In a twist, US officials in an interesting turn of events amidst the intensified US-China technological warfare have granted Taiwan Semiconductor Manufacturing Company (TSMC) a renewed annual license permitting direct export of US chip-making equipment directly to its Nanjing plant located in China.

This decision, announced on 1 January 2026, provides continuity to the proceedings of TSMC as a manufacturing company, which has affirmed the decision to Reuters.

Licenses Keep Factories Running Smooth

The license will cover export-controlled US tools thus removing the need for TSMC to seek one vendor approval after another.

It replaces the outdated so-called validated end-user exemptions that will expire on 31 December 2025.

The production in the Nanjing plant by TSMC, comprising 16-nanometer and beyond technologies, or non-cutting-edge nodes, only comprised 2.4% of the total revenue at TSMC in 2024.

A location in Shanghai expands its mainland operations in response to the local demand in order to reduce the risk of high-tech leaks.

TSMC said in its statement

“The U.S. Department of Commerce has granted TSMC Nanjing an annual export license that allows U.S. export-controlled items to be supplied to TSMC Nanjing without the need for individual vendor licenses,”

Navigating US Export Curbs

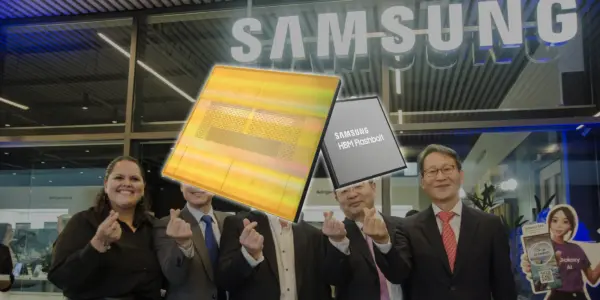

Similar licenses were granted to South Korean companies Samsung Electronics and SK Hynix, as an extension of a general US policy of supporting existing industry players.

This structure makes it easier to maintain a steady flow of products at the time of Washington export restrictions, which seek to limit the ambitions of China in the artificial intelligence and development of military chips.

Since 2022, the export of advanced equipment to China has been prohibited by US sanctions, having an impact on companies like ASML and Lam Research.

However, exceptions have been granted to mature-node plants such as the Nanjing one, since they are less at risk of technology.

What Lies Ahead?

In perspective, to 2026, the examination of advanced nodes is predicted to be tighter, as US fabrication plants in Arizona are expected to grow, and TSMC aims to invest up to $165 billion IN Arizona, fueling invocation and creating thousands of high-tech jobs

Further subcontracting of Chinese operations can still be done in case of intensification of tensions but this is temporary with the existing license.

TSMC said it expects robust artificial intelligence demand to continue, as it raised its 2025 revenue guidance to mid-30% growth in U.S. dollar terms from around 30%, and maintained its forecast for capital spending at up to $42 billion for 2025.

CEO C.C. Wei told an earnings call

“AI demand actually continues to be very strong – more strong than we thought three months ago,”

The resourceful allocation of resources keeps the production of silicon alive at least in the short-run.