The literature review of the market sentiment suggests a buy of Nvidia stocks and a sell of Palantir interests in reference to the year 2026 unequivocally.

The tangible interest in artificial intelligence has instigated a greater value in Nvidia whose worth has grown significantly over a period of five years, as compared to that of Palantir which has seen its worth soar, fueled by the deepening interest in its software products.

This has resulted in Nvidia taking a higher position with unma tched value propositions, compared to its competitor.

AI Titans in Focus

Within the sphere of graphics processors units (GPUs), Nvidia has been sustaining a lead in designing and implementing the hardware, which is persistently supporting generative artificial intelligence applications, and this ultimately culminated in the creation and manufacturing of software and hardware that facilitates the delivery of parallel computing capacities that are incomparable.

The bulk of the Nvidia market share, constituting the data center type of GPUs, has been enjoying a steady sell through and this has been supported by projections that indicate continued demand up to the year 2030.

Palantir, on the other hand, is built on artificial-intelligence-assisted analytical software optimized to government operations, such as military missions, and the delivery of vaccines, but it is now becoming a commercial enterprise with its AIP network.

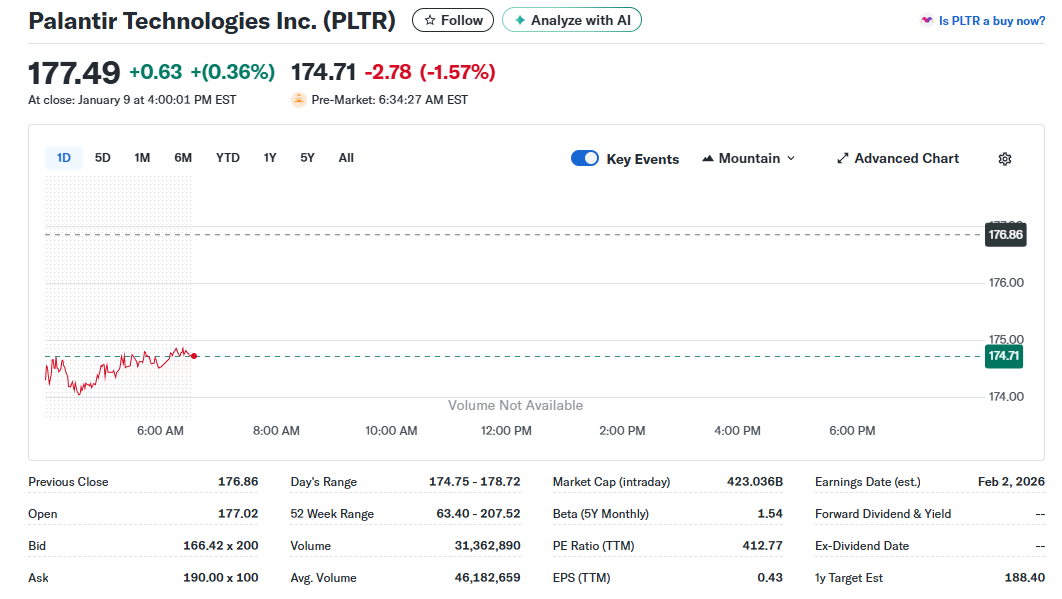

Palantir is reported to have gross margins of 80.81% as of January 9, 2026, but sustainability of recurring software-subscription revenue will only be possible when adoption growth persists.

Valuation Verdict Hits Hard

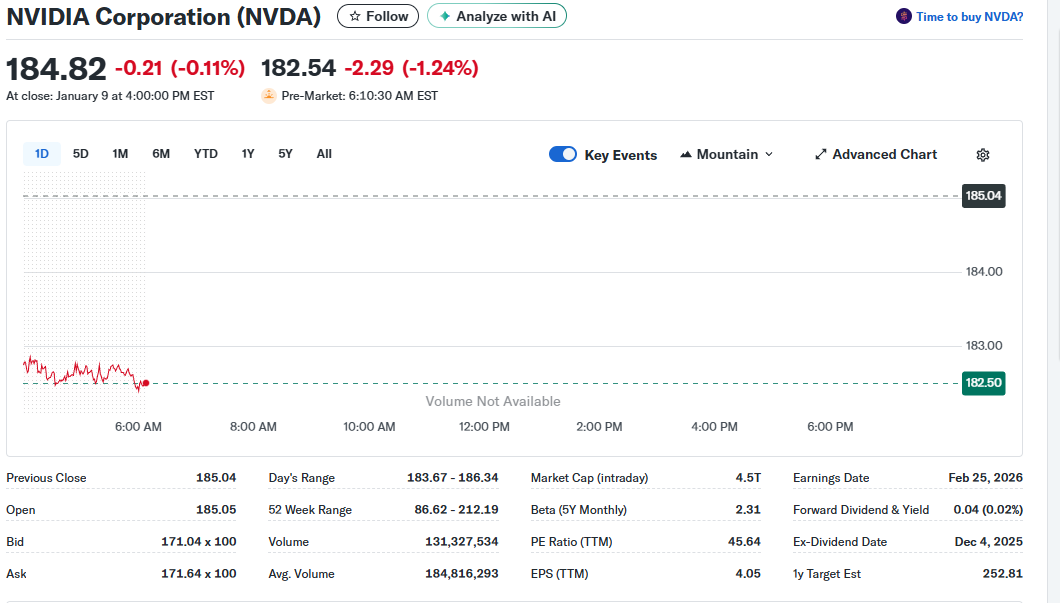

The Nvidia valuation ratios suggest a market capitalization of $4.5 trillion and a trailing-earnings multiple of 46 and a forward-earnings multiple of 24 in the fiscal year 2027.

Palantir Technologies (PLTR)’s P/E ratio is 415.08 as of January 9, 2026. This indicates a -19.34% decline from the previous 12-month average P/E ratio of 514.63.

However, a higher P/E ratio implies that investors anticipate substantial future earnings growth, whereas a lower P/E ratio may indicate a cheap stock or decreasing growth.

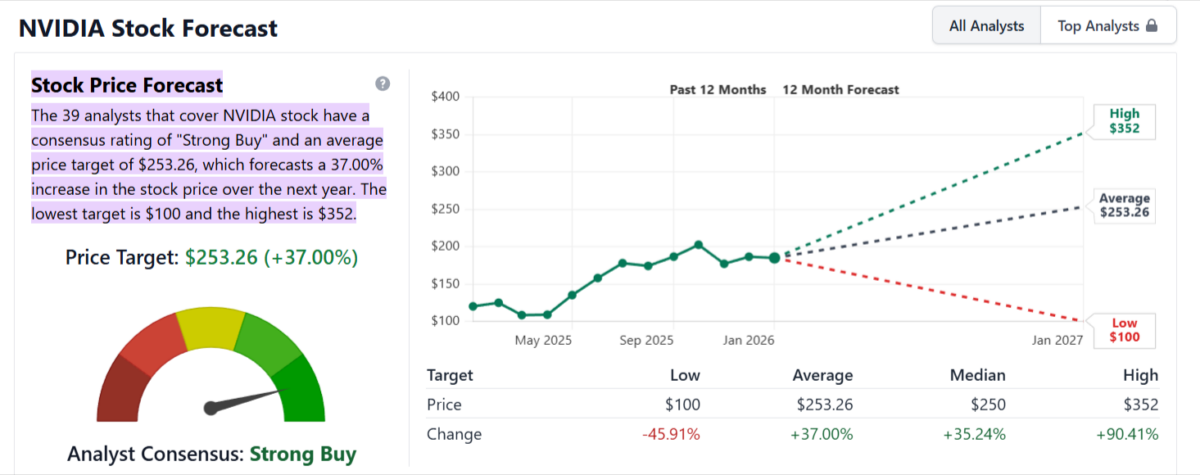

Analyst forecasts indicate that the Nvidia shares are overvalued at $253.26 or 37 % to the current share price of $184.86, and it is rated at strong buy.

2026 Projection: Nvidia Continues To have the Momentum

The positive trends projected at Nvidia are anticipated to proceed through the further growth of artificial-intelligence infrastructure.

According to RobertoAllende Record Performance Driven by Blackwell NVIDIA reported Q3 FY2026 revenue of $57.0 billion, marking a 62% increase year-over-year and a 22% sequential gain from the previous quarter.

The company’s Data Center segment, which now represents the overwhelming majority of revenue, reached $51.2 billion, up 66% from a year ago.

The future projection of Palantir is risky, with an increase of 63% in revenues in 2025 (resulting in the anticipated $1.18 billion) caused by increasing valuation pressures that are reflected in a forward price-to-earnings ratio of 178.6. In turn, responsible investors would recommend Nvidia to pursue the balanced growth model, rather than the high-risk-high-reward model used by Palantir.