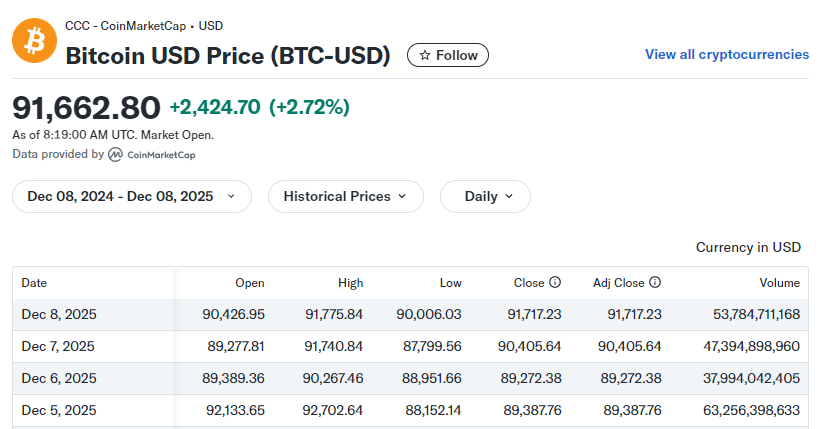

Bitcoin is among the oldest cryptocurrencies and has a market capitalization of approximately $91,662.

In 2025, the Federal Reserve’s policy shifts have emerged as a critical driver of Bitcoin price volatility, with research documenting a measurable 15-20% effect on cryptocurrency market movements.

That said, the appeal of Bitcoin remains, primarily to the limited supply of this cryptocurrency: the idea is restricted to 21 million tokens that will be mined (19.9 million of which are currently in circulation).

This rarity only increases its digital gold status and gives it a great hedge against inflation.

In addition, both institutional and retail interest has been picked up faster due to the recent reinforcement of the U.S. Securities and Exchange Commission that approved spot exchange-traded funds (ETFs).

However, Bitcoin is faced with difficulties such as energy requirements of its proof-of-work mining mechanism and relatively constrained smart-contracting, providing features that are currently used by other systems in decentralized applications like Ethereum.

XRP’s Case and Challenges

XRP is currently trading at around $2.08 and has a market capitalization of about $125.36 billion.

The token suffered a worse year, falling 8% following legal tussles of Ripple Labs with SEC.

This year the lawsuit ended in a small fine and relisting on major exchanges and introduction of a new spot ETF became possible.

XRP is used as a layered currency that enables cheaper and faster fiat-to-fiat is possible and it aims at expanding its inflexion through Ethereum-compatible sidechains.

However, its pre-mined status and competition with stablecoins, including one Ripple owns, namely, Ripple USD, limit its scarcity value and its growth opportunities, respectively.

Outlook

The regulated supply of Bitcoin and the institutional penetration already put the coin on a solid ground, however, the changing regulatory environment and technological progress may alter the landscape significantly.

The recovery that XRP has seen is promising, but the position of Bitcoin and the fact that it is limited makes it seem that it has a bigger upside potential in the future.

As major cryptocurrencies, investors must keep an eye on Bitcoin in the next five years as the likely dominant player with the arrival of quantum computing and regulatory trends in the market in 2026.