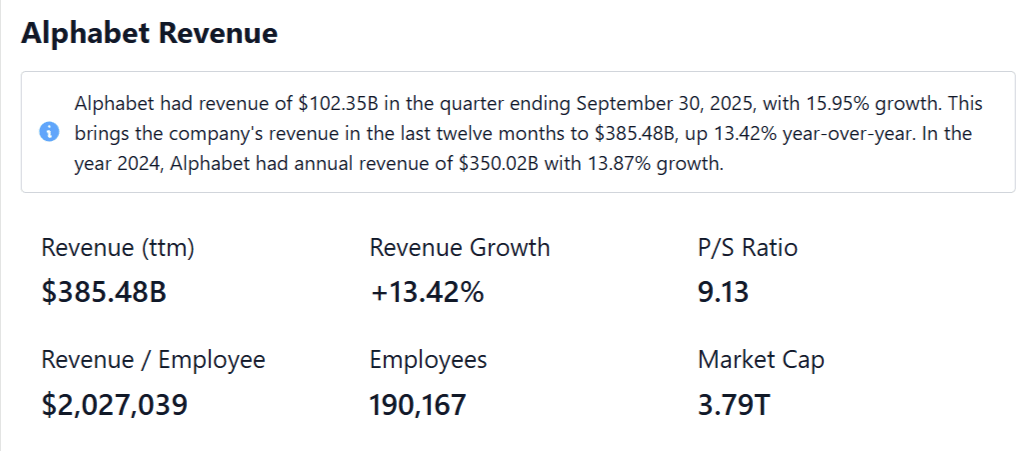

As of December 31, 2025, Alphabet shares were trading at $313.85, giving the company a market capitalization of $3.79 trillion.

This change indicates great bullishness towards the AI-driven revamping of Google, as it will be followed by speculations of later price growth.

Why the Upgrade Now?

Citizens analysts upgraded Alphabet after highlighting the dramatic amount of search revenue in the fourth quarter of 2025, which was possible due to such projects as AI Overviews, AI Mode, or Gemini, which together contribute to the growth of queries.

The full implementation of Smart Bidding Exploration which will occur in the third quarter will match advertisers with user intent instead of just keyword matching to maximize ad connections per query.

The trailing twelve-month revenue of Alphabet is in the form of $385.47 billion, which has grown by 13.42% on a year to year basis.

Alphabet currently trades at a price-to-earnings ratio of 30.98 and PEG ratio of 0.88 indicating that the shares are underestimated compared to its growth potentials, yet the shares are trading at its 52-week highs.

Key Growth Engines

The future category of promising drivers is the year 2026-2027 with Gemini AI, Google Cloud, Waymo autonomous-driving technologies, and Tensor Processing Units (TPUs).

Citizens states that query acceleration AI-based is a groundbreaker in the effectiveness of advertising, which is further enhanced by constant macro-economic situations during the time of holidays.

According to recent statistics, over the last few quarters, the year-on-year growth in the cloud unit of Alphabet has risen by 34%.

Risk Analysis

Alphabet stock also faces a significant threat of heightened antitrust scrutiny in the US, such as the investigation of search dominance and advertising technology in the United States Department of Justice, which could compel divestiture or may significantly penalize.

Similarly, competitive pressure is also rising from AI-focused rivals such as OpenAI, Microsoft, and xAI replace the street portion of Alphabet in searching and cloud computing, whereas the weaknesses in supply chains after Sino-US tension do not allow the acquisition of GPUs to build data centers.

The macroeconomic risk remains relevant such as elevated advertising costs, economic decline, and currency devaluation of the emerging market also increase downside risk, especially when interest-to-earnings ratio is higher than usual indicating little or no cushion against any decline in earnings.

Bold Future Outlook

The latest move by Alphabet to take over Intersect at a cost of $4.75 billion helps to boost its data-centers, as other competitors like open AI continue their magnification efforts after Google made significant strides in its benchmark.

On the premise that AI integrations will continue to be productive, it is expected that by 2026, with no adjustments to changes, baseline search-engine growth will be high.

As Gartner predicted a reduction of up to 25% in traditional search volume by 2026 as users rely on agents (requires citation) which will place GOOGL as an attractive subject of value growth by 2027.