap on credit card interest rates, which banks have warned could restrict consumers’ access to credit.

SoFi CEO Anthony Noto told Reuters,

I would expect a meaningful contraction in credit card lending because the economics of revolving balances wouldn’t work. People will still need credit and it would leave a massive gap in the market.

Prospective and future positioning

Looking ahead to 2026, SoFi expects a 30% annual increase in total members and adjusted net revenue of $4.655 billion. The company also expects adjusted EBITDA of $1.6 billion and adjusted EPS of $0.60, which exceeds consensus estimates.

Should fee-based revenue continue growing at a rate of more than 50 % annually, and loan originations keep in the mid-single digits growth path, the company could be approaching a leveled adjusted EBITDA margin of the mid-single digits.

However, the largest threat that continues to be an issue of concern is regulatory limits on the pricing of credit-cards.SoFi earnings Q4 2025