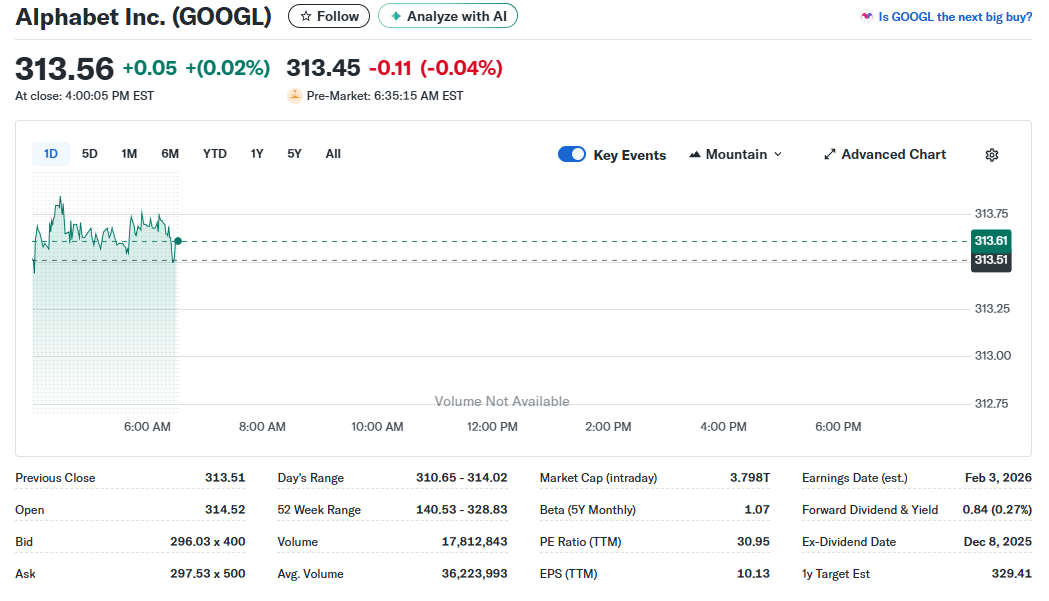

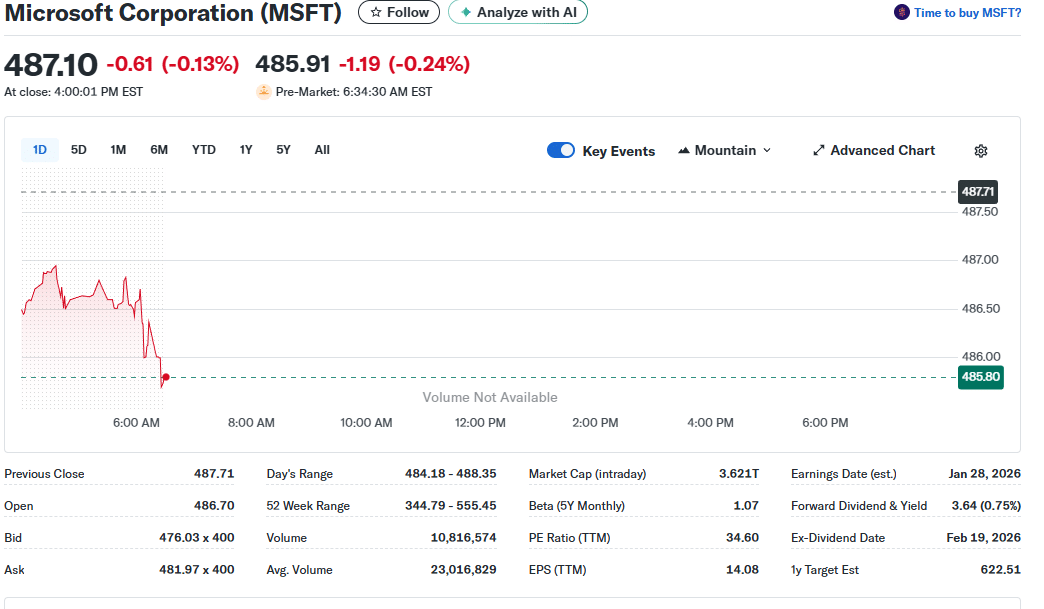

With the year 2025 approaching to an end and the surge of artificial intelligence developments, Alphabet did a better job, as its share price grew by 65% to reach $313.56, compared to a 16% increase in Microsoft to $487.10.

After the great performance Alphabet has shown in the last one-year, the question arises: will it be Alphabet that will also win in 2026 in a row?

Microsoft’s Azure Segment

The increase in revenue and earnings per share (18 % and 23 % respectively) were led by the presence of a 27% stake in OpenAI and the exclusivity to utilize the large-language-model services until 2032.

The constraints on supply side accelerated spending on capital till fiscal 2026. The July hike in the price of Microsoft 365 was another trigger, but dependence on NVIDIA technology of the GPU is what helped to raise operating costs.

Strategic Advantage of Alphabet

Google Cloud earnings grew in the last quarter by 34%, and operating earnings by 84%. Introduction of Tensor Processing Units (TPUs), which are special chips optimized over 10 years, was better than the similar solutions created by Microsoft, leading to reduced costs and acquisition by huge clients like Anthropic.

The Gemini large-language model further cemented the edge and formed a circle of synergy between silicon and software to which Microsoft hopes to be able to imitate.

Bull vs. Bear Table

| Aspect | Alphabet Bull | Alphabet Bear | Microsoft Bull | Microsoft Bear |

| Growth | TPUs + Gemini flywheel drives 35%+ cloud growth | Search AI risks antitrust hits | Azure surges, OpenAI ties | Capacity constraints delay scaling |

| Valuation | 28x 2026 P/E, undervalued stack | Premium erodes if margins stall | 30x FY2026, steady EPS | GPU costs squeeze profits |

| Edge | Full AI control, 12% Search boost | Slower enterprise adoption | Copilot ubiquity, $250B OpenAI commit | Dependency on partners |

The Future Outlook

Alphabet trades at a forward price-to-earnings (P/E) ratio of 28 times 2026 analyst estimates, while Microsoft trades at 30 times fiscal 2026 (ending June 2026) estimates and 26 times fiscal 2027 estimates.

Given their valuation and growth outlooks, both stocks can perform well next year.

As an added vote of confidence, Berkshire Hathaway announced

a stake in Alphabet marking a stark contrast from quarter after quarter of trimming its Apple position, indicating Warren Buffett and his team perceive Alphabet as a good value.

Whereas the Last quarter, Azure revenue surged 40%, driven by demand for AI services. It was the ninth consecutive quarter of 30% or more growth for Azure.

Growth could have been even more robust if Azure were not capacity-constrained, and Microsoft said, given accelerated demand, that its capital expenditures (capex) will now grow at a quicker pace in fiscal 2026 versus last year.

Microsoft has had a steady performance, but with the reinforcing feedback loop at Alphabet, it is possible that the most successful company in 2026 will repeat the achievements of 2025, thus benefiting proactive investors.