The Alaska Air Group is striving to address the incorrect technological structure characterized by frequent malfunctions after experiencing large scale system failures that led to stalling of many flights and huge losses of finances.

This is a crisis that has caused a decisive turn to cloud computing as the airline considers expanding internationally.

Impact of the System Outages

In October 2025, a critical incident in the main data center of the carrier located in Seattle caused the cancellation of over 400 planned flights and remaining around 49,000 passengers stuck.

The failure weakened a crucial aircraft weight and balance calculation device, thus necessitating a massive number of flight cancellations. Another world-wide failure of Microsoft Azure also worsened the operational systems of Alaska.

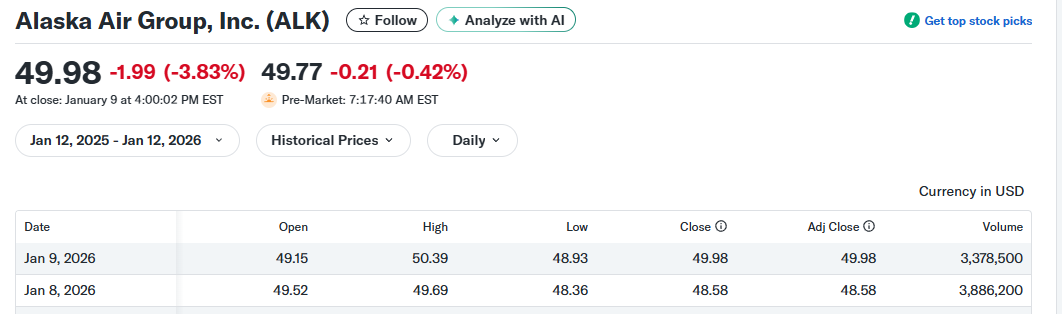

The events decreased the earnings in the fourth-quarter coupled with a decrease of 3.83% in the ALK stock by January 12, 2026, with trading prices standing at around 49.98 per share on Nasdaq exchange.

Planned Migration to Cloud Architecture to achieve Greater Resiliency

The plans to shift operational systems, back-office processes, and data centers to cloud-based facilities were announced by Shane Tackett, the Charging Financial Officer who met Bloomberg last week.

To increase the redundancy and resilience, Tackett said that increments will improve how much we use cloud resources.

We will incrementally be using more cloud to create redundancy and resiliency,” Tackett said. “That’s work that we’re going to undertake this year to understand if it makes sense for us to stay in the data center business or move to cloud over time.

The airline, in conjunction with Accenture, undertook a comprehensive audit after the outage, and it is planning to invest tens of millions of dollars per year on technology platforms, divided between capital and operating spending.

Examples of potential cloud service providers are Amazon Web Services and Microsoft Azure which promise high-availability.

Potential Dividends and Knock-on effects on the market

The analysis estimates that in the year 2027, the effectiveness of Alaska investments in cloud technology will result in efficiency growth, which would consolidate its merger with Hawaiian Airlines and contribute to the goal of international expansion.

Alaska Air is expected to be the first to outperform its competitors in the post-pandemic market, with reliability being the greatest asset, where despite a decrease in overall revenue, due to the outages, analysts and the company foresee a turnaround and resumption of booking momentum, with growth expected through late 2026 and beyond.

Therefore, this means that a higher reliability in operations and possible increase in share price will be realized as the cloud-based redundancy goes live in full force.