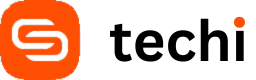

With alarmists sounding the alarms and naysayers saying, “nay,” it’s certainly looking very similar to the way things were over a decade ago right before the dotcom bubble burst. Did we learn our lesson back then or are we in the process of repeating our mistakes?

Few can argue against the concept that we’re in another tech bubble. The only real debate is whether or not the bubble will burst. With Facebook leading the way with valuations far exceeding prospects of revenue and slowdown in growth, it’s the poster child for both high-value investors as well as those warning of a more catastrophic collapse than we saw the first time.

This infographic by our friends at Udemy breaks down some of the key points hinting towards a bubble bursting. Whether it’s imminent, a few years away, or never to happen at all, we should still take a look at the data and make educated choices of how to spend our time and money. If the bubble bursts this time, the effects will be felt more universally thanks to a much higher reliance on the web in day-to-day life.

Click to enlarge.

1999 was incredible. Would love to be there again.

complete-privacy.no.tc

1999 was like totally awesome. Would love to turn back time and be there again.’

Oh yeah…and dot boom crash again no way!

WTF… If you are going to make an info graphic and title it “Startup Bubble 2.0” you should at least spend 5 minutes and do some research to find out when “Startup Bubble 1.0” happened. THERE WAS NO STARTUP BUBBLE IN 2008. That was a US housing bubble. All major investment classes had “a major dip in late 2008 and early 2009”! Comparing the numbers of 2008 and 2011 don’t tell us anything. If you compare the numbers from the last major tech bubble 1999/2000 and 2010/2011 you will see a very different picture; one where current investment and revenue/valuation multipliers are much lower than they were in 1999/2000.