The “Magnificent 7” still dominates headlines, but a more minor shift is taking place in artificial intelligence investment.

Another group of less well-known mid-cap equities getting involved in AI infrastructure, power provisioning, and autonomous systems can offer better upside over the next five years than the existing mega-cap leaders.

The 1,300 % success rate of Nvidia since the last 5 years has set a standard of AI performance. Nevertheless, with the escalation of valuations of the technology giants, there is an increasing shift of potential investors seeking an asymmetric payoff downstream.

A number of companies, including Cipher Mining, Ondas Holdings and Argan, with respectively market capitalizations of less than $7 billion, are already showing triple-digit returns far exceeding the performance of their market.

These organizations do not create chatbots or consumer applications. Instead, they provide the physical platforms on which AI is based: data centres that need a lot of power, safe wireless networks, and autonomous flying platforms.

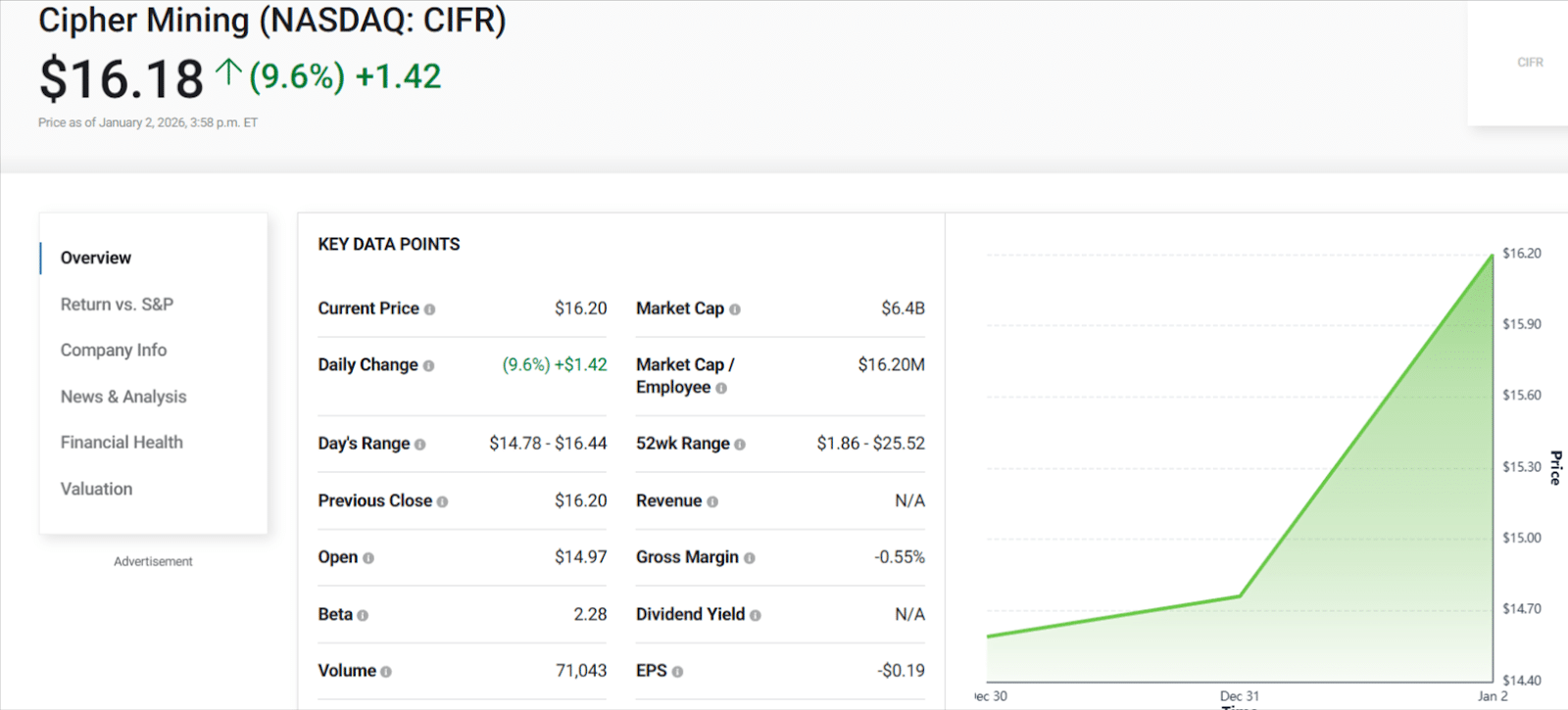

Cipher Mining: Crypto to AI Power Broker

Perhaps one of the most famous strategic re-pivotings that has occurred in the AI ecosystem is Cipher Mining (CIFR). As an early Bitcoin mining company, the business has reinvented itself as a provider of power-infrastructure to AI data centres.

Having a 3.4-gigawatt development pipeline, Cipher has signed long-term, multilateral deals including a 15-year, $5.5 billion contract with Amazon Web Services covering 300-megawatts of capacity- estimated to bring about $367 million of yearly earnings.

Further diversification of geography by expanding beyond Texas into Ohio. With the planned execution, analysts expect that Cipher will attain multi-billion recurring income by late 2026.

Critical threat: High capital demand and dependence on big counterparties.

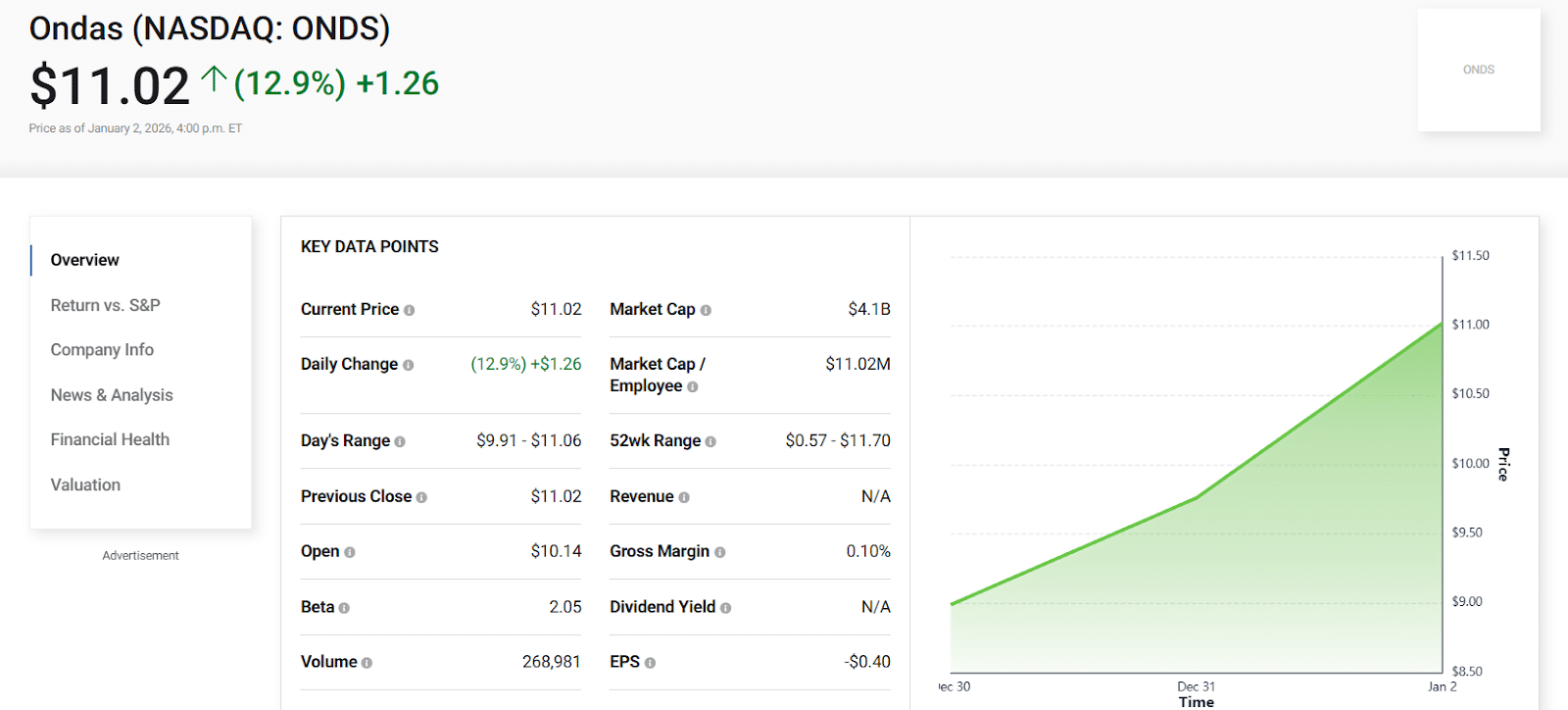

Ondas Holdings: Trying the AI Drone Wave

Ondas Holdings (ONDS) is using AI-aware drones to use in the defense and the inspection of infrastructures and prevention of risks to people.

The company is showing an increase of 60% in quarter over quarter revenue of $10.1 million in the third quarter and is expected to have a revenue $110 million in 2026 higher from that in 2025 which was $36 million.

New government orders totaling $10 million indicate a further move in validation in that government orders though there is much more business than that which is being realized at present in sales of Ondas, at present.

Critical threat: Expansion of production and maintenance of margins in the competitive drone market.

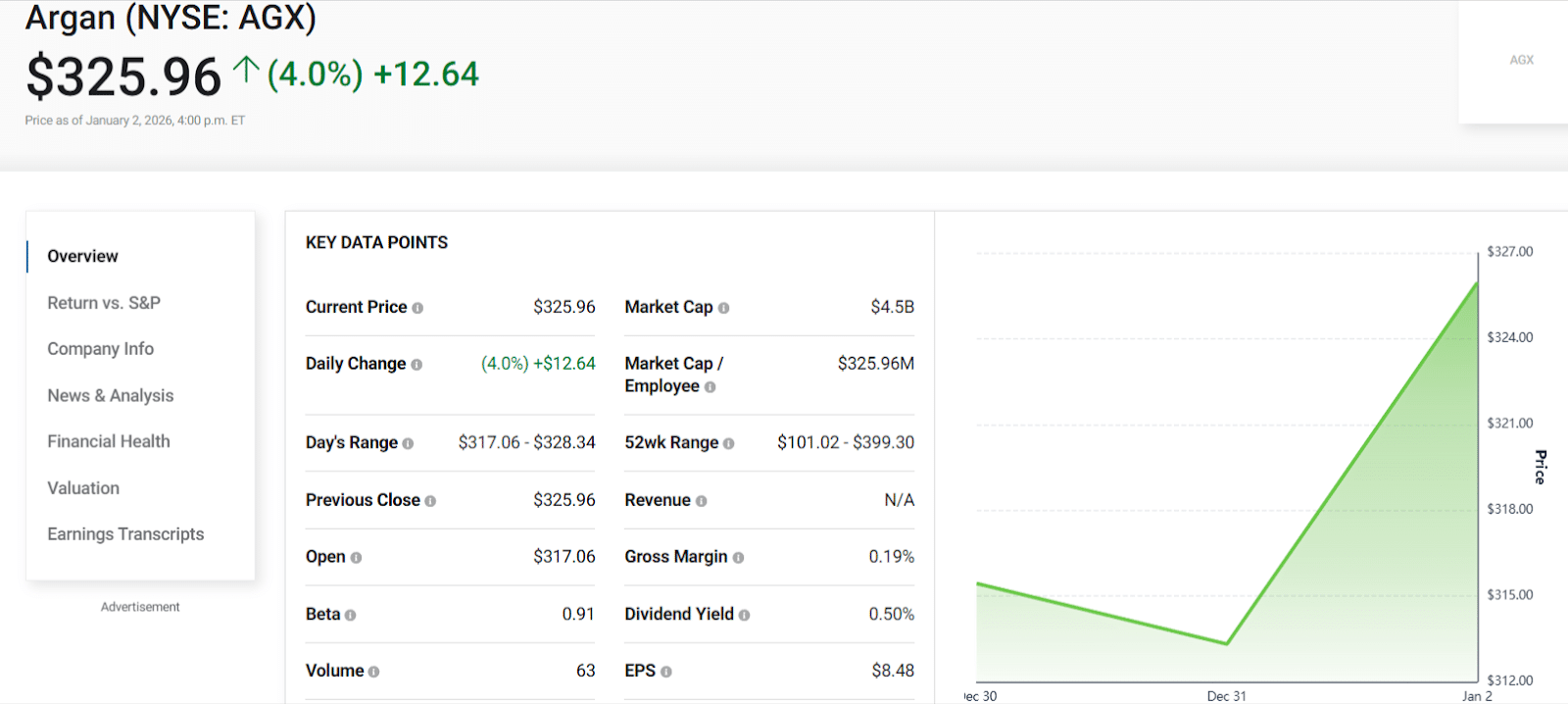

Argan: The Creation of the AI Backbone

Argan (AGX) offers the construction and engineering of power intensive data centers such as AI data centers. The firm has a backlog of record $3 billion and 6 gigawatts of capacity contracted projects.

Even though recent quarterly performance has shown a small decline compared to last year, the management expects the conversion of backlog and the acquisition of new contracts to drive the acceleration till fiscal 2026.

Critical threat: Construction delays and cyclical construction demand.

Bottom Line

With the spread of AI workloads, the true bottleneck should be the power, infrastructure, and autonomy demand. These mid-capital players hold key artificial bottlenecks in the AI value chain where demand is structural and long-lived.

There is execution risk and volatility is to be expected. However, to investors who are willing to go beyond household names, these equities can offer the kind of early-stage AI exposure that mega caps cannot offer any more.

Historically, the largest and longest-lasting returns are not usually to the creators of algorithms but to corporations that build and maintain the infrastructure onto which artificial intelligence is based.